Fourth Industrial Revolution for the

Earth Series

Building block(chain)s

for a better planet

September 2018

Building block(chain)s for a better planet is published by the

World Economic Forum System Initiative on Shaping the

Future of Environment and Natural Resource Security in

partnership with PwC and the Stanford Woods Institute for

the Environment. It was made possible with funding from the

MAVA Foundation. It forms part of a series of reports from the

Fourth Industrial Revolution for the Earth project, run in

association with the World Economic Forum Centre for the

Fourth Industrial Revolution.

About the ‘Fourth Industrial Revolution for

the Earth’ series

The “Fourth Industrial Revolution for the Earth” is a

publication series highlighting opportunities to solve the

world’s most pressing environmental challenges by

harnessing technological innovations supported by new and

effective approaches to governance, financing and

multistakeholder collaboration.

About the World Economic Forum

The World Economic Forum, committed to improving the

state of the world, is the International Organization for Public-

Private Cooperation. The Forum engages the foremost

business, political and other leaders of society to shape global,

regional and industry agendas.

About PwC

With offices in 158 countries and more than 236,000 people,

PwC is among the leading professional services networks in

the world. We help organizations and individuals create the

value they’re looking for, by delivering quality in assurance,

tax and advisory services.

3

Building block(chain)s for a better planet

Contents

Preface ............................................................................................... 4

Foreword............................................................................................ 5

Executive Summary ........................................................................... 6

Our planet: The challenge and opportunity ....................................... 9

The building blocks: Overview of blockchain and its maturity ......... 12

The blockchain opportunity for our environment ............................. 16

Blockchain game changers for the Earth ......................................... 21

Blockchain blockers and unintended consequences ......................... 30

Conclusions and recommendations .................................................. 34

Acknowledgements .......................................................................... 40

Annex I: ........................................................................................... 41

Annex II: .......................................................................................... 42

Annex III: ......................................................................................... 43

4

Building block(chain)s for a better planet

Preface

The Fourth Industrial Revolution and the Earth

The majority of the world’s current environmental

problems can be traced back to industrialization,

particularly since the “great acceleration” in global

economic activity since the 1950s. While this delivered

impressive gains in human progress and prosperity, it

has also led to unintended consequences. Issues such as

climate change, unsafe levels of air pollution, depletion

of forestry, fishing and freshwater stocks, toxins in rivers

and soils, overflowing levels of waste on land and in

oceans, and loss of biodiversity and habitats are all

examples of the unintended consequences of

industrialization on our global environmental commons.

As the Fourth Industrial Revolution (4IR) gathers pace,

innovations are becoming faster, more efficient and

more widely accessible than ever before. Technology is

becoming increasingly connected, and we are now

seeing a convergence of the digital, physical and

biological realms. Emerging technologies, including the

Internet of Things (IoT), virtual reality and artificial

intelligence (AI), are enabling societal shifts as they

seismically affect economies, values, identities and

possibilities for future generations.

There is a unique opportunity to harness the Fourth

Industrial Revolution – and the societal changes it

triggers – to help address environmental issues and

transform how we manage our shared global

environment. Left unchecked, however, the Fourth

Industrial Revolution could have further unintended

negative consequences for our global commons. For

example, it could exacerbate existing threats to

environmental security by further depleting global

fishing stocks, biodiversity and resources. Furthermore,

it could create entirely new risks that will need to be

considered and managed, particularly in relation to the

collection and ownership of environmental data, the

extraction of resources and disposal of new materials,

and the impact of new advanced and automated

machines.

Harnessing these opportunities and proactively

managing these risks will require a transformation of the

current “enabling environment” for global environmental

management. This includes the governance frameworks

and policy protocols, investment and financing models,

the prevailing incentives for technology development,

and the nature of societal engagement. This

transformation will not happen automatically. It will

require proactive collaboration among policy-makers,

scientists, civil society, technology champions

and investors.

If we get it right, it could create a sustainability

revolution.

Working with experts from the environmental and

technology agenda, the “Fourth Industrial Revolution for

the Earth” project is producing a series of insight papers

designed to illustrate the potential of Fourth Industrial

Revolution innovations and their application to the

world’s most pressing environmental challenges.

Collectively and individually, these papers offer insights

into the emerging opportunities and risks of this fast-

moving agenda, highlighting the roles various actors

could play to ensure these technologies are harnessed

and scaled effectively. The papers are not intended to be

conclusive, but rather to act as a stimulant – providing

overviews that provoke further conversation among

diverse stakeholders about how new technologies driven

by the Fourth Industrial Revolution could play a

significant role in global efforts to build environmentally

sustainable economies, helping to provide foundations

for further collaborative work as this dynamic new

agenda evolves. This particular paper looks at blockchain

and the Earth. Previous papers in the “Fourth Industrial

Revolution for the Earth" series have looked at how the

Fourth Industrial Revolution could transform ocean

management, enable sustainable cities, and build an

inclusive bio-economy that preserves biodiversity, as

well as examining how artificial intelligence could be

harnessed to address economic, social and governance

challenges related to Earth systems.

5

Building block(chain)s for a better planet

Foreword

Blockchain

1

is a foundational emerging technology of the

Fourth Industrial Revolution, much like the internet was

for the previous (or third) industrial revolution. Its

defining features are its distributed and immutable

ledger and advanced cryptography, which enable the

transfer of a range of assets among parties securely and

inexpensively without third-party intermediaries. It is

also democratized by design – unlike the platform

companies of today’s internet – allowing participants in

the network to own a piece of the network by hosting a

node (a device on the blockchain). Blockchain is more

than just a tool to enable digital currencies. At its most

fundamental level, it is a new, decentralized and global

computational infrastructure that could transform many

existing processes in business, governance and society.

Blockchain has received considerable hype, ranging from

“cryptomania” in the trading markets in 2017 to

widespread discussions about the breadth and depth of

its potential impact across public and private sectors and

society in general. It has also invited scepticism related

to its scalability and the high-energy use of early

blockchain platforms.

2

As of early July 2018, the total

cryptocurrency market cap (spanning 1,629 currencies)

stands at about $254.67 billion.

3

As the architecture for

this transformational technology matures and as both

the blockchain hype and scepticism begin to rationalize,

there is a significant opportunity to shape how

blockchain is developed and deployed.

A number of blockchain applications and platforms are

becoming widely known, starting with Bitcoin, which

pioneered cryptocurrency (and crypto-assets), followed

by Ethereum, which as a platform for building

decentralized applications through smart contracts has

inspired a whole new “token economy”. The emergence

of applications in voting, digital identity, financing and

health illustrate how blockchain can potentially be used

to address global challenges.

4

There is now also

emerging enthusiasm about blockchain’s potential to

support global efforts to advance environmental

sustainability. To date, however, there has been little

appraisal of the use-cases or systematic orientation to

vital environmental opportunities and challenges, much

less of how to build the public-private collaborations and

platforms that will be needed to realize these nascent

opportunities.

This report focuses on the application of blockchain to

address pressing environmental challenges such as

climate change, biodiversity loss and water scarcity. It

looks at emerging applications, including those that

might be the biggest game changers in managing our

global environmental commons, while assessing the

potential challenges and developing recommendations to

address them. Some of these applications could

dramatically improve current systems and approaches,

while others could completely transform the way

humans interact with – and manage – our environmental

stability and natural resources.

