1

1620 I Street, NW, Suite 200, Washington, DC 20006 www.consumerfed.org

Subprime Locations: Patterns of Geographic Disparity in Subprime Lending

September 5, 2006

Allen J. Fishbein

Patrick Woodall

1

Executive Summary

Significant variation exists in the pricing of higher-priced subprime refinance mortgage

loans between states, regions and localities. The Consumer Federation of America

(CFA) study also found the prevalence of racial pricing disparities, with African

Americans and Hispanic homeowners more than twice as likely to receive higher-priced

subprime refinance loans as other racial and ethnic groups.

Loan data released for only the first time last year by the Federal Reserve Board and

other federal banking regulators contained pricing information on certain subprime

mortgages made by lenders. The Fed noted at the time that the incidence in higher priced

subprime lending varied considerably by geographic area.

2

This study provides the first

comprehensive and systematic look at the geographic variations by region and

metropolitan area for the soon to be released federal government data covering lending

activity in 2005.

The subprime market provides loans to borrowers who do not meet the credit standards

for borrowers in the prime market. These loans are generally more expensive for

borrowers with interest rates higher than prevailing prime rates, presumably to

compensate lenders for the added risks associated with lending to borrowers with weaker

credit histories. Most subprime refinance borrowers use the collateral in their homes for

debt consolidation and other consumer credit purposes. Subprime lending has grown

rapidly as a segment within the conventional mortgage market, growing from 5 percent

of mortgage lending in 1994 to 20 percent in 2005.

3

1

Fishbein is Director of Credit and Housing Policy and Woodall is Senior Researcher at Consumer

Federation of America. Research Intern Daniel Brown provided invaluable assistance in preparing this

report.

2

Avery, Robert B. and Glenn B. Canner, Federal Reserve, “New Information Reported Under HMDA and

Its Application in Fair Lending Enforcement,” Federal Reserve Bulletin, Summer 2005 at 371.

3

Olson, Mark W., Board of Governors of the Federal Reserve System, Statement Before the Subcommittee

on Financial Institutions and Consumer Credit of the Committee on Financial Services, U.S. House of

Representatives, June 13, 2006 at 4.

2

However, the growth of subprime lending has also raised public policy concerns. High

levels of subprime lending indicate markets where borrowers are paying unusually high

costs for credit and where borrowers face unusually high risks of losing their homes.

Indeed, the wide range of prices available in the subprime market today has raised

concerns about whether such price variations are solely reflective of legitimate risk-based

pricing factors or are reflective of other factors, including unlawful discrimination,

opportunistic pricing and predatory lending practices. The Federal Reserve reported last

year that pricing disparities existed between different racial and ethnic groups even after

controlling for a borrower’s income, gender, property location, and loan amount. A

recent analysis by the Center for Responsible Lending found that racial disparities existed

in the subprime market even when controlling for credit score and debt load factors that

cannot be determined from HMDA data alone.

4

Also of mounting concern is the fact that in recent years as the subprime market has

grown so has its reliance on adjustable rate loan products. Moreover, the reset triggers

on subprime ARMs have dramatically shortened. Last year over 80 percent of subprime

loans were adjustable rate loans, including many in the form of 2/28 loans.

5

These loans

carry an initial short-term fixed rate for the first twenty-four months that is followed by

annual or six-month rate adjustments for the remaining life of the loan. The low initial

rate means that monthly payments will likely rise when the rate resets. Climbing rates

and cooling local housing markets has led to dire forecasts that a significant percentage

of these loans are likely to default.

6

This study concentrates on single-family, first lien conventional refinance loans, where

subprime lending is most concentrated, by analyzing 2004 and 2005 data provided by the

Federal Home Mortgage Disclosure Act (HMDA). This study analyzes a sample of the

HMDA data soon to be released by the Federal government to provide local context to

the national release of the 2005 HMDA due out this month.

In 2005, the share of subprime loans increased and the highest-cost loans increased even

more. The share of reported subprime loans (classified for HMDA purposes as those

more than 3 percent above comparable Treasury notes) increased by 79.9 percent

between 2004 and 2005, from 14.7 percent of refinance mortgages in 2004 to 26.5

percent of refinance loans in 2005. Over the same period, reported refinance loans priced

at more than 5 percent above Treasury securities more than doubled, from 4.2 percent of

refinance lending to 8.8 percent of refinance mortgages in 2005. Some portion of the

increase can be attributed to a changing interest rate environment, but the HMDA

reporting provided to the public cannot discern the extent to which the increase can be

explained by the changes in the interest rate yield curve alone. Nevertheless,

interpretations of year-to-year changes in the volume of higher-priced subprime loans

4

Gruenstein, Debbie, Kieth S. Ernst and Wei Li, Center for Responsible Lending, “Unfair Lending: The

Effect of Race and Ethnicity on the Price of Subprime Mortgages,” May 31, 2006.

5

FitchRatings, 2006 Global Structured Finance Outlook, January 17, 2006 at 12; Hagerty, James,

“Millions Are Facing Squeeze On Monthly House Payments,” Wall Street Journal, March 15, 2006.

