Residential Flood Risk in the United States:

Quantifying Flood Losses, Mortgage Risk and Sea Level Rise

May 2020

2

Copyright © 2020 Society of Actuaries

Residential Flood Risk in the United States

Quantifying Flood Losses, Mortgage Risk and Sea Level Rise

Caveat and Disclaimer

The opinions expressed and conclusions reached by the authors are their own and do

not represent any official position or opinion of the Society of

Actuaries or its members. The Society of Actuaries makes no representation or warranty to the accuracy of the information

.

Copyright © 2020 by the Society of Actuaries. All rights reserved.

AUTHORS

David D. Evans, FCAS, MAAA

Consulting Actuary

Milliman, Inc.

Cody Webb, FCAS, MAAA, CPCU

Principal and Consulting Actuary

Milliman, Inc.

Elias Braunstein

GIS Analyst

Milliman, Inc.

Jonathan Glowacki, FSA, CERA, MAAA

Principal and Consulting Actuary

Milliman, Inc.

Andrew Netter

Senior Financial Consultant

Milliman, Inc.

Brandon Katz, M.Sc.

Executive Vice President, Member

KatRisk, L.L.C.

Dag Lohmann Ph.D.

Chief Executive Officer

KatRisk, L.L.C.

SPONSOR

Society of Actuaries

Research Executive Committee

3

Copyright © 2020 Society of Actuaries

CONTENTS

Introduction.............................................................................................................................................................. 4

Executive Summary .................................................................................................................................................. 5

1. The Flood Insurance Gap ...................................................................................................................................... 7

1.1 How Mortgage Requirements Affect Insurance Purchase ................................................................................ 7

2. Methodology: Estimating the Exposure of U.S. Residences to Flood ..................................................................... 7

2.1 Data and Assumptions ........................................................................................................................................ 7

2.2 Catastrophe Simulation Models – A Primer ....................................................................................................... 8

2.3 The KatRisk Flood Model ..................................................................................................................................... 9

2.4 Applying and Selecting Sea Level Projections .................................................................................................. 11

2.5 Creation of a Market Basket ............................................................................................................................. 12

2.6 Estimating NFIP Take-Up Rate .......................................................................................................................... 13

2.7 The Residential Private Flood Insurance Market ............................................................................................. 15

3. Results: Estimates of Insured and Uninsured Flood Exposure to U.S. Homes ...................................................... 18

3.1 Insured and Uninsured Loss Results ................................................................................................................. 18

3.2 Impacts of Sea Level Rise .................................................................................................................................. 20

3.3 Summary of Results by MSA ............................................................................................................................. 26

4. Projections: Mortgage Default Risks After Catastrophic Flooding ........................................................................ 28

4.1 Potential Bearers of Flood Risk: Beyond Homeowners and Insurers ............................................................. 29

4.2 Methodology: Catastrophe Analytics for Home Loans .................................................................................... 32

4.3 Results: Catastrophe Analytics for Home Loans .............................................................................................. 44

4.4 Historical Results: 2017 Mortgage Performance Following Hurricane Irma .................................................. 48

5. Appendix ............................................................................................................................................................ 58

5.1 Maps: Increase in expected Flood Losses under Sea level rise scenarios ...................................................... 58

5.2 Exhibits ............................................................................................................................................................... 64

5.3 Overview of MIlliman M-Pire: Mortgage Analytic Methodology .................................................................... 77

About The Society of Actuaries ............................................................................................................................... 81

Limitations .............................................................................................................................................................. 82

4

Copyright © 2020 Society of Actuaries

Residential Flood Risk in the United States

Quantifying Flood Losses, Mortgage Risk, and Sea Level Rise

Introduction

This Society of Actuaries (SOA) report authored by Milliman, Inc. (Milliman) is designed to evaluate the impact and

evolution of societal risk management due to projected future changes in frequency, severity, and variety of

weather-related catastrophes.

One catastrophic peril that could be particularly impacted by these changes is flooding. As sea levels rise, so will the

risk of hurricane-related inundation to coastal properties, driven by storm surge. Additionally, changes to

precipitation patterns could lead to increased risk of inland riverine flooding and urban flash floods.

Under current climactic conditions, flooding stands out among other natural catastrophes in terms of the ongoing

risk that it poses to the financial health of the average United States household. Despite recent efforts to reform

the National Flood Insurance Program (NFIP), most U.S. homeowners do not carry insurance to protect their

properties against the risk of flooding. For most homeowners, the purchase of this coverage is mandatory only if

they live in certain specified high-risk areas. However, significant risk exists in areas where the purchase of flood

insurance is rare. Additionally, even in areas where flood coverage is required, data from the NFIP and private flood

insurers do not indicate high degrees of coverage.

Beyond direct damages to property and communities, the flood insurance protection gap could have many

downstream financial impacts. Because homeowners insurance is integral to protecting the collateral that underpins

the U.S. mortgage system, coverage gaps could create adverse financial exposure to bearers of mortgage risk

including mortgagees, insurers, reinsurers, federal underwriting agencies, and bondholders.

If the frequency or intensity of flooding were to increase, exposed American households could be at more risk in

the future than they are today. Further, some areas historically considered to have low flood risk could become

more exposed, extending the problem’s potential economic impact on the U.S. residential housing stock.

This report examines current countrywide residential exposure to flooding, considers how it could be impacted by

sea level rise, evaluates how this could affect the financial health of residential householders, explores a new

technique to determine whether it could impair their ability to meet their mortgage obligations, and analyzes the

effects of defaults to other parties or institutions.

5

Copyright © 2020 Society of Actuaries

Executive Summary

This report provides estimates of the insured and uninsured flood exposure of single-family residences in the

contiguous United States from both storm surge and inland flooding. Additionally, storm surge losses have been

produced across sea level rise scenarios that represent how moderate to extreme interpretations of contemporary

scientific projections could affect today’s housing stock.

Results are presented below and in the pages that follow, mostly at the Metropolitan Statistical Area (MSA) level.

While management of flood risk occurs from the federal jurisdiction down to the individual homeowner, MSA-level

results provide an opportunity to identify which local regions may face the most imminent challenges with respect

to developing risk-management strategies to address flooding risk. Note the following key findings with respect to

our analysis of countrywide single-family flood risk:

• Building losses to single-family residences due to flood are expected to cost more than $7 billion annually, and

more than 87% of those losses are estimated to be uninsured by the NFIP. If private flood insurance data were

included with NFIP data in the estimation of the uninsured loss percentage, it is likely that this estimate would

only marginally decrease due to the small size of the residential private flood market relative to the NFIP.

• Building losses to single-family residences due to flood are estimated to average about $78 per single-family

residence per year

. Other costs to homeowners such as damage to contents and other structures, as well as

additional living expenses, mean that

expected total losses for homeowners due to flood are comparable to other

major perils typically insured by a homeowners policy, such as fire and wind/hail.

• Uninsured losses are prevalent across the entire United States. We estimate that 69% of MSAs in the United

States have 90% or more of their expected flood losses uninsured, with only 6% of MSAs having more than 30%

of their expected flood losses insured.

• Countrywide, we estimate that approximately one-third of homes in the SFHA have an NFIP policy, with the

majority of states having less than a 25% take-up rate. Outside the SFHA, every state except Louisiana, Florida,

and Texas has take-up rates of approximately three percent or less, with the majority being less than one

percent.

• The increase in storm surge losses due to sea level rise is significant in all storm surge exposed areas, and highly

sensitive to the amount of sea level rise.

We estimate that sea level rise will increase total storm surge losses 21%

by 2050 in our medium sea level rise scenario, and 66% in our high sea level rise scenario. Local impacts can be

much higher than these averages.

• The severity of extreme flooding events is significantly higher with sea level rise. Half of MSAs exposed to storm

surge currently are expected to have losses from extreme “one-in-500-year” flood events increase by 10% or

more in our medium sea level rise scenario. In our high sea level rise scenario, the increase is 17%.

• MSAs where flooding is already significant relative to income stand to see some of the largest increases in

expected flood losses.

The 10 MSAs with the highest ratio of expected flood losses to annual household income

today are estimated to have flood losses increase by 0.27% of income in our medium sea level rise scenario and

0.75% in the high sea level rise scenario.

• The high percentage of losses uninsured is not expected to improve in the future unless current flood insurance

purchase patterns change. The vast majority of additional losses due to sea level rise will continue to be mostly

uninsured. Sea level rise will cause the amount of uninsured losses to increase on an order similar to total losses.

6

Copyright © 2020 Society of Actuaries

With uninsured losses already relatively high, homeowners will be faced with either increasing uninsured losses

or paying for flood insurance policies that they do not have today.

An area of growing concern has been the impact of flooding and sea level rise on the ability of homeowners who

financed their residences to pay their mortgages. This report builds on the flood catastrophe modeling results by using

them in conjunction with a financial model predicting homeowner default to estimate the degree of mortgage

impairment that could potentially result from catastrophic flood events. This was estimated using a sample of loans

backing recent credit risk transfer (CRT) securities from the Federal Home Loan Mortgage Corporation (Freddie Mac).

We note the following key observations with respect to our modeled estimates of flood impacts to mortgage risk:

• While current insurance purchasing patterns and the mandatory purchase requirement do mitigate the expected

impact to credit losses,

model estimates indicate that that at least 42% of the expected increase in credit losses

due to extreme flood events could remain after considering the benefits of insurance claim payments.

• Local impacts of some extreme flood events on mortgage defaults could be substantial, with modeled credit

losses an order of magnitude higher post-event.

Even considering current insurance purchasing patterns and

requirements, estimated credit losses for impacted regions increased between approximately four and 23 times

for each of our modeled events.