Throughout this assessment, it is emphasized that the

potential for blockchain lies in its architectural ability to

shift, and potentially upend, traditional economic

systems – potentially transferring value from

shareholders to stakeholders as distributed solutions

increasingly take hold.

If harnessed in the right way, blockchain has significant

potential to enable a move to cleaner and more resource-

preserving decentralized solutions, unlock natural

capital and empower communities. This is particularly

important for the environment, where global commons

and non-financial value challenges are currently

so prevalent.

However, if history has taught us anything, it is that such

transformative changes will not happen automatically.

They will require deliberate collaboration between

diverse stakeholders ranging from technology industries

through to environmental policy-makers, underpinned

by new platforms that can support these stakeholders to

advance not just a technology application, but the

systems shift that will enable it to truly take hold. It is

our hope that the following overview of the

opportunities, risks and suggested next steps will

stimulate stakeholders to embark on an exciting new

action agenda that builds blockchains for a better planet.

Dr Celine Herweijer

Partner, PwC UK

Innovation and Sustainability Leader

Dominic Waughray

Head of the Centre for Global Public Goods,

World Economic Forum

Sheila Warren

Project Head, Blockchain and Distributed Ledger Technology

World Economic Forum’s Centre for the Fourth Industrial Revolution

6

Building block(chain)s for a better planet

Executive Summary

Background

Blockchain has the potential to transform how humans

transact. It is a decentralized electronic ledger system

that creates a cryptographically secure and immutable

record of any transaction of value, whether it be money,

goods, property, work or votes. This architecture can be

harnessed to facilitate peer-to-peer payments, manage

records, track physical objects and transfer value via

smart contracts.

This potential to fundamentally redefine how business,

governance and society operate has generated

considerable hype about blockchain. Despite this hype, it

remains a nascent technology with considerable

challenges that need to be overcome, from user trust and

adoption through to technology barriers (including

interoperability and scalability), security risks, legal

and regulatory challenges, and blockchain’s current

energy consumption.

However, as the technology matures and its application

across sectors and systems grows, there is both a

challenge and an opportunity to realize blockchain’s

potential – not just for finance or industry, but for people

and the planet. This opportunity comes at a critical

juncture in humanity’s development. As a result of the

“great acceleration” in human economic activity since the

mid-20th century, which has yielded impressive

improvements in human welfare, research from many

Earth-system scientists suggests that life on land could

now be entering a period of unprecedented

environmental systems change.

Fortunately, an opportunity is also emerging to harness

blockchain (and other innovations of the Fourth

Industrial Revolution) to address six of today’s most

pressing environmental challenges that demand

transformative action: climate change, natural disasters,

biodiversity loss, ocean-health deterioration, air

pollution and water scarcity. Many of these opportunities

extend far beyond “tech for good” considerations and are

connected to global economic, industrial and human

systems. Blockchain provides a strong potential to unlock

and monetize value that is currently embedded (but

unrealized) in environmental systems, and there is a

clear gap within the market. In the first quarter of 2018,

for example, 412 blockchain projects raised more than

$3.3 billion through initial coin offerings (ICOs).

5

Less

than 1% of these were in the energy and utilities sector,

representing around $100 million of investment, or

around just 3% of the total investment for the quarter.

Principal findings

Our research and analysis identified more than 65

existing and emerging blockchain use cases for the

environment through desk-based research and

interviews with a range of stakeholders at the forefront

of applying blockchain across industry, big tech,

entrepreneurs, research and government.

Blockchain use-case solutions that are particularly

relevant across environmental applications tend to

cluster around the following cross-cutting themes:

enabling the transition to cleaner and more efficient

decentralized systems; peer-to-peer trading of resources

or permits; supply-chain transparency and management;

new financing models for environmental outcomes; and

the realization of non-financial value and natural capital.

The report also identifies enormous potential to create

blockchain-enabled “game changers” that have the ability

to deliver transformative solutions to environmental

challenges. These game changers have the potential to

disrupt, or substantially optimize, the systems that are

critical to addressing many environmental challenges.

A high-level summary of those game changers is

outlined below:

•

“See-through” supply chains: blockchain can create

undeniable (and potentially unavoidable)

transparency in supply chains. Recording

transactional data throughout the supply chain on a

blockchain and establishing an immutable record of

provenance (i.e. origin) offers the potential for full

traceability of products from source to store.

Providing such transparency creates an opportunity

to optimize supply-and-demand management, build

resilience and ultimately enable more sustainable

production, logistics and consumer choice.

7

Building block(chain)s for a better planet

•

Decentralized and sustainable resource

management: blockchain can underpin a transition

to decentralized utility systems at scale. Platforms

could collate distributed data on resources (e.g.

household-level water and energy data from smart

sensors) to end the current asymmetry of information

that exists between stakeholders, enabling more

informed – and even decentralized – decision-making

regarding system design and management of

resources. This could include peer-to-peer

transactions, dynamic pricing and optimal demand-

supply balancing.

•

Raising the trillions – new sources of sustainable

finance: blockchain-enabled finance platforms could

potentially revolutionize access to capital and unlock

potential for new investors in projects that address

environmental challenges – from retail-level

investment in green infrastructure projects through

to enabling blended finance or charitable donations

for developing countries. On a broader level, there is

the potential for blockchain to facilitate a system shift

from shareholder to stakeholder value, and to expand

traditional financial capital accounting to also capture

social and environmental capital. Collectively, these

changes could help raise the trillions of dollars

needed to finance a shift to low-carbon and

environmentally sustainable economies.

•

Incentivizing circular economies: blockchain could

fundamentally change the way in which materials and

natural resources are valued and traded, incentivizing

individuals, companies and governments to unlock

financial value from things that are currently wasted,

discarded or treated as economically invaluable. This

could drive widespread behaviour change and help to

realize a truly circular economy.

•

Transforming carbon (and other environmental)

markets: blockchain platforms could be harnessed to

use cryptographic tokens with a tradable value to

optimize existing market platforms for carbon (or

other substances) and create new opportunities for

carbon credit transactions.

•

Next-gen sustainability monitoring, reporting and

verification: blockchain has the potential to

transform both sustainability reporting and

assurance, helping companies manage, demonstrate

and improve their performance, while enabling

consumers and investors to make better-informed

decisions. This could drive a new wave of

accountability and action, as this information filters

up to board-level managers and provides them with

a more complete picture for managing risk and

reward profiles.

•

Automatic disaster preparedness and

humanitarian relief: blockchain could underpin a

new shared system for multiple parties involved in

disaster preparedness and relief to improve the

efficiency, effectiveness, coordination and trust of

resources. An interoperable decentralized system

could enable the sharing of information (e.g.

individual relief activities transparent to all other

parties within the distributed network) and rapid

automated transactions via smart contracts. This

could improve efficiencies in the immediate aftermath

of disasters, which is the most critical time for

limiting loss of life and other human impacts.

•

Earth-management platforms: new blockchain-

enabled geospatial platforms, which enable a range of

value-based transactions, are in the early stages of

exploration and could monitor, manage and enable

market mechanisms that protect the global

environmental commons – from life on land to ocean

health. Such applications are further away in terms of

technical and logistical feasibility, but they remain

exciting to contemplate.

These game changers, and the more than 65 use cases

identified, offer the exciting potential to build a

sustainable future; however, as with many emerging

technologies, there are a number of risks to manage and

challenges to overcome. In broad terms, the challenges

relate to blockchain’s maturity as a technology,

regulatory and legal challenges, stakeholders’ trust in the

technology, and their willingness to invest and

participate in applications. Managing and overcoming

these risks and challenges will require stakeholders to

work together to develop solutions that are effective,

holistic, relevant and deployable. Currently, such

collaborative efforts are few in number, making it almost

impossible for stakeholders to fully harness the potential

opportunities that blockchain technology provides.

Harnessing blockchain technologies to drive sustainable

and resilient growth and a new wave of value creation

will require decisive action. The opportunities that

blockchain offers need to be developed and governed

wisely, with upfront and continual management of

unintended consequences and downside risks. A variety

of measures will be needed, from ensuring compliance

with privacy rights, improving security and clarifying

accountability in case things go wrong, through to

establishing standards for minimizing energy

consumption. These responsibilities are shared by all

stakeholders.

8

Building block(chain)s for a better planet

Establishing new global platforms or accelerators

focused on creating a “responsible blockchain

ecosystem”, rather than just incubating specific projects,

would be a valuable and much-needed next step. Such a

platform could support stakeholders from across

different sectors to develop effective blockchain

solutions for environmental challenges, help ensure

blockchain technology is sustainable (i.e. good for people

and the planet) and play a crucial role in building out the

necessary governance arrangements at industrial, state

and global levels.

Finally, today’s hype surrounding blockchain can lead to

the temptation to try to use blockchain to solve

everything. A reasoned and structured approach is

needed to help practitioners assess whether and how to

deploy blockchain for delivering new environmental

solutions. The following three broad principles should be

the starting point for any such assessment:

•

Will blockchain solve your actual problem?

Consider whether blockchain is actually needed to

solve the problem by clearly identifying what the

problem is and whether distributed ledger technology

is really needed to deliver your envisaged solution.

•

Can you acceptably manage the downside risks or

unintended consequences? Consider the risks and

challenges posed by a blockchain-enabled solution,

the technical and commercial feasibility of being able

to mitigate these and the likely time frames to

realize them.

•

Have you built the right ecosystem of

stakeholders? Blockchain’s value as a solution

multiplies when more players participate and when

stakeholders come together to cooperate on matters

of industry-wide or system-level importance. New

partnerships and opportunities are more likely to

emerge from multidisciplinary ecosystems.

9

Building block(chain)s for a better planet

Our planet: The challenge and opportunity

The challenge

From an anthropocentric perspective, the past century

(particularly the past few decades) of human existence

has marked a very successful period for population and

economic growth.

6

The “great acceleration”

7

in human activity, particularly

since the mid-20th century, has delivered exponential

economic growth. Real output grew five-fold in the four

centuries leading to 1900, before accelerating more than

20-fold in the 20th century.

8

The past 60 years and, in

particular, the past 25 years, have witnessed an

increased acceleration in human economic activity. The

recent past is an example of markets working to their

fullest extent, as technologies have driven progress and

real commodity prices have fallen, despite a 20-fold

increase in demand for certain resources.

9

The follow-on

effects have included impressive improvements in

human welfare as the number of people living on less

than $1.25 a day has been cut by one-half since 1990

10

and more than 700 million people have moved into the

global middle classes.

11

Yet, from an Earth-systems perspective, the human

success story is not so positive. The stress on the Earth’s

natural systems caused by human activity has worsened

considerably in the 25 years since the 1992 Rio de

Janeiro Earth Summit in Brazil.

Underpinning these extraordinary human advances has

been the consistently steady state of the Earth’s global

environmental systems provided by the so-called

“Holocene equilibrium”. Global patterns of temperature,

precipitation, seasonality and the overall health of our

atmosphere, cryosphere, hydrosphere and biosphere

have remained predictable for much of the past 10,000

years. During this period, they have functioned within a

“Goldilocks” zone – not too hot and not too cold – for

humans.

12

However, as a result of the great acceleration in human

economic activity since the mid-20th century, research

from many Earth-system scientists suggests that our

planetary systems could now be entering a period of

unprecedented environmental systems change. This

change can be observed across six critical challenge

areas, with implications for the planet and human

prosperity, and demands transformative action early in

the 21st century, as illustrated in Figure 1.

10

Building block(chain)s for a better planet

Figure 1: Global challenge areas

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

11

Building block(chain)s for a better planet

Over the coming decades, these six critical challenges are

set to intensify as global trends are expected to put an

increasing strain on finite resources. The current world

population of around 7 billion is expected to grow to

nearly 10 billion by 2050. As the world becomes more

populous and the global middle class grows in size, it will

increase the demand for energy, transport, food and

water. Under current approaches, as our consumption of

resources continues to rise, so do the levels of waste,

plastic and pollution. To put this in perspective, 8.3

billion tonnes of plastic have been created in the past

century, more than 70% of which is now in waste

streams. Alongside this, societies are under growing

social and economic strain from mounting inequality,

youth unemployment, the threat of automation and

geopolitical volatility. Many of these issues are

exacerbated by environmental deterioration.

While we have seen a progressive increase in

environmental interventions over the past four decades,

the breadth and depth of environmental challenges and

the pace with which they are evolving demonstrates the

need for governments, regulators and businesses to

adapt more quickly than before. Business as usual is

clearly not enough, and the evidence shows that progress

made over the past four decades has been insufficient for

the scale of the challenge.

The opportunity

While these challenges are urgent and extraordinary,

they also coincide with an era of unprecedented

innovation, technical change and global connectivity –

the Fourth Industrial Revolution.

This industrial revolution, unlike previous ones, is

underpinned by the established digital economy and is

based on rapid advances in technologies such as

blockchain, artificial intelligence, the Internet of Things,

robotics, autonomous vehicles, biotechnology,

nanotechnology and nascent quantum computing among

others. It is also characterized by the way in which the

combination of these technologies increasingly merges

the digital, physical and biological realms, and

collectively increases the speed, intelligence and

efficiency of business and societal processes.

The Fourth Industrial Revolution generates

opportunities for global growth and value creation that

far outstrip the advancements of the past century. Left

unguided, these advancements have the potential to

accelerate the environment’s degradation. However, they

also create an opportunity for governments, regulators

and companies to make the Fourth Industrial Revolution

the first sustainable industrial revolution by harnessing

these rapidly evolving technologies to overcome the

world’s most pressing environmental challenges.

Blockchain for the Earth

The Fourth Industrial Revolution includes a new phase of

blockchain-enabled innovation. The computational

architecture of blockchain technology creates a wide

range of potential uses. For example, by providing an

immutable, distributed ledger, it can help to facilitate

peer-to-peer payments, manage records, track physical

objects and transfer value via smart contracts, all without

a third party or manual reconciliation.

During 2017 and 2018, blockchain has received

considerable hype regarding its potential to create wide-

reaching impact, with proponents projecting that it could

account for as much as 10% of global GDP by 2025.