• Despite the large local impacts, diversification can mitigate most of the credit losses arising from a single extreme

flood event on large portfolios of loans similar to those backing Freddie Mac CRT securities. We estimate that

increased credit losses due to a given extreme flood event ranges between one and five basis points per event

across each scenario for an entire collateral pool, after accounting for flood insurance claim payments. This cost

will vary based on the severity of the event and concentration of loans in the pool for a given event.

• The incremental credit loss impact estimates, while small on the aggregate pool, could deliver a more significant

impact to investors in subordinate tranches of CRT mortgage securities. For a subordinate tranche of high loan-

to-value loans, we estimated flood events could increase principal writedowns by 15% to 95% relative to a

baseline scenario without a flood event. Thus, the relationship between catastrophic and economic

concentrations of risk may be important to consider when evaluating and pricing these transactions.

• Sea level rise can potentially impact credit losses similar to the overall increase in expected losses discussed

above.

Increased credit losses due to extreme flood events increased by 24% and 72% using our medium and

high sea level rise scenarios, respectively.

• Each of the points above is in contrast to historical experience of loan performance. In many cases, such as

Hurricane Irma, historical experience has been more favorable than these estimates would indicate. We believe

there are several intuitive reasons for this, notably

that federal and state financial assistance programs likely

provided a significant buffer against credit losses for prior flood events. Thus, the true credit exposure to these

events is likely lower than models would indicate, so long as assistance continues to be paid at a rate similar to

the one it historically has been. However, if disaster assistance programs were to be reduced or eliminated, the

financial threat posed by this issue could be larger than historical data indicates.

7

Copyright © 2020 Society of Actuaries

1. The Flood Insurance Gap

1.1 HOW MORTGAGE REQUIREMENTS AFFECT INSURANCE PURCHASE

For homeowners, there is no legal obligation to obtain property insurance. However, insurance purchase

requirements apply to most homeowners as a condition of their mortgages, for which insurance is an essential tool

for lending institutions to mitigate risk to the collateral that secures their loans. They do this by requiring borrowers

to purchase hazard insurance meeting certain guidelines. These guidelines are typically set by federal agencies

because the ultimate guarantors of approximately 60%

1

of outstanding U.S. mortgage debt are the government-

sponsored enterprises (GSEs). These guidelines shape the coverages and exclusions provided by most insurance

policies and are the primary mechanism society has in place to ensure that homeowners maintain proper insurance.

As a result, the uptake of various coverages is heavily dependent upon such requirements, and homeowners may

incorrectly assume that the insurance they are required to purchase is enough to protect their property from loss.

For flood insurance, purchase is only mandated on federally-backed mortgages for properties located in Special Flood

Hazard Areas (SFHAs), defined by flood maps that use boundaries of “one-in-100-year” floodplains. The requirement

is a “yes or no” mandate, and could provide poor alignment between coverage and risk for many reasons, including:

• The location of a property outside the “100-year floodplain” does not indicate that there is no flood risk or that

the risk is insignificant. The “100-year flood,” or, more accurately, the flood with a 1% annual chance of occurring,

does not fully capture the range of risk. Estimates indicate that an inch of water in a home from a “less-than-100-

year flood” may still be catastrophic, reaching close to $27,000 for a typical home

2

. The 100-year flood can

happen in any year and has a 26% chance of occurring over the life of a 30-year mortgage, even assuming a stable

climate

3

.

• The 100-year floodplain changes over time due to land use and natural factors, but maps only change when

government agencies update them.

4

• The Flood Insurance Rate Maps (FIRMs) defining the 100-year floodplain mostly do not consider precipitation-

driven flash flooding, tsunami, or the interaction between riverine and coastal flooding.

Accordingly, although there are existing mortgage requirements intended to ensure that flood insurance is in place in

high-risk areas, uninsured exposure to flood risk may exist for many homeowners and mortgages.

2. Methodology: Estimating the Exposure of U.S. Residences to Flood

2.1 DATA AND ASSUMPTIONS

To assess overall flood risk and the flood insurance gap, we paired a realistic cross-section of the U.S. housing stock

with data from the NFIP and a catastrophe simulation model, a tool that insurers use to quantify their financial

exposure to natural catastrophes. Using this data, we are able to produce estimates of total, insured, and uninsured

flood risk not only at the national level but also at a local level so that this issue can be examined for each region and

municipality in the country.

1

Urban Institute, Housing Finance Policy Center (March 2020). Housing Finance at a Glance: A Monthly Chartbook. Available at:

https://www.urban.org/sites/default/files/publication/101926/housing-finance-at-a-glance-a-monthly-chartbook-march-2020.pdf

2

Federal Emergency Management Agency. Estimated Flood Loss Potential. Available at: fema.gov/media-library-data/1499290622913-

0bcd74f47bf20aa94998a5a920837710/Flood_Loss_Estimations_2017.pdf

3

The 26% probability is equal to one minus the probability of no 100-year flood in each year (1 – 0.99

30

).

4

See Federal Emergency Management Agency, Flood Map Revision Processes at https://www.fema.gov/flood-map-revision-processes for details of the

flood map revision process.

8

Copyright © 2020 Society of Actuaries

We focused on expected flooding losses for buildings of single-family residences in the contiguous United States as

modeled with the KatRisk SpatialKat Flood Model (KatRisk Model). Unless stated otherwise, this definition applies to

all references to expected loss contained in this report.

The KatRisk Model comes from a field of analytical tools known as stochastic catastrophe models, which are used for

pricing and managing the risk of natural catastrophe risk in the insurance industry. With most catastrophes, and

particularly flood, historical data is limited in its ability to predict future events. When provided with input data in the

form of a portfolio of exposure characteristics, these catastrophe models provide estimates of losses from future

events using accepted scientific and engineering principles, but with smoothed results derived from the execution of

thousands of simulation runs.

Insurers typically use these models in conjunction with their own policy data for the purpose of assessing portfolio

risk or negotiating reinsurance treaties. For our analysis, the portfolio in question was the stock of U.S. single-family

residences.

To build a dataset that could be exposed to the KatRisk model to provide estimated countrywide flood losses, we

developed a “market basket” of single-family residences in the contiguous United States. Market baskets are

hypothetical datasets used to represent cross-sections of markets. They rely on the actual locations of properties with

risk characteristics relevant to flood risk that are estimated with an intent to be as realistic as possible.

We also used NFIP’s OpenFEMA data to estimate which properties were likely to have purchased flood insurance from

the NFIP, both inside and outside the SFHAs where purchase is mandated. The impact of private flood insurance is

relatively small compared to the NFIP today and has been excluded from our analysis. For further discussion of this

point, see Section 2.7.

The final market basket contained approximately 1% of all single-family residences in the contiguous United States—

close to 1 million locations. Though this is a credible amount of data when using a catastrophe model for the purposes

of this paper, the statistics presented are sensitive to some inherent uncertainty arising from the sampling of locations,

assignment of property characteristics, and estimates relating to whether NFIP insurance is in place.

KatRisk model output for the market basket serves as the core for the analysis that follows in this report. Detailed

information about the analysis is presented throughout the remainder of the section.

2.2 CATASTROPHE SIMULATION MODELS – A PRIMER

Catastrophe simulation models combine engineering, sciences, and principles of insurance to project future costs

associated with natural disasters. In the insurance industry, they have become a fixture upon which the vast majority

of catastrophe pricing is based. At their core, these models seek to simulate every realistic potential type of disaster

for which a property may be at risk, computing measures of both frequency and severity in the form of return period

and average annual loss statistics. The output of these models is then used by actuaries as a synthetic loss history and,

along with any actual loss history, can be used to inform an underwriter or homeowner of their potential financial risk

over different time horizons. The output from catastrophe models as they pertain to flood risk are especially important

in the United States because publicly available insurance loss history for flood is either summarized, sparse, or volatile,

making it difficult to know the potential risk of a property.

The primary input to a catastrophe model includes information about each property at risk. The most important of

these inputs for computing flood risk include: location, occupancy (e.g., residential or commercial) construction type

(e.g., wood, masonry, steel), presence of a basement, elevation of the first floor above ground, number of stories,

and the value of different types of property (building, contents, appurtenant structure, interruption of use value).

Other important factors may include whether a structure has any enhanced flood defensive measures and any existing

insurance limits and deductibles. How a structure is affected by a flood is a function of the materials and composition

of the building; detailed building information is required for a catastrophe model to provide accurate results.

9

Copyright © 2020 Society of Actuaries

After importing the building characteristics into an inland flood and storm surge model, every structure is then

exposed to thousands of years of simulated hurricane and rain-storm events. Losses are computed for each of these

events both individually and by other aggregates (ZIP code, state, etc.). For each of these aggregation levels, an event

loss table (ELT) is computed that tracks the total loss by event. With an ELT, which may be thought of as a simulated

loss history, average annual loss (AAL, also known as the pure premium) can be computed. This is determined by

summing all the losses and dividing by the number of simulated years. This is referred to as the pure premium because

it is the minimum amount an insurance company would need to charge over the entire simulation period to, on

average, break even. It is the average loss over every year for a location or aggregation level. Finally, exceedance

probability (EP) may be calculated, which relates a probability or return period year with a given loss. As an example:

if the one-in-100-year flood loss for a property is $100,000, then every year there is a 1% chance of having a $100,000

or greater loss event at that location. It should be noted that there are two different perspectives of EP curves:

occurrence and aggregate exceedance probability (OEP and AEP). OEP simply uses the largest event loss in a given

year to compute the EP curve, whereas AEP uses the sum of all events in a given year. The below figure summarizes

the three output loss statistics presented above.