There has also been considerable scepticism with regard

to its performance and scalability that has thus far kept

crypto-networks from seriously disrupting centralized

systems. During the next few years, the focus will likely

be on fixing these technical limitations and addressing

regulatory and legal challenges. As the technology

matures, there is both a challenge and an opportunity to

realize blockchain’s potential – not just for finance or

industry, but for people and the planet.

This analysis explores the opportunity to harness

blockchain to address environmental challenges,

including climate change, loss of biosphere integrity and

water scarcity. Potential and emerging use-cases and

game-changing solutions are explored. Emerging

opportunities include the management of supply chains

and finite resources, enabling the financing of

environmental solutions and incentivizing behaviour

change.

The challenge is to unlock the potential in a way that

ensures inclusion, safety, interoperability and scale.

Whether or not the technology succeeds will not be

exclusively determined by its technical performance,

scalability and resilience. It will also depend on the level

of responsible development and adoption, and will

require fit-for-purpose and supportive new regulatory

and legal systems, investment landscapes and societal

understanding and acceptance.

12

Building block(chain)s for a better planet

The building blocks: Overview of blockchain and

its maturity

Blockchain basics

Figure 2: A look at blockchain technology

Source: PwC

13

Building block(chain)s for a better planet

Blockchain is a decentralized (distributed) electronic

ledger system that records any transaction of value

whether it be money, goods, property, work or votes.

29

It is also an interlinked and continuously expanding list

of records stored securely across a peer-to-peer

network.

30

Every participant with access can

simultaneously view information with no single point

of failure, creating trust in the system as a whole.

Each “block” is uniquely connected to the previous blocks

by including the hash

31

of the previous block in the new

block. Digital signatures are then used to authenticate

transactions. This structure means that making a change

without disturbing the subsequent records in the chain is

extremely difficult. These characteristics make blockchain

cryptographically secure and currently tamper-proof.

Verification of transactions is achieved by participants

confirming changes with one another, replacing the need

for a third party to authorize transactions. Decentralized

consensus makes blockchain platforms immutable, and

updatable only via consensus or agreement among peers.

This design is meant to protect against domination of the

network by any single computer or group of computers.

Blockchains can be public, private (permissioned) or

hybrid systems. Unlike public blockchains, whereby

transactions can be validated by anyone and there is no

access control – private blockchain participants or

validators must be authorized by the owners of the

blockchain. Between the two there are hybrid systems,

combining both private- and public-ledger

characteristics.

32

Why now?

Distributed computing and cryptography have both

existed for decades. However, in 2009 these ideas came

together in the form of Bitcoin: a cryptocurrency network.

Though initially slow to take hold, more recently there has

been a proliferation of its use and a rapid increase in the

number of transactions. As the world became enamoured

with Bitcoin, both large corporations (first financial

institutions, then others) and smaller-scale technology

entrepreneurs saw a bigger picture. The underlying

technology behind Bitcoin had the power to cut

intermediary and reconciliation costs and revolutionize

manual, frequently disjointed, opaque processes to

increase their efficiency. Thus, broader ideas and

conceptual applications for blockchain technology

emerged.

For example, the creation of Ethereum in 2015 (now a $25

billion crypto-network) showed that blockchain was more

than just a niche technology for the financial sector, but

also offered a new, decentralized, trusted and transparent

platform that could benefit a wider range of industries and

issues, with developers naturally seeking out areas where

it could add the most value.

As the volume of coders proficient in blockchain has

increased, start-ups and established corporations alike

have begun to invest in tools, data, people and

blockchain-enabled innovations. ICOs have also emerged

as a new crypto-based alternative to classic early-stage

capital/debt finance, creating opportunities to quickly

fund new blockchain technology ventures. This has

encouraged more investors, speculators and

entrepreneurs to take an interest in this emerging and

potentially powerful technology.

At the same time, a number of converging global trends

have helped to create an environment conducive to the

proliferation of blockchain. Increasingly, digitalization

and connectivity of the global economy, along with the

emergence of powerful global tech firms, has meant that

corporations have become increasingly open to adopting

blockchain and other emerging technologies of the

Fourth Industrial Revolution. Developments in computer

processing power and networked computer systems

have facilitated advances in blockchain programs, while

the domination of smartphones has made digital wallets

possible and increasingly relevant. Alongside this, there

has been a proliferation of IoT and AI applications that

can automate big-data collection and processing for use

in blockchain platforms.

Taken together, these advances in technology and an

emerging global enabling environment have created a

platform from which many blockchain applications are

now being launched.

Blockchain capabilities: now and in the future

It is worth noting that the technology itself is still very

new, and there is a considerable way to go to build trust

among businesses, investors and regulators in relation to

blockchain applications.

However, blockchain’s potential – and at least some of

the associated hype – stems from a combination of its

current capability and the anticipated technology

development roadmap, which suggest that as the

technology matures it could become a foundational

technology like the internet and could dramatically

improve operating efficiencies in some sectors while

completely disrupting others. Two of today’s most

prominent blockchain applications – cryptocurrencies

and smart contracts – illustrate this potential.

Cryptocurrencies are designed to be used as an

alternative to real currencies and to create new token

economies that, among other things, could capture and

monetize currently unrealized economic value, while

smart contracts use a digital protocol to automatically

execute predefined processes of a transaction without

requiring the involvement of a third party or

intermediary.

14

Building block(chain)s for a better planet

The next few years of blockchain will focus on fixing the

most severe technical limitations of blockchain networks’

performance and scalability, as these are limitations that

currently keep them from challenging centralized

incumbents. In particular, these limitations relate to

blockchain’s distributed verification protocols.

To avoid the use of an intermediary, blockchain

applications are characterized by a distributed

verification process, which is designed to achieve

consensus on the content of the distributed ledger. The

following two mechanisms are most commonly used for

verification of a transaction to establish consensus:

•

Proof of work (PoW): Each block is verified through

a process called “mining” before information is stored.

The data contained in each block is verified using

algorithms that attach a unique hash to each block

based on the information stored in it. Users

continuously verify the hashes of transactions

through the mining process in order to update the

current status of the blockchain assets. Doing so

requires an enormous number of random guesses,

making it a costly and energy-intensive process – one

that also faces speed constraints as the network

grows. Early blockchains such as Bitcoin use PoW

verification.

•

Proof of stake (PoS) – PoS simplifies the mining

process. Instead of mining, users can validate and

make changes to the blockchain on the basis of their

existing share (“stake”) in the currency. This

approach reduces the complexity of the decentralized

verification process and can thus deliver large savings

on energy and operating costs. Increasingly, emerging

blockchains such as Ethereum, NEO and WAVES use

PoS verification.

To date, PoW has been the most frequently used

verification method in conjunction with blockchain

technology. In light of concerns regarding cost, energy

intensity and scalability, however, emerging blockchain

applications rely increasingly on PoS and other less cost-

and energy-intensive verification methods. Recent and

emerging verification methods include (but are not

limited to) “proof of authority” (PoA), “proof of

importance” (PoI) and “proof of history” (PoH), which

are also deemed to be less cost-, energy- and time-

intensive (see Glossary for terms). Second-layer “proof of

stake” solutions currently being developed for the

Ethereum platform, such as Casper, Plasma and Sharding,

should address the fundamental scalability challenges of

Ethereum and pave the way for more innovative and

scalable protocols.

Once the networks that form the infrastructure layer of

the cryptostack are built, technologists will increasingly

turn their energy to building decentralized applications

(dApps) on top of this infrastructure. We are also likely

to see the emergence of numerous bespoke ledgers

customized for specific purposes. In parallel, there will

need to be a focus on developing fit-for-purpose

regulation, and on industry and multistakeholder efforts

to experiment, adopt and apply the technology, building

trust when doing so. The speed at which such technical

developments could unfold makes it crucial for the

notion of responsible blockchain to be rapidly adopted

by all stakeholders, in particular the burgeoning

developer community.

Like any new and evolving technology, further advances

in blockchain are difficult to predict accurately as the

technology (and its potential) are evolving so fast that it

can be hard to know how much of the hype will be

realized and, in turn, how exactly the broader enabling

market will mature. How far and how fast blockchain

evolves will be somewhat a function of how quickly (and

successfully) technical, regulatory, scalability and other

challenges – including trust – can be overcome (see

below). One area to watch will be the financial and social

incentives created as these will likely determine the

aspects on which developers focus and where

investment flows. We can also expect the most

transformational blockchain use-cases to emerge where

collaborative and multistakeholder ecosystems are built

to tackle matters of industry-wide or society-wide

importance – such as decentralized energy platforms.

Looking further afield, expected advances in AI,

distributed computing and quantum computing will

likely support – and potentially accelerate – blockchain’s

technological evolution. If it truly lives up to its promise,

this new global computational architecture could rewire

commerce and transform how society operates,

becoming one of the most significant innovations since

the creation of the internet. The opportunity to harness

this innovation to help tackle environmental challenges

is equally significant.

15

Building block(chain)s for a better planet

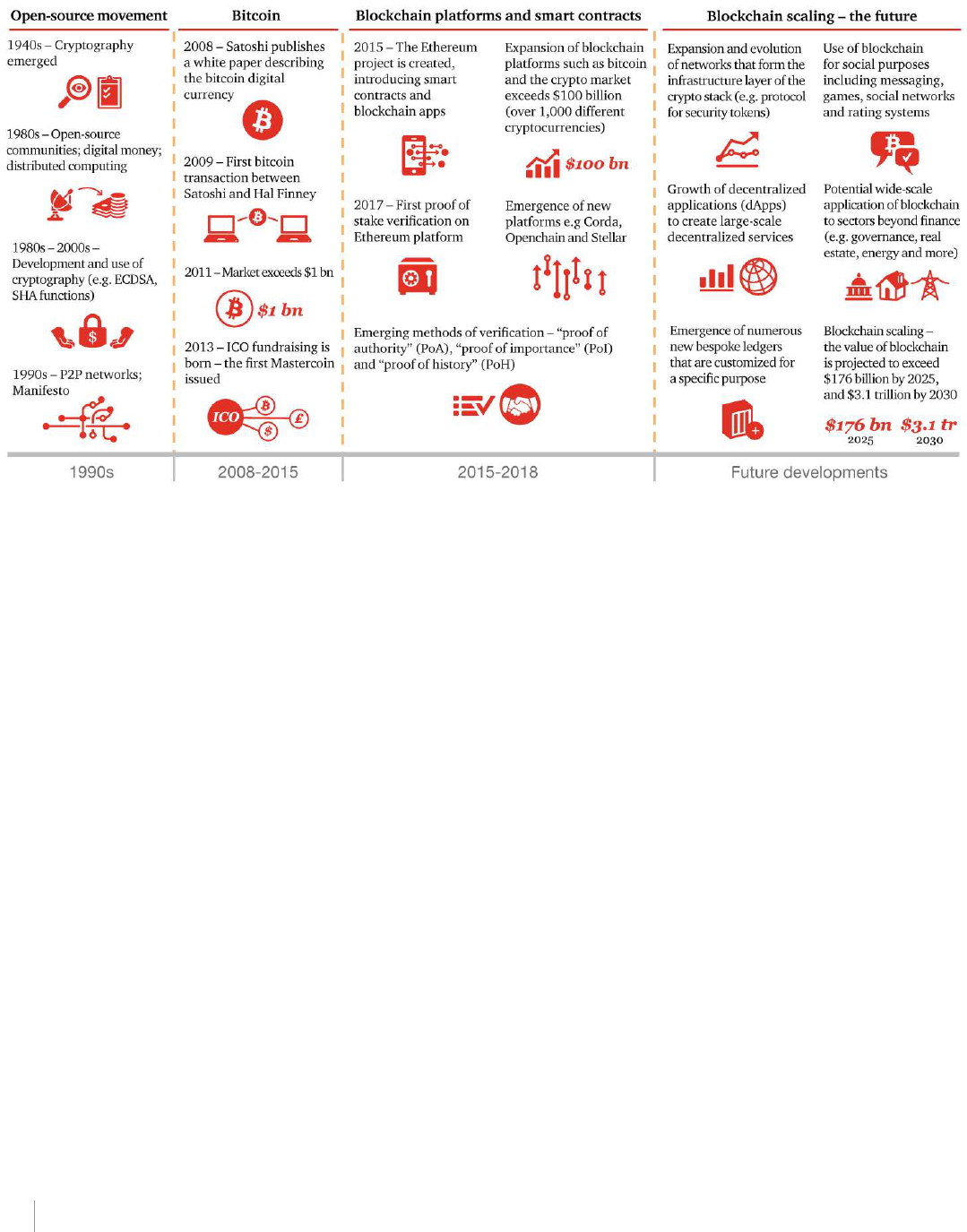

Figure 3: Timeline of blockchain developments

Source: PwC research

16

Building block(chain)s for a better planet

The blockchain opportunity for our

environment

While blockchain has the potential to become a powerful

foundational technology used across different sectors to

tackle a wide range of challenges and opportunities, if it

is to be truly transformative for our global environment,

it will need to be deployed in the right areas. Figure 4

highlights six of the world’s most pressing environmental

challenges and the priority action areas to successfully

address them.

Figure 4: Priority action areas for addressing Earth challenge areas

Source: PwC research

In meeting these challenges, there is wide scope for

innovation and investment. There is potential for

blockchain to provide solutions in and of itself and also

to facilitate solutions that involve other Fourth Industrial

Revolution technologies. Indeed, more than 65 existing

and emerging blockchain use cases for the environment

were identified through desk-based research and

interviews with a range of stakeholders from the

industrial, technological and entrepreneurial sectors, in

addition to research associations and governments.

Figure 5 provides a glimpse of such blockchain

applications by environmental challenge area. The

snapshots are not intended to be exhaustive, but to

provide an initial overview, represent the most

prominent innovations and stimulate a more concerted

action agenda.

These snapshots show that each environmental

challenge area stands to benefit from the use and

deployment of blockchain, and that the majority of

solutions operate by transforming an underlying

economic, industrial or governance system. Many of the

use-cases also represent opportunities to unlock and

monetize (or tokenize) economic value that is currently

embedded within environmental and natural resource

systems, but which has been largely unrealized to date.

Examples include opportunities to build an inclusive bio-

economy, capture the value of intact forests and create

new markets for trading natural resources.

Currently, the majority of use-cases identified are in the

concept or pilot phase, with only a handful having been

fully developed.