Figure 1: Exceedance Probability Curve

2.3 THE KATRISK FLOOD MODEL

The KatRisk flood and storm surge model is based on the simulation of 50,000 years of precipitation and hurricane

events, which includes more than 2 million events in the United States and Canada. For the U.S. flood model, primary

input data includes precipitation data from the Center for Climate Prediction (CPC) since 1979, forcing data (such as

temperature, humidity, and radiation) from the North American Land Data Assimilation (NLDAS) since 1979, stream

gauge station data from the United States Geological Survey (USGS), and 10m horizontal resolution elevation data

from the National Elevation Dataset (NED).

After obtaining all required data, simulation of inland flood events is performed by first modeling sea surface

temperature (SST) globally using a corrected approach.

5

Afterwards, we coupled the principal components of the SST

analysis (often referred to as teleconnections, such as El Niño/La Niña, Atlantic Multidecadal oscillation, etc.) to

5

Navarra et al.: A stochastic model for SST for climate simulation experiments, Climate Dynamics (1998) 14: 473-487

10

Copyright © 2020 Society of Actuaries

precipitation by using a VARMAX state-space model.

6

Next, all major statistical patterns of rainfall and land and sea-

surface temperature are computed using the VARMAX model that was built with observed data. Finally, simulation of

events of 10 thousand seven-year periods are computed using a combination of historic data and the statistical

patterns mentioned above, sometimes referred to as analog models.

7

These data will then cover both events that

look similar to history and those events that may be more extreme than history.

Once KatRisk has computed 10 thousand seven-year periods of simulated rainfall, the flow of water downhill toward

river outlets must be computed using hydrologic and hydraulic models to capture both the fluvial (river over-topping)

and pluvial (surface water) sources of flooding. To compute pluvial flooding, KatRisk first uses a hydrologic model to

track all sources and sinks of water over time. This includes but is not limited to snow melt/retention,

evapotranspiration, and loss to groundwater. Once the appropriate rainfall/runoff parameters are computed, the

model can then determine what percent of the water that falls in a catchment will flow overland and not be lost to

the aforementioned sinks. Water is then allowed to fall onto the ground and is routed using a two-dimensional finite

volume wave diffusion equation. Computing the fluvial component of flood is accomplished by using the St. Venant

equations, which track how water moves from upstream to downstream and out into the ocean. Once the total flow

is known along the river, the two-dimensional shallow water equations are used to compute flood inundation. This

process is described visually in Figure 2.

In summary, to compute the inland (pluvial and fluvial) components of flood over every simulated year, the general

steps as shown below include (1) modeling rainfall and snowmelt, (2) modeling the fraction of rainfall that results in

run-off, (3) hydraulic modeling of the water over land surface to streams and rivers, and (4) modeling riverine flow

from upstream catchments to downstream catchments. The final step in computing the pluvial/fluvial event set is to

discard the first two years of every simulation to ensure that the model has reached a steady state before data is

retained.

Figure 2: Hydrologic Flow

The above covers flooding from large (synoptic) scale inland flood events. The KatRisk model also simulates flooding

as a result of tropical cyclone-induced extreme precipitation and storm surge. KatRisk has developed a hurricane track

set using the HURDAT dataset from 1950 to 2008, which has been filtered to use only pertinent hurricanes. Cyclone

genesis is then determined using the rates from the historic record during different seasons and climate cycles, the

most important feature being climate patterns related to high and low sea surface temperatures that respectively

increase and decrease hurricane generation rates and strength. The movement and intensity of these cyclones is then

governed by a combination of physics and statistical likelihood functions over a sea surface with spatial and temporal

6

Kedem, B, and Fokianos, K: Regression Models for Time Series Analysis, Wiley, 2002

7

van den Dool, Huug: Empirical Methods in Short-Term Climate Prediction, Oxford, 2007.

11

Copyright © 2020 Society of Actuaries

variation. The landfall rate and intensity of these storms is then analyzed to ensure that they generally match historical

rates during different seasons and climate states. Finally, tropical cyclone rainfall is computed using physical equations

relating statics including but not limited to central pressure and the wind field.

The final track set consists of 50,000 years of tropical cyclone tracks with annual rates and tracks of tropical cyclones

dependent on main development region SST and El Nino-Southern Oscillation (ENSO). The main development region

is the area between 10

o

N and 20

o

N, between the coast of Africa and Central America, where most African waves

originate. Each of the 50,000 modeled years is associated with a climate state, making it possible to subset years and

events and resulting model losses corresponding to a given climate state, or range of climate states.

Because these events are generated using the same 50,000 years of simulated sea-surface temperatures as the inland

flood model, they may be directly combined, creating a model that tracks all primary sources of flood in the U.S.,

inland and hurricane-induced. Figure 3 provides a sampling of the KatRisk tropical cyclone track set.

Figure 3: Cyclone Track Set

2.4 APPLYING AND SELECTING SEA LEVEL PROJECTIONS

Beyond modeling insured and uninsured risk under current conditions, this report provides estimates of how this risk

could change as a result of sea level rise. Our aim was not to project sea levels themselves, but rather to extend our

analysis to a future scenario that is plausible and within the range of estimates provided by the contemporary scientific

community. It should be noted that we only sought to estimate the potential for increases in storm surge risk due to

sea level rise.

8

8

Potential changes in other sources of flooding arising from precipitation or river flooding extremes under a non-stationary climate would be significantly

harder to estimate. While observations show that “annual precipitation since the beginning of the last century has increased across most of the northern

and eastern United States and decreased across much of the southern and western United States,” (NCA4) the interplay of precipitation with soil moisture,

snow pack, and evapotranspiration is complicated to capture and the uncertainty in estimating the impacts on river floods is an unsolved problem.

Following the IPCC special report (“https://www.ipcc.ch/site/assets/uploads/2019/08/4.-SPM_Approved_Microsite_FINAL.pdf

) “climate change can

12

Copyright © 2020 Society of Actuaries

According to the Fourth National Climate Assessment:

9

“Global average sea level has risen by about 7–8 inches (about 16–21 cm) since 1900, with almost

half this rise occurring since 1993 as oceans have warmed and land-based ice has melted. Relative

to the year 2000, sea level is very likely to rise 1 to 4 feet (0.3 to 1.3 m) by the end of the century.

Emerging science regarding Antarctic ice sheet stability suggests that, for higher scenarios, a rise

exceeding 8 feet (2.4 m) by 2100 is physically possible, although the probability of such an extreme

outcome cannot currently be assessed.”

These implications led the National Oceanic and Atmospheric Administration (NOAA) to widen its potential outcomes

in 2100 from previous studies to be between 0.3m and 2.5m of global sea level rise, and formed the basis

of the analysis of potential sea level rise scenarios in this report.

10

A range of possible outcomes in 2100 for global

sea level rise scenarios of 0.3m, 0.5m, 1.0m, 1.5m, 2.0m, and 2.5m broken down by time horizon between 2020 and

2100, with regionally low, medium, and high estimates form the envelope of possible outcomes.

In addition to current sea levels, selections for this analysis were made for “medium” and “high” sea level rise

scenarios. The medium regional sea level rise by 2050, with 0.5m globally by 2100, was selected as the medium

scenario. The high regional sea level rise by 2050, with 1.5m globally by 2100, was selected as the high scenario.

Once the above selections were determined, the KatRisk storm surge model was modified to reflect the risk under

future sea levels. Because the KatRisk Model stores storm surge events as gridded flood depths above datum, it must

first subtract the local elevation to determine the local flood height above ground. Sea level rise is then simulated by

subtracting local sea level rise from the local elevation. KatRisk then simulates the sea level rise scenarios detailed

above by creating two new exposure data sets, each with their local elevations subtracted by the appropriate value

to simulate each sea level rise scenario. These conditioned exposure datasets are then run through the KatRisk storm

surge and inland flood model. Output is analyzed to obtain AALs and EP curves for all locations and MSA aggregate

areas using the methods and models stated above.

2.5 CREATION OF A MARKET BASKET

To assemble the market basket, Milliman obtained parcel data from county assessor records compiled by a third-party

data vendor. Each parcel has the latitude, longitude, and other attributes of an actual single-family property.

Beyond the characteristics directly obtained from these parcel records, property characteristics were imputed at each

location so that the risk would contain all the necessary input characteristics for catastrophe modeling. To simulate

the value of these characteristics, we used a number of public and private data sources to determine the expected

distribution of each risk characteristic, where risks with certain characteristics are most likely to be located, and the

expected relationships and correlations between characteristic classifications. Data sources include:

USGS digital elevation maps and FEMA digital flood maps (GIS)

exacerbate land degradation processes (high confidence) including through increases in rainfall intensity, flooding, drought frequency and severity, heat

stress, dry spells, wind, sea level rise and wave action, permafrost thaw with outcomes being modulated by land management.” However, regional impact,

changes in atmospheric patterns as well land management make impact studies very dependent on the underlying assumptions. Many studies that form

the basis of the IPCC and NCA4 assessments show that most likely local precipitation extremes will increase. We therefore choose to alter local

precipitation intensities and asses those impacts by re-scaling local precipitation extremes with the Clausius-Clapeyron equation that relates the impact on

atmospheric water holding capacity with temperature. This gives approximately a 7% increase per 1K temperature increase. Recent studies have found on

a global scale similar trends (e.g. Westra et al., Global increasing trends in annual maximum daily precipitation, J.Clim, 2012).