17

Building block(chain)s for a better planet

Climate change and biodiversity were the challenge areas

where most use-cases were identified, with fewer

developed in the areas of water resource management,

ocean management and clean air so far. Recent

investment figures highlight the largely untapped nature

of the opportunity. In the first quarter of 2018, for

example, 412 blockchain projects raised more than $3.3

billion through ICOs.

33

However, less than 1% of these

were in the energy and utilities sector, representing

around $100 million of investment, or around 3% of the

total investment for the quarter.

The more than 65 use case solutions identified as being

particularly relevant across environmental applications

tend to cluster around the following cross-cutting

themes:

•

Enabling decentralized systems

•

Peer-to-peer trading of natural resources or permits

•

Supply chain monitoring and origin tracking

•

New financing models, including democratizing

investment

•

Realization of non-financial value, including natural

capital

The challenge for innovators, investors and governments

is to identify and scale these pioneering innovations both

for people and the planet – while also making

sustainability considerations central to wider blockchain

development and use.

While blockchain-based solutions hold great promise,

there is also a lot of hype associated with the technology.

On its own, it is not necessarily transformational for the

environment. However, the potential of blockchain to

help solve environmental challenges can be amplified

exponentially when it is combined with other emerging

Fourth Industrial Revolution technologies such as AI, IoT,

drones, 3D printing and biotechnologies. When it is

applied this way – as a “cocktail mixer” for other

emerging technologies – blockchain starts to become a

truly game-changing technology. Some of those game-

changing examples, drawing on emerging use-cases in

Figure 5 below, are set out in the next section,

“Blockchain game changers for the Earth”.

Figure 5: Blockchain applications by challenge area

Climate change

18

Building block(chain)s for a better planet

Biodiversity and conservation

Healthy oceans

19

Building block(chain)s for a better planet

Water security

Clean air

20

Building block(chain)s for a better planet

Weather and disaster resilience

Source: PwC research

21

Building block(chain)s for a better planet

Blockchain game changers for the Earth

In addition to enhancing current efforts to address

environmental issues, there is enormous potential to

create blockchain-enabled “game changers” in which the

application of blockchain, often in combination with

other Fourth Industrial Revolution technologies, has the

potential to deliver transformative or disruptive

solutions.

The following set of potential game changers are defined

by five important features:

1. Transformational impact (i.e. it could completely

disrupt or alter current approaches)

2. Adoption potential (i.e. the potential population size

is significant)

3. Centrality of blockchain to the solution (i.e.

blockchain is a vital cog in the solution)

4. Systems impact (i.e. the game changer could really

shift the dial across human systems)

5. Realizable enabling environment, including

political and social dynamics (i.e. the enabling

environment can be identified and supported)

The eight most significant game changers are listed

below. Some of these are cross-cutting and more

overarching in nature (but clearly have significant

ramifications for environmental challenges), while others

focus more specifically on environmental challenges.

Although some of these game changers could improve

the efficiency of existing markets, others could drive

transformational shifts in how we operate and how we

tackle environmental challenges.

1. ‘See through’ supply chains

Transactional data throughout the supply chain can be

recorded through the blockchain and an immutable record

of provenance (i.e. origin) can be created, offering the

potential for full traceability of products from source to

store. Providing such transparency creates an opportunity

to optimize supply-and-demand management, build

resilience and ultimately enable more sustainable

production, logistics and consumption. There are a number

of potential applications, some of which are more

advanced and specifically address environmental

challenges.

Corporations are facing increasing regulatory,

reputational, investor and consumer pressure to address

supply chain risks, such as corruption, human rights

violations, modern slavery, gender-based violence, water

security and environmental degradation. An increasing

number of companies are responding with bold public

commitments – from 100% renewable energy use

34

to

zero deforestation,

35

conflict-free minerals or 100%

recycled material

36

pledges. However, global supply

chains are often complex and opaque, and companies

frequently struggle to implement their commitments or

showcase their achievements in the absence of better

visibility into their supply chains. Such provenance,

traceability and transparency of data across supply

chains is also critical to business management in a

broader sense – from improving enterprise-risk

management practices to enabling corporate disclosure

and reporting.

Blockchain-based solutions are providing, for the first

time, full transparency and traceability within the supply

chain. This can build confidence in legitimate operations,

expose illegal or unethical market trading or activities,

mitigate quality or safety problems, reduce

administrative costs, enable greater access to finance,

improve monitoring, verification and reporting, and

potentially help avoid litigation. As these solutions

become more mainstream, they will likely push

companies to be aware of their actions, and enable them

to clearly demonstrate responsible and ethical

operations in a cost- and time-efficient way. Better

corporate data will also enable investors and asset

managers to implement responsible investing practices

with improved effect.

22

Building block(chain)s for a better planet

Solutions that harness blockchain for supply-chain

management are some of the more advanced

applications currently observed that address

environmental challenges.

For example, in agriculture, blockchain has been used,

thanks to its ability to provide a verifiable record of

possession and transaction, to manage and authenticate

harvesting of resources to ensure sustainable practices.

The Instituto BVRio has developed an online trading

platform it has termed a “Responsible Timber Exchange”

to increase efficiency, transparency and reduce fraud and

corruption in timber trading.

37

In 2016, Provenance, a UK-based start-up, worked with

the International Pole and Line Association (IPLA) to

pilot a public blockchain tuna-tracing system from

Indonesia to consumers in the UK.

38

Similarly, Carrefour

Supermarkets have recently introduced an application

where customers can scan products to receive

information on a product’s source and production

processes. Ventures such as FishCoin are developing a

utility token tradable for mobile phone top-up minutes in

an attempt to incentivize fishers to provide information

on their catch. The data captured is then transferred

down the chain of custody until it reaches consumers.

Such data could also be invaluable for governments

seeking to better manage global fish stocks.

39

From a consumer angle, the complexity of supply chains

means that it is difficult for consumers to know how their

consumption habits and purchasing decisions are

affecting the environment, or the associated working and

living conditions along the supply chain. Using

blockchain tools to enable retailers and consumers to

transparently track products from source to shop floor

will enable more informed purchasing decisions.

Current barriers to scaling blockchain applications for

supply-chain traceability and management include: the

interoperability of blockchain solutions with existing

systems for supply-chain management; the lack of

supply-chain standards in place for blockchain solutions

or providers; the transactional capacity of blockchains

versus the capacity that big data from supply chains will

require; and the regulatory implications regarding data

security and privacy among participants.

An additional challenge is ensuring the reliability of

information entered on the blockchain – e.g. while

blockchain applications can track fish all the way from

the boat to the plate, they cannot guarantee they were

caught how and where the data claims. Other

technologies, such as satellite monitoring and handheld

DNA sequencers, could potentially help overcome this

concern.

Looking into the future, blockchain has the potential to

connect all stakeholders in a global supply chain – from

workers in factories through to logistics companies,

retailers, consumers, investors, NGOs and regulators –

under one platform. A platform that provides the data,

traceability, transparency and control or compliance

mechanism that the given user needs would be a truly

transformational proposition for workers in the informal

economy and consumers alike.

Spotlight on illegal fishing

There was explosive growth in the harvest of fish from

the ocean in the second half of the 20th century, as large

industrial ships ventured out from local waters to reach

every corner of the sea, trailing miles of hooks or nets

large enough to catch Boeing 747s. As a result, two-thirds

of the world’s fish stocks today are overexploited.