9

U.S. Global Change Research Program (November 2018). Fourth National Climate Assessment. Available at: https://www.globalchange.gov/nca4

10

National Oceanic and Atmospheric Administration (January 2017). Global and Regional Sea Level Rise Scenarios for the United States. Available at:

https://tidesandcurrents.noaa.gov/publications/techrpt83_Global_and_Regional_SLR_Scenarios_for_the_US_final.pdf

13

Copyright © 2020 Society of Actuaries

Industry homeowners quote data obtained from a software company

Public parcel records, compiled by a data vendor

Residential Energy Consumption Survey (RECS), published 2009

Multi-hazard Loss Estimation Methodology (HAZUS), current Flood Model Technical Manual developed by

the Federal Emergency Management Agency

National Association of Insurance Commissioners (NAIC) report: “Dwelling Fire, Homeowners Owner-

Occupied, and Homeowners Tenant and Condominium/Cooperative Unit Owner’s Insurance Report: Data for

2015,” published 2017

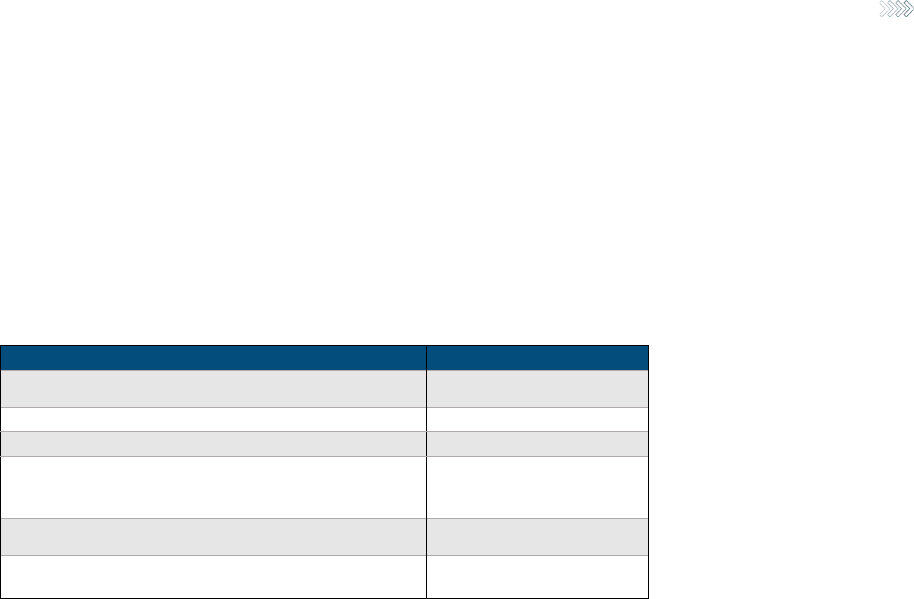

Table 1: Market Basket Attributes and Data Sources

Characteristic

Data Source

Year Built

Parcel Records

Construction

Industry Quote Data

Number of Stories

Industry Quote Data

Foundation Type and First Floor Height

Parcel Records, GIS,

RECS, and HAZUS

Building Value and Limit

Parcel Records and NAIC

Site Deductible

Industry Quote Data

2.6 ESTIMATING NFIP TAKE-UP RATE

Once the market basket was developed, we assigned to each risk an assumption as to whether an NFIP policy was

present using the following process. First, we used geocoding and FEMA flood maps to determine whether each risk

in the market basket was inside or outside an SFHA. We then used the NFIP OpenFEMA data, which provides NFIP

policies in force by state, both inside and outside the SFHA, as well as census data, which provides the number of

single-family residences in the same areas, to determine the probability than any given home would have NFIP

coverage for each combination of SFHA and state. The resulting estimated NFIP take-up rates are shown in Figure 4.

Countrywide, we estimate that approximately one-third of homes in the SFHA have an NFIP policy, with the majority

of states having less than a 25% take-up rate in the SFHA. Outside the SFHA, every state except Louisiana, Florida, and

Texas has take-up rates of approximately three percent or less, with the majority being less than one percent.

15

Copyright © 2020 Society of Actuaries

We produced the estimates of insured and uninsured losses in the sections that follow by applying the KatRisk model

and NFIP take-up rate assumptions to the market basket. At the MSA level, our estimates of insured and uninsured

losses are thus dependent on the state(s) in which each MSA is located, and the proportion of single-family residences

in and out of the SFHA for that MSA. Thus, the take-up rates used throughout this study reflect the unique risk profile

of each MSA based on the location of residences and insurance purchasing patterns in their state(s). However, it

should be noted that to the extent that an MSA has unusually high or low take-up rates in the SFHA relative to the

remainder of the state, our results for that MSA may be biased.

Our methodology for take-up rate estimation was selected because the intersection of flood maps, parcel data, and

OpenFEMA data provides for highly variable results below the state level. Some of these results appear to be driven

by data limitations. We found that aggregating to the state level provided more interpretable and stable results. Even

when aggregating to the state and SFHA level, estimates of take-up rates in the SFHA for one state, South Carolina,

were significantly higher than any other state and did not appear credible. We capped South Carolina take-up rates

in the SFHA at the maximum for all other states.

2.7 THE RESIDENTIAL PRIVATE FLOOD INSURANCE MARKET

Recent catastrophes have demonstrated low rates of insurance coverage in affected areas,

12

and uninsured losses are

often not fully addressed by post-disaster assistance.

13

Statistics for residential and even single-family homes insured

are published by the NFIP, yet public information on the growing private flood market is scarce.

Best estimates indicate that that the majority of reported premiums for private flood are for commercial lines, and

that for residential insurance, the ratio of private to NFIP flood writings is small. To benchmark our own estimates of

the size of the flood insurance market, and to validate our assumption that private residential flood insurance is

relatively immaterial in terms of its impact on the insurance gap today, we examined a number of estimates by

independent sources and tabulated them in in Exhibit 1 on the following page. Each estimate shown quantifies some

aspect of the residential or private flood insurance market. Because the flood insurance market is growing steadily

and changing over time, it may be important to consider the time at which any estimate was made in addition to the

estimate itself.

12

Milliman (July 2018). Available at: https://milliman-cdn.azureedge.net/-/media/milliman/importedfiles/uploadedfiles/insight/2018/ny-nj-market

feasibility.ashx

13

Congressional Budget Office (April 2019). Expected Costs of Damage From Hurricane Winds and Storm-related Flooding. Available at:

https://www.cbo.gov/system/files/2019-04/55019-ExpectedCostsFromWindStorm.pdf

16

Copyright © 2020 Society of Actuaries

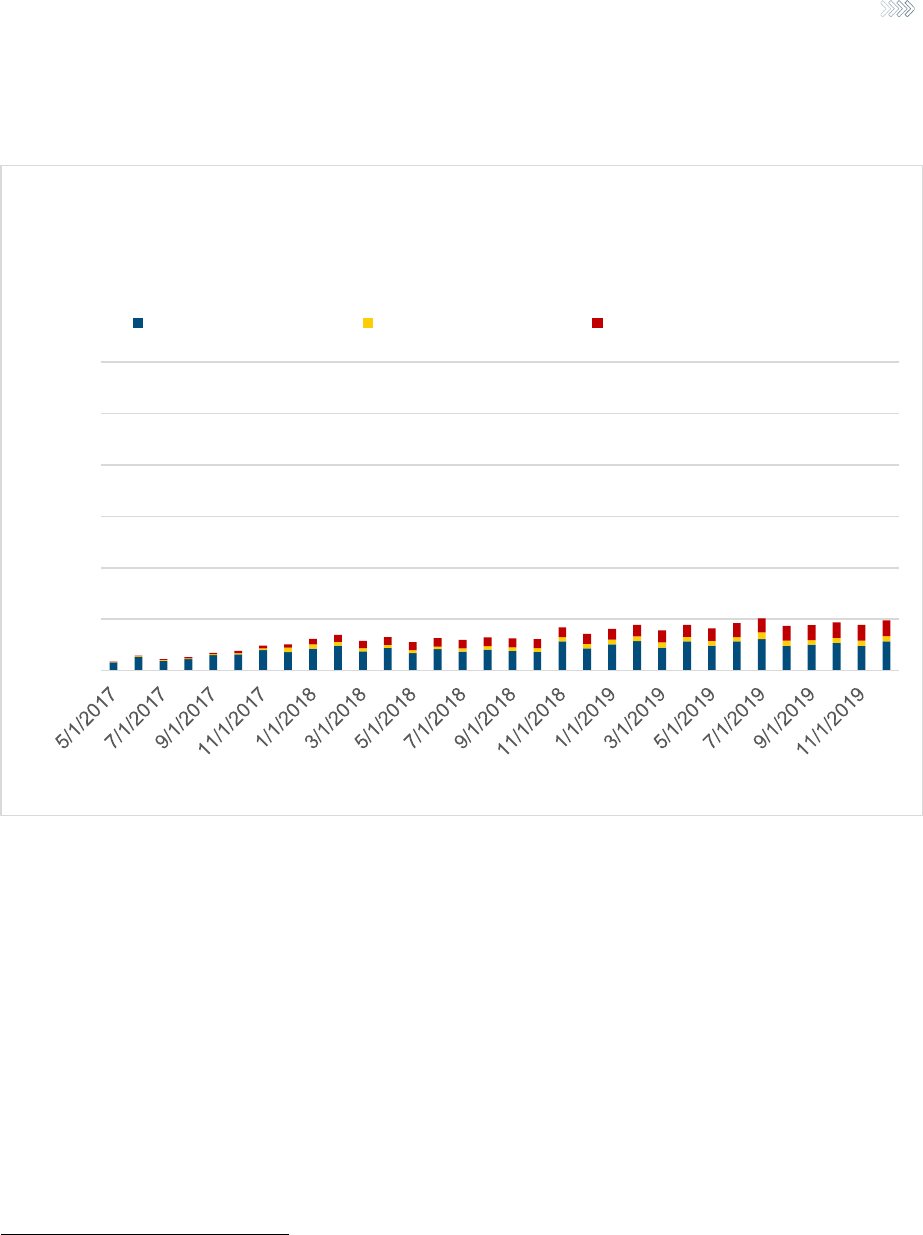

Exhibit 1: Estimates of Private Flood Insurance Written

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11)

Private Flood compared to NFIP

Based on Estimates of Residential Percent of Flood Market

Statutory Accounting Data (Note 2) Wharton III Survey NAIC Survey

NFIP Private Private Flood WSIA Carrier Management Private % of % of Homeowners % of Residences

Earned Flood as % (Note 3) (Note 4) Total Policies with with

Premium Earned Premium

of Private +NFIP

Residential Residential Residential Primary

Flood Insurance

Flood Insurance

Year (Note 1) (Note 2) (3)/[(2) + (3)] Residential % of Total Residential % of Total (Note 5) (Note 6) (Note 7)

2013 $3,512,987 14%

2014 3,542,525 14%

2015 3,436,750 14%

2016 3,332,142 $239,456 6.7% $120,224 32.0% 12%

2017 3,308,151 599,562 15.3% $220,000 34.9% 3.5% to 4.5%

2018 3,327,327 659,467 16.5% 161,432 34.0% 213,000 31.3% 15%

2019 17%

Notes:

1. https://www.fema.gov/total-earned-premium-calendar-year. Dollar amounts in thousands.

2. (3) from SNL.com database of statutory annual statement for P&C industry. Dollar amounts in thousands.

3. Wholesale and Surplus Lines Insurance Association, Surplus Lines Flood Insurance Market Data and Statistics. January 24, 2017. and February 28, 2019

https://www.wsia.org/docs/PDF/Legislative/Surplus%20Lines%20Market%20Data%20and%20Statistics%201-24-17%20w%20attachement.pdf

https://www.wsia.org/docs/PDF/Legislative/SurplusLinesMarketDataandStatistics2-28-19.pdf

4. Carrier Management - Private Flood Insurance Report - 2019. Dollar amounts in thousands.

https://www.insurancejournal.com/research/app/uploads/2019/06/FINAL-Private-Flood-Insurance-Report-2019.pdf

5. Kousky, et al. "The Emerging Private Residential Flood Insurance Market in the United States" Wharton Risk Managament and Decision Process Center.

http://www.floods.org/ace-files/documentlibrary/committees/Insurance/Emerging_Flood_Insurance_Market_Report-Wharton-07-13-18.pdf

6. Insurance Information Institute (III) - Insurance Factbook 2019, based on Pulse surveys conducted by III.

https://www.iii.org/sites/default/files/docs/pdf/insurance_factbook_2019.pdf

7. https://naic.org/Releases/2019_docs/naic_survey_flood_insurance.htm

17

Copyright © 2020 Society of Actuaries

A 2017 report from Wharton provided a range of 3.5% to 4.5% (column 9) as the percentage of total residential flood

insurance policies attributable to the private market. NFIP take-up rates countrywide were approximately 3.5% in

2018 for single-family homes.

14

Accounting for the high end of Wharton’s range suggests that no more than 3.7%

(1.045 * 3.5%) of single-family homes in the United States have flood insurance of any kind, far below the recent

Insurance Information Institute (III) and NAIC survey results of 15% and 17%, shown in columns 10 and 11 above.

While the surveys shown are for slightly different sets of the residential market, single-family homes represent most

of the housing stock in the United States. We note that these survey estimates appear to reflect consumer sentiments,

and it is possible that the results indicate an incorrect belief among some uninsured consumers that flood coverage

is in place. The NAIC has commented that it also expects this to be the case.

15

We compared the 3.7% single-family flood insurance take-up rate derived above to estimates of the surplus lines and

admitted residential flood markets shown in columns 5 and 7. Summing these premiums, we estimate that the private

residential flood market premium totaled about $374 million in 2018, close to 10% of the total residential flood market

premium when including the NFIP. This is about twice as high as the Wharton estimate, but not necessarily in conflict,

as the Wharton estimate is based on policy counts and not premium.

Whether looking at policy counts or premium, public data supports the notion that the size of the private residential

flood market relative to the NFIP is small as assumed in this report. We find that all data and independent estimates

provide corroborative evidence that despite encouraging recent growth, the private residential flood insurance

market remains relatively small, with almost all homeowners flood policies currently written by the NFIP. Thus, while

our characterization of uninsured flood risk in this report could be overstated because it relies on the assumption that

NFIP is the only provider of residential flood insurance, the small size of this market today means that any bias resulting

from this estimate should also be small.

14

NFIP single-family policies in 2018 (which include mobile homes) were 3.54 million in 2018 for the United States

(https://bsa.nfipstat.fema.gov/reports/w2rpcnta.htm), compared to 99.97 million single-family and mobile homes in the 2017 five-year American

Community Survey, provided by the United States Census Bureau. 3.54 / 99.97 = 3.5%

15

As quoted in the NAIC press release (https://naic.org/Releases/2019_docs/naic_survey_flood_insurance.htm) by Eric Cioppa, NAIC president and

superintendent of the Maine Bureau of Insurance, "This disparity perhaps reflects the common, though incorrect, assumption that homeowners insurance

covers flooding."

18

Copyright © 2020 Society of Actuaries

3. Results: Estimates of Insured and Uninsured Flood Exposure to U.S. Homes

The extreme catastrophic nature of floods can make it problematic to project future losses based on past flood events,

particularly in the face of changing hazard presented by sea level rise. We used a catastrophe simulation model to

produce estimated flood losses for each location in the market basket, with our resulting dataset providing two key

features that cannot be obtained using only historical flood data: 1) An estimate of total losses, including losses for

homes not insured and 2) a projection of future expected losses using future sea level rise scenarios.

3.1 INSURED AND UNINSURED LOSS RESULTS

The output of this process is detailed in Exhibit 8 of the Appendix, which shows modeled output of average annual

losses, the resulting portions that are expected to be insured versus uninsured, and an ultimate estimate of the

percent of losses uninsured for all 380 MSAs in the study area.

We estimate that losses to single-family residences

due to flood are expected to cost more than $7 billion annually, with more than 87% those losses being uninsured by

the NFIP. The combination of insured and uninsured flood losses are significant relative to other perils typically

covered for single-family residences, such as fire, non-flood water, and wind.

16

Countrywide, the average homeowner

has $78 of expected annual flood losses to their building alone. Costs incurred for losses to contents, additional living

expenses (ALE), and losses to other structures aside from the primary residence would be in addition to the $78

average.

17

Individual and community-level flood risk is skewed, with portions of the populations having flood risk that is orders

of magnitude higher than others. Even when aggregated at the MSA level, our findings indicate that many areas have

high average expected losses and are mostly uninsured. As seen in Figure 5

, an estimated 69% of MSAs in the United

States have 90% or more of losses uninsured, with approximately 5% of MSAs having more than 30% of their expected

flood losses insured. The MSAs with the highest portion of insured loss are mostly in Florida and Louisiana, with a

handful of others in Atlantic states and Texas. MSAs range from mostly uninsured when total expected flood losses

are high, and nearly entirely uninsured in areas that are generally not exposed to storm surge losses from tropical

cyclones

16

Multiplying weighted average claim frequency and severity for homeowners from 2013 to 2017 results in estimated average losses of $191, $214, and

$210 for the perils of fire and lightning, wind and hail, and water damage and freezing, respectively. In addition to building losses, these estimates include

losses to contents, additional living expenses, and losses to other structure. Source: Insurance Information Institute. Facts + Statistics: Homeowners and

renters insurance, Average Homeowners Losses, 2013-2017 (1), referencing ISO®, a Verisk Analytics® business. Available at:

https://www.iii.org/fact-

statistic/facts-statistics-homeowners-and-renters-insurance

17

Using OpenFEMA data, we estimate that contents coverage only accounts for 16% of the total building and contents losses paid by the NFIP since 2010,

and also only accounts for 15% of the insured limits among policies that had losses. This shows that contents losses are roughly the same, relative to their

NFIP insured limits, as building losses. Extrapolating to building value suggests that a homeowner with contents equal to 50% of their building value, for

example, would shave expected building and contents flood losses roughly 50% higher than just building flood losses. ALE and other structures-specific flood

loss data are not available from this data.

19

Copyright © 2020 Society of Actuaries

Figure 5: Distribution of MSAs by Uninsured Loss Percent

With regard to the magnitude of both insured and uninsured losses, 27 of the 48 states studied have at least one

entire MSA with average expected losses of more than $100 per single-family residence. This statistic does not mean

that the other 21 states have low flood risk, as they tend to be lower-population states with a limited number of MSAs,

such as Rhode Island, Vermont, and Wyoming, which only have four MSAs designated between them. Further

supporting the fact that flood is a countrywide peril, six of the top 20 MSAs by total expected annual flood losses are

in the West or Midwest.

69%

19%

6%

4%

1%

0% 10% 20% 30% 40% 50% 60% 70% 80%

90% to 100%

80% to 90%

70% to 80%

60% to 70%

Less than 60%

Percent of MSAs

Uninsured Loss Percent

Distribution of MSAs by Uninsured Loss Percent

20

Copyright © 2020 Society of Actuaries

3.2 IMPACTS OF SEA LEVEL RISE

Focusing on exposure to storm surge, we sought to understand how uninsured losses would be impacted by

changes in sea level rise. Table 2 shows that, under each sea level rise scenario, the percent of losses uninsured is

relatively unchanged. The high percentage of losses uninsured is not expected to improve in the future unless

current flood insurance purchase patterns change. Sea level rise will cause the amount of uninsured losses to

increase on an order similar to total losses. With uninsured losses already relatively high, homeowners will be faced

with either increasing uninsured losses or paying for flood insurance policies that they do not have today.