40

The

cost of mismanagement is high. A recent studsssy found

that reforming management of the world’s fisheries

could increase the total annual catch by 16 million

tonnes and increase annual profits by $53 billion, while

improving the health of ocean ecosystems.

41

One important challenge facing the industry is illegal,

unreported and unregulated (IUU) fishing. The Food and

Agriculture Organization of the United Nations (FAO)

estimates that approximately 20% of the global fish catch

is IUU – robbing governments and legitimate fishers of

up to $23 billion per year.

42

The appetite for tackling this

issue is clearly growing, with a number of related

initiatives emerging in recent years. These include the

Tuna 2020 Traceability Declaration

43

and the Global

Dialogue on Seafood Traceability.

44

Global markets could play a vital role in creating

incentives for better management by offering the

prospect of better prices and better market access for

fish that come from well-managed fisheries. The

potential of blockchain to help unlock this opportunity

has caught the attention of members of the global fishing

industry, global retailers and the Friends of Ocean

Action

45

network, which is convened by the United

Nations Secretary-General’s Envoy for the Ocean, Peter

Thomson, and Sweden’s Deputy Prime Minister, Isabella

Lövin, and is being explored for its capability, along

with other technologies, to enable the eradication of

IUU fishing.

Blockchain-enabled smart contracts could, for example,

potentially underpin innovative tenure arrangements

that give specific resource rights to communities or

fishers. Additionally, blockchain could be used to track a

fish from “bait to plate”, providing a transparent view of

the fish’s origin. This could be complemented by DNA

barcoding,

46

which allows the rapid identification of

seafood in trade by matching fish products to a

standardized genetic library for all fish species.

23

Building block(chain)s for a better planet

2. Decentralized and sustainable resource

management

Centralized utility systems can often struggle to match

supply and demand optimally, are prone to single points of

failure, and suffer from distribution losses and leaks across

the network. For energy, decarburization also relies on the

emergence of renewable distributed energy resources.

Blockchain could initiate a fundamental transition to

global distributed utility systems. Platforms could collate

distributed data on resources (e.g. household-level water

and energy data from smart sensors) to end the current

asymmetry of information that exists between

stakeholders, enabling more informed – and even

decentralized – decision-making in regards to system

design and management of resources. This could include

peer-to-peer transactions, dynamic pricing and optimal

demand-supply balancing. It would reduce intermediaries,

make systems more efficient, cost-effective and resilient,

and increase local sharing of resources to bolster efficient

use of resources, which in turn will make distributed

models more attractive.

Decentralized energy grids

Decentralized energy grids, linked to the emergence of

renewables and distributed generation sources around

the world, are a rapidly emerging phenomenon.

Decentralized energy grids have the potential to cut costs

at the same time as increasing energy efficiency,

improving reliability and supporting renewable energy

integration. Coordination issues across these grids,

however, remain largely unresolved. Blockchain can

provide the solution to these issues, using smart

contracts to optimize coordination, enabling genuinely

local markets for energy trading. For example,

installation of blockchain software with integrated smart

contracts, coupled with smart-meter technology, allows

for traceability and verification of energy sources,

efficient peer-to-peer trading, better balancing and

optimization of energy load and demand.

Peer-to-peer trading also has the potential to support

and bolster renewables uptake as well as minimizing the

need for energy companies, energy traders and payment

providers, and reducing energy transportation losses.

Furthermore, transactions can be securely and

automatically recorded, with smart contracts on a

blockchain establishing a transparent process that users

can trust, but with better protection against cyber-

attacks and without revealing personal information.

A network of companies using these types of solutions

has emerged, though most are currently at trial stage.

LO3 Energy and Siemens Digital Grid, for example, have

launched the Brooklyn Microgrid project,

47

an early

example of an open-source and scalable blockchain

platform for the energy sector. “Prosumers” (consumers

involved in the design, manufacture or development of a

product or service), generating their own solar energy

from rooftop panels, have been autonomously trading in

near-real time with customers (neighbours) in the local

Brooklyn market in New York.

Decentralized grids additionally have the capability to

build local energy resilience: for instance, through

rerouting power in response to a natural disaster, or in

areas around the world where energy scarcity is

prevalent. The Brooklyn Microgrid, for example, has a

built-in microgrid control system, enabling redirection of

electricity towards hospitals and community centres.

Looking further ahead, the global transition to electric

mobility could be integrated into decentralized energy

systems, further adding to energy-system storage and

demand-supply balancing. BlockCharge by RWE and

Slock.it are developing a mobile phone app, which links

to a blockchain-based network that allows electric

vehicle (EV) owners to charge their car via any charging

station network and to be billed for the energy

consumed.

48

The EVs interact automatically with the

stations, and the electricity payment process is

autonomous. This type of charging information, for

regions and in aggregate, can help increase the

management and optimization of decentralized grid

solutions.

Decentralized water

Blockchain, combined with other Fourth Industrial

Revolution technologies, could enable a step-change in

the optimization of distributed water management. Real-

time transparent data on water quality and quantity can

inform conservation, dynamic pricing and trading, and

spot illegal extraction or water tampering.

Blockchain could become a core part of the solution to

enable “off-grid” water resources, analogous to

decentralized energy systems.

24

Building block(chain)s for a better planet

Household smart meters can produce large volumes of

data that can be used to predict water flows, spot

inconsistencies and check leaks. Blockchain technology

could also support peer-to-peer trading of water rights in

a given basin, allowing water users willing to share their

excess resources to become “prosumers” without relying

on a centralized authority. The next stage will be to

combine blockchain with machine learning and the

internet of things to create a truly decentralized water

system where local resources and closed-loop water-

recycling gain value.

Realizing fully decentralized utility solutions will require

sufficient regulation to assure the security and integrity

of the software, ownership and control of intellectual

property rights and the transferring and trading of

resources, which, in some instances, will be virtual.

These are surmountable challenges and the reward is the

critical transition of utility infrastructure and markets to

a decentralized, decarbonized and more water-secure

future.

Spotlight on new energy management platforms

The transition to low-carbon energy systems will be

critical in enabling governments to meet their climate

commitments as part of the 2015 Paris Agreement on

climate change. Scaling up the amount of renewable

energy generated in the global energy mix is a central

part of this transition. However, integrating high

percentages of renewable energy such as solar and wind

into traditional energy grids can present challenges to

their stability and predictability. This is largely because

renewable energy can be intermittent and is often

generated from smaller-scale and less centralized

sources than traditional fossil-fuel generators. To

facilitate the generation and distribution of renewable

energy at the scale needed, a range of transactive energy

technologies enabling electricity storage, energy trading,

demand forecasting and management, will need to be

integrated into new, intelligent “smart grids”. Blockchain

offers exciting potential to help knit such technologies

and grids together.

To help progress these solutions, Grid Singularity and the

Rocky Mountain Institute founded the Energy Web

Foundation (EWF),

49

with an ecosystem of large utility,

information and communication technology (ICT),

energy and blockchain partners, including those bringing

blockchain-based energy trading to real-world markets.

The foundation is a global open-source, scalable

blockchain platform designed specifically for the energy

sector. It is currently in beta release and allows

companies to develop and test applications to support,

for example, micropayment channels, data analysis and

benchmarking, certificates of origin, smart and microgrid

management, renewable energy procurement and

trading, electric-vehicle charging and demand response.