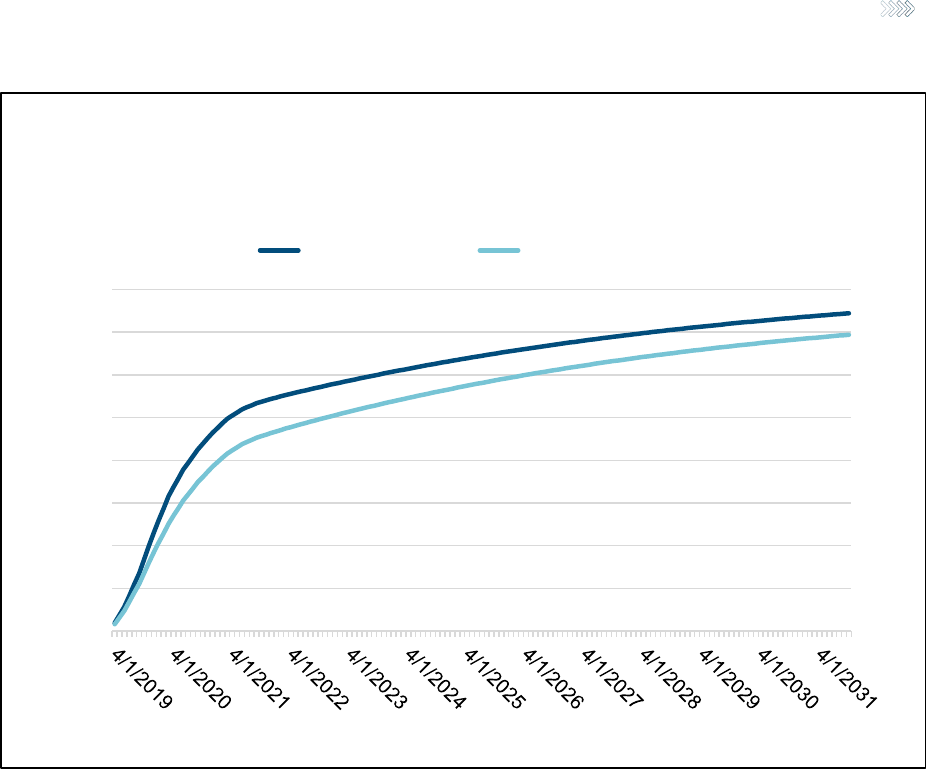

Table 2: Summary of Total Annual Storm Surge Losses by Sea Level Rise Scenario

Annual Storm Surge Losses

Current Sea Levels

Medium

Sea

Level

Rise

High

Sea

Level

Rise

Insured (millions)

$601

$728

$989

Uninsured (millions)

$1,776

$2,155

$2,949

Total (millions)

$2,376

$2,883

$3,938

Uninsured Percent of Total

75%

75%

75%

Change in Total Relative to

Current Sea Levels

N/A

21%

66%

In addition to calculations supporting Table 2 above, MSA level results for storm surge losses by sea level rise

scenario can be found in Exhibits 9 to 12 of the Appendix. Under our medium sea level rise scenario, total storm

surge losses increase an average of 21% and up to a maximum of just over 50% by MSA. In a high sea level rise

scenario these numbers increase to 66% on average, and a maximum of over 200%.

These statistics indicate a high

sensitivity in future storm surge losses due to sea level rise, as the increase in total storm surge losses between the

medium and high scenario averages over 300%.

Figure 6 further illustrates how sea level rise impacts will vary regionally. At current sea levels, we estimate that the

New Orleans-Metairie MSA has the most expected losses due to storm surge. In a medium sea level rise scenario,

Miami-Fort Lauderdale-Pompano Beach would have the highest expected losses, and for the high sea level rise

scenario it would be the New York-Newark-Jersey City MSA.

21

Copyright © 2020 Society of Actuaries

Figure 6: Storm Surge Losses by MSA and Sea Level Rise Scenario

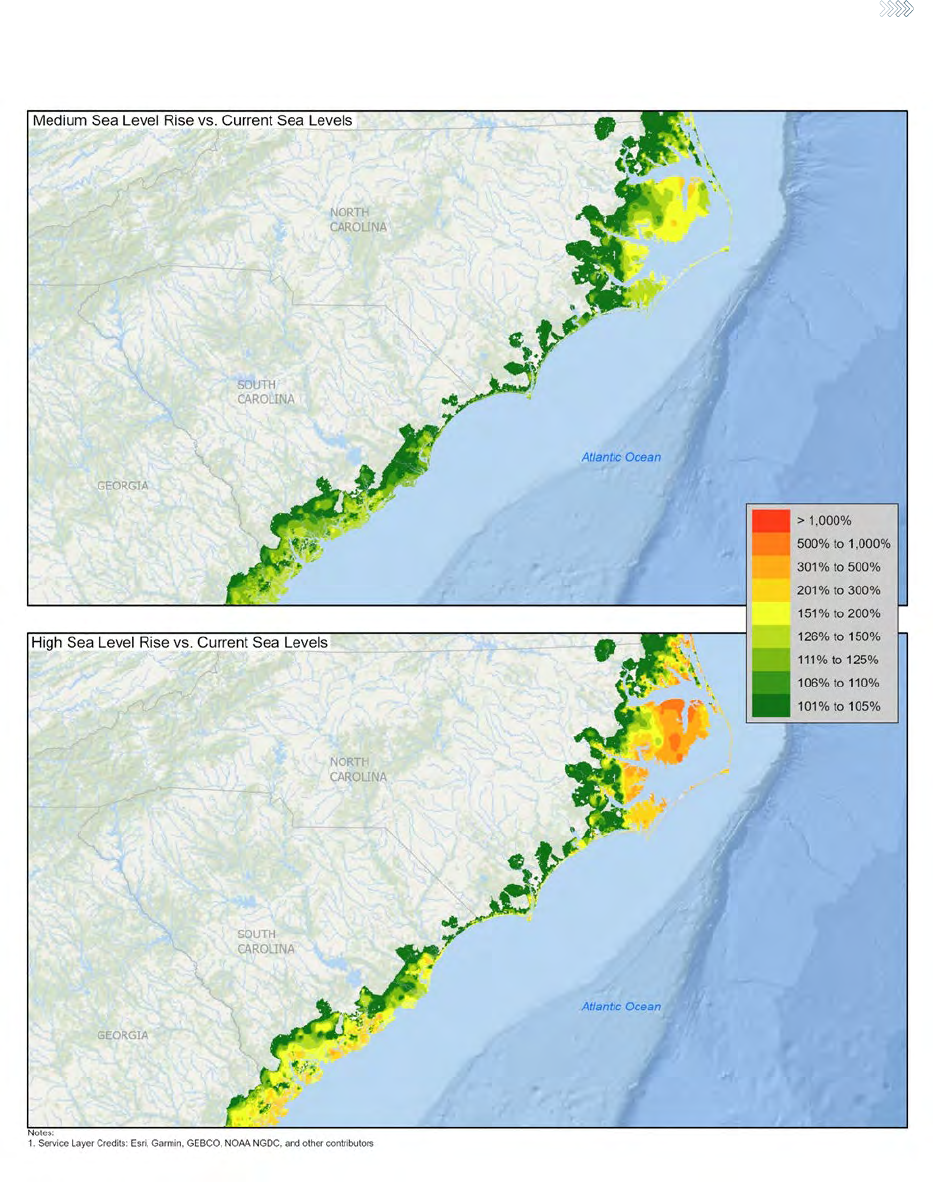

To view sea level rise impacts visually, we developed Figure 7, which maps the increase in losses due to the impacts

of sea level rise on total flood losses for several Middle Atlantic states. The increase in losses are spatially smoothed

to show how the increase in total flood losses changes with geography, even in areas that may not be represented in

the market basket. Maps for other regions of the country and a description of the spatial smoothing process are

provided in the Appendix.

Lafayette, LA

Sebastian-Vero Beach, FL

Myrtle Beach-Conway-North Myrtle Beach, SC-NC

Beaumont-Port Arthur, TX

Boston-Cambridge-Newton, MA-NH

North Port-Sarasota-Bradenton, FL

Houma-Thibodaux, LA

Punta Gorda, FL

Virginia Beach-Norfolk-Newport News, VA-NC

Jacksonville, FL

Ocean City, NJ

Charleston-North Charleston, SC

Houston-The Woodlands-Sugar Land, TX

Naples-Marco Island, FL

Tampa-St. Petersburg-Clearwater, FL

Hilton Head Island-Bluffton, SC

Cape Coral-Fort Myers, FL

New Orleans-Metairie, LA

Miami-Fort Lauderdale-Pompano Beach, FL

New York-Newark-Jersey City, NY-NJ-PA

Total Storm Surge Average Annual Loss by Sea Level Rise Scenario

MSA

Total Average Annual Storm Surge Losses

Highest 20 MSAs under High Sea Level Rise Scenario

Current Medium High

22

Copyright © 2020 Society of Actuaries

Figure 7: Increase in Total Flood Losses: High vs. Medium Sea level Scenarios, Middle Atlantic States

While the Mid-Atlantic states tend to have lower storm surge losses than lower Atlantic and Gulf states, the increase

in total flood losses due to sea level rise is estimated to be the highest from North Carolina to New York (above and

Maps 3 to 5 in the Appendix).

By appending census estimates of median household income to the market baskets, we estimated the magnitude of

the costs of flooding relative to current incomes. Table 3 shows these results for selected MSAs exposed to storm

surge. The resulting estimates show the average ratio of location level losses to income, by MSA, under each sea level

rise scenario.

23

Copyright © 2020 Society of Actuaries

AALs for both storm surge and inland flood are important metrics and are increasingly used by insurers to set prices

for flood insurance premiums. For insurers that do so, changes in AAL would be expected to be correlated with

changes in insurance premiums. Homeowners either would bear the cost of increased prices in insurance premiums

or increased flood losses depending on whether or not they purchase insurance.

The ratio of AAL to median income is highly skewed, with a few MSAs having relatively high ratios. Table 3 illustrates

this, showing the 20 highest ratios at current sea levels, and the associated expected increases as sea levels rise. Flood

is a peril that can present extreme risk in certain areas, which means that every MSA has homeowners that will have

high costs of flooding relative to income. However, these results point to which MSAs may be particularly subject to

either high insurance premiums, possible flood losses, or both. At current sea levels, only Hilton Head Island-Bluffton,

SC is estimated to have AALs average over 2% of median incomes, but In the medium sea level rise scenario, Houma-

Thibodaux, LA and Punta Gorda, FL are also estimated to have AALs exceed 2% of median incomes.

Table 3: Ratio of Average Annual Loss to Census Block Group Median Household Income – Averaged by MSA

18

MSA

Current Sea Levels

Medium Sea Level

Rise

High Sea Level Rise

Hilton Head Island-

Bluffton, SC

2.13%

2.52%

3.29%

Houma-Thibodaux, LA

1.87%

2.50%

3.32%

Punta Gorda, FL

1.89%

2.21%

2.78%

Naples-Marco Island, FL

1.37%

1.65%

2.16%

Cape Coral-Fort Myers,

FL

1.24%

1.48%

1.88%

New Orleans-Metairie,

LA

1.25%

1.39%

1.57%

Ocean City, NJ

0.88%

1.26%

2.21%

Beaumont-Port Arthur,

TX

0.75%

0.86%

1.00%

Jacksonville, NC

0.73%

0.83%

1.04%

Lake Charles, LA

0.66%

0.80%

0.98%

Homosassa Springs, FL

0.63%

0.71%

0.86%

Sebastian-Vero Beach, FL

0.46%

0.54%

0.74%

Lafayette, LA

0.38%

0.48%

0.58%

Myrtle Beach-Conway-

North Myrtle Beach, SC-

NC

0.37%

0.42%

0.54%

Wilmington, NC

0.36%

0.40%

0.50%

Charleston-North

Charleston, SC

0.31%

0.40%

0.59%

North Port-Sarasota-

Bradenton, FL

0.34%

0.38%

0.50%

18

For detailed calculations, data sources, and a complete table for storm surge exposed MSAs, see Appendix, Exhibit 13

24

Copyright © 2020 Society of Actuaries

The risk of extreme events has always had a major impact on the private flood insurance market. This risk, and the

inability to calculate it, has been part of the reason why private flood insurers have not offered significant amounts

of flood coverage in the past. All else equal, affordability and availability of insurance premiums will likely be

adversely impacted as the risk of extreme events occur in an area, as insurers and reinsurers will raise rates or

refuse to accept risks to preserve profitability and solvency.

Exhibit 14 of the Appendix shows increases in the risk of extreme (one-in-500 year)

19

events under the medium and

high scenarios. Similar to AAL changes, changes in the costs of extreme events are highly correlated between the

medium and high scenarios but are also highly sensitive to sea level assumptions.

The average increase in 500-year

losses with high sea level rise tends to be about three times higher than with medium sea level rise.

Figure 8 below shows the percent change in these extreme flood events for the MSAs with the highest increase in

expected flood losses from extreme events. While Florida and Louisiana have some of the highest risk of storm surge

today, the greatest increases in losses for extreme events tend to be along the Atlantic Coast north of Florida.

The

eight MSAs with the largest percent increases in either sea level rise scenario are in all between Georgia and New

Jersey. New Jersey MSAs are particularly vulnerable, with two showing the highest percent increases in the medium

sea level rise scenario among all MSAs.

19

One-in-500-year scenarios are based on the OEP curve of event losses. The one-in-500-year loss for a given region is the event loss that has a chance of

being exceeded with an annual probability of 0.2% (1/500).

25

Copyright © 2020 Society of Actuaries

Figure 8: Change in 500-year Return Period Flood Losses for Sea Level Rise Scenarios Compared to Current Sea Levels

0% 20% 40% 60% 80% 100% 120% 140% 160% 180% 200%

Gulfport-Biloxi, MS

Houma-Thibodaux, LA

Miami-Fort Lauderdale-Pompano Beach, FL

Naples-Marco Island, FL

Lafayette, LA

Jacksonville, FL

Corpus Christi, TX

Lake Charles, LA

Myrtle Beach-Conway-North Myrtle Beach, SC-NC

Hinesville, GA

Norwich-New London, CT

Barnstable Town, MA

Charleston-North Charleston, SC

New Bern, NC

Virginia Beach-Norfolk-Newport News, VA-NC

Brunswick, GA

Savannah, GA

Ocean City, NJ

Salisbury, MD-DE

Atlantic City-Hammonton, NJ

Percent Change in 500 Year Return Period Flood Losses

Highest 20 MSAs under High Sea Level Rise Scenario

Medium High

26

Copyright © 2020 Society of Actuaries

3.3 SUMMARY OF RESULTS BY MSA

Compiling the model output and metrics developed, we take a broader look at the different risks faced by MSAs with respect to sea level rise in Exhibit 2. The

selected scenario in this case is medium sea level rise.

Exhibit 2: Summary of Flood Losses by MSA – Medium Sea level Rise vs. Current Sea Levels

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11)

Exposure Metrics under Current Sea Level Exposure Increase Metrics under Medium Sea Level Rise

Total Percent of AAL to Percent Percent Increase in

Total Annual Percent of Losses AAL to Income Percent Increase in Percent Increase in 500 Year

Metropolitan Annual Losses Losses Uninsured Income Ratio Increase in Total Loss 500 Year Return Period Loss

Statistical Area Title Losses Rank Uninsured Rank Ratio Rank Total Loss Rank Return Period Loss Rank

(Note 1) (Note 2) (Note 3) (Note 4) (Note 5) (Note 6) (Note 7) (Note 8) (Note 9) (Note 10) (Note 11)

Atlantic City-Hammonton, NJ $4,761,940 54 62.8% 58 0.1% 51 44.1% 1 42.9% 1

Ocean City, NJ 45,806,409 18 72.7% 46 0.9% 7 42.8% 2 30.1% 2

Salisbury, MD-DE 15,973,654 37 60.0% 62 0.1% 43 40.3% 3 29.3% 3

Houma-Thibodaux, LA 55,876,027 15 72.3% 47 1.9% 3 33.6% 4 18.3% 13

Brunswick, GA 7,657,390 47 87.1% 22 0.3% 21 30.8% 5 28.4% 5

Corpus Christi, TX 7,255,456 48 90.2% 10 0.1% 45 29.2% 6 19.2% 11

Charleston-North Charleston, SC 62,080,754 14 67.5% 52 0.3% 17 28.0% 7 22.7% 6

Virginia Beach-Norfolk-Newport News, VA-NC 55,407,985 16 78.2% 37 0.1% 41 28.0% 8 20.9% 8

Savannah, GA 11,081,849 43 86.1% 25 0.1% 39 27.3% 9 28.8% 4

New Bern, NC 4,444,006 55 78.1% 38 0.2% 28 25.7% 10 21.2% 7

Lafayette, LA 26,692,981 25 61.6% 61 0.4% 13 23.6% 11 19.4% 10

Jacksonville, FL 68,047,575 12 80.8% 32 0.2% 26 22.7% 12 13.4% 18

Vineland-Bridgeton, NJ 788,067 61 51.7% 63 0.0% 58 21.8% 13 11.9% 21

Lake Charles, LA 20,273,215 32 67.8% 51 0.7% 10 21.8% 14 20.8% 9

Sebastian-Vero Beach, FL 26,478,775 26 93.0% 5 0.5% 12 20.9% 15 10.7% 30

Naples-Marco Island, FL 96,781,625 8 64.7% 55 1.4% 4 20.2% 16 14.7% 16

Cape Coral-Fort Myers, FL 191,457,026 5 66.5% 54 1.2% 6 18.9% 17 10.9% 27

Hilton Head Island-Bluffton, SC 143,457,248 6 88.7% 16 2.1% 1 17.8% 18 10.8% 29

Hinesville, GA 721,087 63 98.6% 2 0.1% 54 17.7% 19 18.5% 12

Miami-Fort Lauderdale-Pompano Beach, FL 296,245,156 2 77.4% 41 0.3% 20 17.2% 20 13.6% 17

Punta Gorda, FL 68,115,329 11 63.7% 57 1.9% 2 17.1% 21 8.6% 37

Barnstable Town, MA 14,117,678 39 94.0% 3 0.2% 30 16.7% 22 15.9% 14

Beaumont-Port Arthur, TX 42,592,102 19 90.9% 8 0.7% 8 16.2% 23 11.0% 25

Deltona-Daytona Beach-Ormond Beach, FL 29,902,256 22 77.4% 40 0.2% 24 15.8% 24 11.1% 24

North Port-Sarasota-Bradenton, FL 63,139,612 13 68.1% 50 0.3% 16 14.8% 25 10.9% 26

Gulfport-Biloxi, MS 16,960,076 35 83.8% 30 0.3% 19 14.5% 26 12.1% 20

Panama City, FL 3,592,699 56 79.8% 34 0.1% 42 14.5% 27 10.8% 28

New York-Newark-Jersey City, NY-NJ-PA 389,971,283 1 85.4% 27 0.1% 40 14.4% 28 7.6% 38

Myrtle Beach-Conway-North Myrtle Beach, SC-NC 35,561,772 21 72.8% 45 0.4% 14 14.4% 29 13.3% 19

Jacksonville, NC 24,365,009 29 69.7% 48 0.7% 9 14.2% 30 5.1% 46

27

Copyright © 2020 Society of Actuaries

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11)

Exposure Metrics under Current Sea Level Exposure Increase Metrics under Medium Sea Level Rise