Platform innovations include a more energy-efficient,

decentralized proof of authority (PoA) protocol, a secret

transaction feature to encrypt smart contracts and

protect personal data, and a light-client version for small

IoT devices to overcome potential platform-scaling

issues.

As government-mandated targets for renewable energy

supply and corporate commitments for sourcing

renewable energy

50

increase, there is also a growing

need to verify purchases of such “green” electricity. In

electricity grids that draw from both renewable and non-

renewable energy sources, electrons from renewables

are indistinguishable from electrons generated from

fossil fuels. Because of this, a secondary market can exist

to represent the environmental and social benefits of the

electricity purchases through Certificates of Origin (also

termed Renewable Energy Credits or Guarantees of

Origin). However, the system for buying such certificates

is often a complex process, with many organizations

acting as intermediaries, which adds a time, labour and

cost burden to the process, and can breed a lack of trust

as to whether they were accurately counted and traded.

Blockchain’s ability to enable verification, traceability

and transparency could significantly streamline this

complex process and introduce confidence into the

market. It could also reduce the barriers to entry for

smaller organizations, encouraging further participation

in markets for Certificates of Origin and helping to grow

demand for renewable electricity.

3. Raising the trillions: new sources of sustainable

finance

The UN estimates that there is a funding gap of $5 to $7

trillion per year to meet the SDGs, with an investment gap

in developing countries of about $2.5 trillion.

51

Employing

blockchain-enabled finance platforms could potentially

revolutionize access to capital and unlock potential for

new investors in projects that address environmental

challenges – from retail-level investment in green

infrastructure projects through to charitable donations for

developing countries.

Blockchain-enabled platforms could be employed to

unlock access to capital. Its ability to seamlessly manage

complex financing environments means it can integrate a

wide number of stakeholders, making it feasible for

projects and ventures to crowdsource funds from a large

number of diverse investors rather than just several

large investors. Regardless of the number of investors,

the decentralized framework could also significantly

increase efficiency and lower transaction costs, both

formal and informal.

The “tokenization” of financial investments opens up this

opportunity for a wider group of stakeholders to invest.

Investors with larger amounts of capital would share the

25

Building block(chain)s for a better planet

same automated process as investors with very small

amounts of capital; therefore, access and entry

requirements are democratized. This will remove the

need for third parties and could enable projects that

attempt to tackle environmental challenges to access

capital quickly, without being delayed by the red tape

that is often a part of doing business with big institutions.

Early applications have emerged. The Sun Exchange

launched a blockchain-based platform for crowdselling

solar assets, connecting people who want to invest in

solar with those who want access to it. This enables

financing of solar projects in sub-Saharan Africa, where

high upfront costs and political barriers can prevent

financing from traditional investment-capital sources,

which inhibits widespread deployment. In addition, the

decentralized platform facilitates cross-border

investments and repayments (avoiding exchange fees

associated with national currency). A further example is

the Clean Water Coin, which uses a blockchain platform

to quickly and efficiently raise funds for clean-water

projects worldwide.

52

Other nascent projects are looking

at tokenizing carbon credits (e.g. Poseidon), while the

Natural Asset Exchange blockchain platform and its

Earth Token cryptocurrency aims to create a Natural

Asset Marketplace that connects certified producers of

natural capital assets with consumers of these assets.

Looking ahead, blockchain could be a real game changer

for “blended finance” investment in projects seeking to

deliver the UN’s Sustainable Development Goals. A

platform could efficiently facilitate the complexity of such

transactions where different types of funding, traditional

and non-traditional assets, and multiple stakeholders

with multiple requirements are involved.

53

The overall “token economy” created by the proliferation

of crypto-networks is still in its infancy. Quality projects

represent only a small proportion of all the blockchain

projects that have been created to date, but the

possibility to finance projects and practices that have a

positive environmental benefit is just beginning to be

demonstrated.

4. Incentivizing circular economies

Today, 90 billion tonnes of resources are extracted every

year to meet consumption demands and that number is

expected to more than double by 2050. Estimates also

predict that by 2050 there will be more plastic waste in the

oceans than fish. If harnessed in the right way, blockchain

could fundamentally change the way that materials and

natural resources are valued, incentivizing individuals,

companies and governments to unlock financial value

from things that are currently wasted, discarded or

treated as economically invaluable. This could drive

widespread behaviour change and help to realize a truly

circular economy.

Early-stage blockchain applications are being developed

to reward individuals or companies with cryptocurrency

credits that represent value, in return for sustainable

actions (e.g. collection of ocean plastic, recycling or water

conservation).For example, Plastic Bank has created a

social enterprise that issues a financial reward in the

form of a cryptographic token in exchange for depositing

collected ocean recyclables such as plastic containers,

cans or bottles.

54

Tokens can be exchanged for goods

including food, water, etc. RecycleToCoin is another

blockchain application in development that will enable

people to return their used plastic containers in

exchange for a token from automated machines in

Europe and around the world.

55

Similar mechanisms can be deployed or created for re-

incentivizing markets for food, water, forests and

conservation activities, even if investors have lower

expectations of a financial return. Gainforest is an

example of “crypto-conservation”, using smart contracts

to incentivize farmers in the Amazon to preserve the

rainforest in return for internationally crowdfunded

financial rewards. Remote sensing using satellites

verifies the preservation of a patch of forest, which then

triggers a smart contract using blockchain technology to

transfer payment.

The potential extends beyond merely changing

behaviour and could also incentivize companies to

design and manufacture products in ways that make it

easier to manage the product lifecycle and to reharvest

materials and unlock their embedded value.

Another potential application of blockchain in

incentivizing the move towards a circular economy

involves its use in more traditional systems of waste

management. For example, extended producer

responsibility (EPR) systems incentivize the recycling of

waste by transferring a fee paid at the point of purchase

to recyclers in order to subsidize the cost of recycling

non-profitable or even toxic materials found in products

such as electronic waste. Smart contracts based on

blockchain technology could dramatically increase the

transparency, scalability and efficiency of this process

allowing for uptake in markets where the costs of setting

up EPR systems have been prohibitively high and trust in

the system is low. Coalitions of companies, governments

and international organizations are exploring this use-

case.

An important challenge in scaling these applications will

be the level of public understanding of blockchain

technology, and the willingness to use it. Poor usability

for retail-level users is often cited as a weakness of

existing blockchain platforms and, until this is addressed,

it is difficult to see widespread adoption and use of these

initiatives.

26

Building block(chain)s for a better planet

Spotlight on global soft commodity value chains

The destruction of forests destroys biodiversity and

creates almost as many greenhouse gas emissions as

global road travel, and yet it continues at an alarming

rate, with an area equivalent to the size of South Africa

lost between 1990 and 2015.

56

In addition to the environmental degradation, it poses a

risk to many global supply chains, particularly those

related to consumer products. Research by CDP found

that in 2017 up to $941 billion of turnover in publicly

listed companies was dependent on commodities linked

to deforestation.

57

The production of soft commodities, in

particular beef, soy and palm oil, has the largest impact

on tropical forests, accounting for 36% of tropical

deforestation.

58

In response, a movement has emerged to halt, by 2020,

the deforestation embedded in global agricultural supply