Total Percent of AAL to Percent Percent Increase in

Total Annual Percent of Losses AAL to Income Percent Increase in Percent Increase in 500 Year

Metropolitan Annual Losses Losses Uninsured Income Ratio Increase in Total Loss 500 Year Return Period Loss

Statistical Area Title Losses Rank Uninsured Rank Ratio Rank Total Loss Rank Return Period Loss Rank

(Note 1) (Note 2) (Note 3) (Note 4) (Note 5) (Note 6) (Note 7) (Note 8) (Note 9) (Note 10) (Note 11)

Crestview-Fort Walton Beach-Destin, FL 8,616,116 46 79.2% 35 0.1% 38 13.7% 31 11.5% 22

Tampa-St. Petersburg-Clearwater, FL 136,837,328 7 66.9% 53 0.3% 22 13.4% 32 11.1% 23

Wilmington, NC 23,194,192 30 84.0% 29 0.4% 15 13.3% 33 9.8% 32

Palm Bay-Melbourne-Titusville, FL 27,107,739 24 89.9% 11 0.2% 25 13.0% 34 9.1% 34

Daphne-Fairhope-Foley, AL 13,349,807 41 88.4% 18 0.3% 18 12.6% 35 10.1% 31

Norwich-New London, CT 6,890,794 49 82.6% 31 0.1% 47 12.2% 36 14.7% 15

Baton Rouge, LA 19,909,601 33 64.6% 56 0.1% 35 12.0% 37 8.8% 36

Homosassa Springs, FL 13,655,529 40 68.3% 49 0.6% 11 11.8% 38 5.6% 41

New Haven-Milford, CT 25,364,184 27 87.1% 21 0.1% 37 11.6% 39 9.7% 33

New Orleans-Metairie, LA 258,015,593 3 74.5% 43 1.3% 5 11.4% 40 5.2% 44

Brownsville-Harlingen, TX 5,767,671 51 89.4% 14 0.2% 33 11.1% 41 4.1% 50

Port St. Lucie, FL 22,742,400 31 78.3% 36 0.2% 23 11.0% 42 5.3% 43

Dover, DE 2,120,168 59 88.8% 15 0.1% 52 10.9% 43 0.9% 55

Mobile, AL 14,267,187 38 88.4% 19 0.2% 27 10.6% 44 7.6% 39

Portland-South Portland, ME 24,652,928 28 93.7% 4 0.2% 29 10.6% 45 9.0% 35

California-Lexington Park, MD 2,072,929 60 73.2% 44 0.1% 55 10.4% 46 5.3% 42

Boston-Cambridge-Newton, MA-NH 87,225,356 9 89.8% 12 0.1% 49 9.5% 47 7.3% 40

Bridgeport-Stamford-Norwalk, CT 39,333,937 20 86.1% 26 0.1% 44 9.1% 48 5.2% 45

Houston-The Woodlands-Sugar Land, TX 212,376,082 4 90.8% 9 0.2% 31 8.7% 49 4.9% 47

Hartford-East Hartford-Middletown, CT 16,774,956 36 88.3% 20 0.1% 56 6.9% 50 4.4% 48

Hammond, LA 2,655,297 57 61.7% 60 0.2% 32 6.3% 51 2.4% 52

Pensacola-Ferry Pass-Brent, FL 10,185,699 45 76.7% 42 0.1% 46 6.0% 52 4.1% 49

Tallahassee, FL 5,487,041 53 62.7% 59 0.1% 48 5.6% 53 3.6% 51

Baltimore-Columbia-Towson, MD 18,761,905 34 89.7% 13 0.0% 63 3.5% 54 1.6% 53

Providence-Warwick, RI-MA 11,708,224 42 86.9% 23 0.0% 59 3.5% 55 1.5% 54

Gainesville, FL 6,245,276 50 80.8% 33 0.2% 34 2.5% 56 0.4% 56

Washington-Arlington-Alexandria, DC-VA-MD-WV 55,383,798 17 88.6% 17 0.0% 61 2.5% 57 0.1% 57

Philadelphia-Camden-Wilmington, PA-NJ-DE-MD 74,242,296 10 91.6% 7 0.1% 57 0.6% 58 0.0% 58

Orlando-Kissimmee-Sanford, FL 28,564,743 23 86.6% 24 0.1% 53 0.1% 59 0.0% 60

Richmond, VA 10,827,098 44 85.2% 28 0.0% 60 0.1% 60 0.0% 59

Kingston, NY 5,531,774 52 77.9% 39 0.1% 36 0.0%

61 0.

0% 61

Bangor, ME 743,674 62 100.0% 1 0.0% 62 0.0% 62 0.0% 63

Greenville, NC 2,244,732 58 92.8% 6 0.1% 50 0.0% 63 0.0% 62

Notes:

1. MSAs and residential populations are sourced from the 2017 five year American Community Survey, provided by the United States Census Bureau.

2. Column (2) = Exhibit 8, Column (8)

3. Rank based on total annual losses for MSAs with storm surge exposure.

4. Column (4) = Exhibit 8, Column (9). Insured and Uninsured Losses are based on estimates of NFIP take-up rates and coverages.

5. Rank based on percent of losses uninsured for MSAs with storm surge exposure.

6. Column (6) = Exhibit 13, Column (3)

7. Rank based AAL to income ratio for MSAs with storm surge exposure.

8. Column (8) = Ratio of inland flood and storm surge losses, medium to current scenario

9. Rank based percent increase in total loss for MSAs with storm surge exposure.

10. Column (10) = Exhibit 14, Column (6)

11. Rank based on percent increase in 500 year return period loss for MSAs with storm surge exposure.

28

Copyright © 2020 Society of Actuaries

In general, an area will be most affected by sea level rise if both the current exposure and the increase in that exposure

are large. Areas with high current exposure but manageable increases in exposure may be able to adapt to sea level

rise, assuming current strategies of flood risk management are in place and can scale. MSAs with low current exposure

and high increases in exposure may find that implementing new risk-management strategies presents a high value-

add proposition at a feasible cost. However, the remaining MSAs may find unique issues due to the incremental

change in flood risk.

This study illustrates a significant public policy issue: the protection gap of uninsured flood risk is massive. Our results

show that all MSAs have room to greatly increase flood insurance take-up rates and mitigate the disruptive impacts

of uninsured flood losses. MSAs that already have moderate to high AAL to income ratios may find this strategy

difficult, particularly in the face of high increasing AAL and extreme event losses due to sea level rise as the

accompanying affordability and availability of insurance is adversely impacted. Absent an ability or willingness to

finance increasingly expensive flood costs, some areas may be subject to strategies or impacts involving relocation of

residents. These include managed retreat via policies encouraging or requiring relocation away from more flood-

prone areas, and climate gentrification, which occurs as demand for property increases in traditionally lower-income

areas that are less flood-prone.

As examples of the above, our results show that the Atlantic City-Hammonton, Ocean City, and Salisbury MSAs all top

our lists of exposure increase under medium sea level rise. Atlantic City-Hammonton and Salisbury each have relatively

low annual expected losses today both in an absolute context and relative to household incomes. Coupled with a

relatively high rate of insured losses, the area may be able to absorb sea level rise impacts more readily than most.

Ocean City has high losses relative to the number of residences and incomes. Increasing the insurance take-up rates

could be difficult due to affordability issues, and uninsured losses will be more difficult to absorb by homeowners than

the other MSAs discussed in this example.

The MSA level results provide an opportunity to assess how the varying degree of flood risk and exposure to sea level

rise can pose unique challenges to local region’s risk management strategies. They also provide the ability to

understand the magnitude of flood risk at a level that can be readily absorbed. However, decisions on managing flood

risk will be made from the federal to the local level, and from the insurance industry to the consumer.

4. Projections: Mortgage Default Risks After Catastrophic Flooding

When flood insurance is in place, a portion of incurred losses are absorbed by the NFIP, private flood insurers, and

reinsurers. If flood insurance is not in place, state or federal government programs may provide financial disaster

assistance, but these programs are not always available and often provide only partial indemnification. To the extent

that insurance is not in place or assistance is not available, losses are absorbed by the homeowner, either through

out-of-pocket repair costs or through diminishment in home equity if they must finance necessary repairs.

The homeowner is not the only stakeholder in this case. If a homeowner has a mortgage on their residence, diminished

value of the collateral property securing it could increase the risk of delinquency or default. As recent flood

catastrophes

20

have occurred in non-SFHA areas where flood insurance purchase is exceedingly rare, new attention

has been brought to the relationship between the flood insurance gap and potential mortgage credit risk.

21

The lack

of flood coverage among U.S. homeowners despite the risk, given the importance of hazard insurance for managing

mortgage risk, indicates that there could be a significant degree of exposure to catastrophic flooding that is borne

20

Hunn, D. (March 30, 2018). Harvey’s Floods. Houston Chronicle. Available at: https://www.houstonchronicle.com/news/article/In-Harvey-s-deluge-most-

damaged-homes-were-12794820.php

21

Koning Beals, R. (November 2, 2019). Banks increasingly unload flooded-out mortgages at taxpayer expense. MarketWatch. Available at:

https://www.marketwatch.com/story/climate-change-could-impact-your-mortgage-even-if-you-live-nowhere-near-a-coast-2019-09-30

29

Copyright © 2020 Society of Actuaries

within the U.S. mortgage system. Though it is apparent that this exposure may exist, estimates of its magnitude and

potential severity are elusive due to sporadic data on historical catastrophic events, lack of detailed public information,

lack of information about historical impacts to household finances after these events, and historically inconsistent

government and lender assistance. Since there is no guarantee that ad hoc government and lender assistance

programs will be in place in the future, past events may provide poor predictors of future ones, potentially resulting

in incomplete estimates of the total exposure of credit losses to extreme flood events.