6

Laing, Jonathan R., “Coming Home to Roost”, Barron’s, February 14, 2006.

3

should be treated with caution. (See page 7 for further discussion on this point.)

Among the study’s key findings:

• Significant Subprime Refinance Variation between Regions: For refinance

mortgages, borrowers on the West Coast and Northwest are half as likely to

receive subprime refinance loans than borrowers in the Southwest or Great Plains.

Fewer than one in five refinance borrowers in the Pacific region (18.1 percent)

and the Northwest (18.5 percent) received subprime loans compared to nearly two

in five borrowers in the Great Plains (36.6 percent) and the Southwest (37. 3

percent).

• Gulf and Prairie States Concentrated in Highest Incidence of Subprime

Refinance Lending: In five states, more than two fifths of refinance loans were

subprime in 2005. More than half (51.8 percent) of refinance loans in Mississippi

were subprime. Rounding out the highest subprime refinance rates were

Oklahoma with 44.3 percent subprime, Alabama with 41.6 percent, Nebraska

with 41.4 percent and Louisiana with 40.0 percent.

• Western States Had Lowest Subprime Refinance Rates: Fewer than one in

five refinance loans were subprime in Hawaii (19.5 percent), Washington (18.2

percent), Oregon (17.8 percent) and California (16.2 percent).

• Large Subprime Refinance Variation between Metropolitan Statistical Areas

(MSAs): In 2005, the ten MSAs with the smallest share of subprime refinance

lending had fewer than 10 percent of borrowers receive subprime loans. In

contrast, in the twelve MSAs which have the highest share of subprime refinance

lending had subprime refinance five times higher, with more than half of all

refinance borrowers receiving subprime loans.

• Highest Subprime MSAs Concentrated in Southeast, Southwest and Midwest

Regions: In 2005, of the 30 MSAs with the highest share of subprime refinance

loans (about 10% of the 317 MSAs studied), more than 80 percent were in the

Southeast (from Kentucky east to the Carolinas and south through Mississippi),

Southwest (Louisiana, Arkansas, Texas and New Mexico), or Midwest (Ohio

through Minnesota). The five cities with the highest incidence of subprime

refinance lending were all in Texas (Brownsville, McAllen, El Paso, Lubbock,

and Longview).

• Lowest Subprime Refinance Lending in Pacific: More than half of the 30

MSAs with the lowest incidence of subprime lending are in the Pacific Region

(Arizona, Nevada, California and Hawaii). The five cities with the lowest

incidence of subprime lending are all in California (San Francisco, Santa Rosa-

Petaluma, San Jose, Santa Cruz-Watsonville, and Santa Barbara).

4

• African American and Latino Borrowers are More Likely to Receive

Subprime Loans of All Types: More than one half (53.0 percent) of all African

American conventional borrowers for loans of all types (purchase, home

improvement and refinance) received subprime mortgages in 2005. More than

one third (37.8 percent) of Latinos received subprime mortgages. In comparison,

about one fifth (21.6 percent) of white borrowers and one eighth (13.5 percent) of

Asian borrowers received subprime loans.

• African American Borrowers Twice as Likely to Receive Subprime

Refinance Loans, Three Times as Likely to Receive Subprime Purchase

Mortgages as White Borrowers: Nearly half (48.9 percent) of African American

refinance borrowers received subprime loans compared to less than a quarter

(23.0 percent) of white refinance borrowers. Nearly three fifths (59.7 percent) of

African American home purchase mortgage borrowers received subprime loans

compared to less than one in five (19.4 percent) of white borrowers.

• Latino Borrowers More Likely to Receive Subprime Mortgages than White

Borrowers: Nearly a third (32.6 percent) of Latino refinance borrowers received

subprime loans, receiving subprime loans 41 percent more frequently than the

quarter (23.0 percent) of white borrowers. Two fifths (44.0 percent) of Latino

home purchase borrowers received subprime loans compared to one fifth (19.4

percent) of white borrowers.

5

Introduction

Consumer Federation of America (CFA) has analyzed a sample of the HMDA data from

Loan Application Register (LAR) data received directly from a sample of the nation’s

large mortgage lenders. The federal HMDA requires lenders to make their LARs

available for public review prior to the release of the aggregate data reports. The CFA

research is intended to provide local context to the national release of the aggregate data

by the federal government this month.

CFA looked at the conventional refinance lending patterns in over 300 hundred

Metropolitan Statistical Areas (MSAs) including at least one MSA in every state by the

sampled lenders to provide insight into the loans which are most likely to be subprime

mortgages on the local

level. This snapshot of

conventional refinance

lending shows the share of

these loans that are prime

loans and subprime loans

by region, state and

metropolitan area. The

complete tables are

appended at the end of the

report.

CFA’s analysis suggests

that release of aggregate

HMDA data will reveal

significant disparities in the

pricing of subprime mortgages across racial and ethnic groups. However, our analysis

also indicates wide variation in the pricing patterns of subprime lending between

different regions (measured by Census Bureau regional divisions), states and

metropolitan areas. The release of the national aggregate HMDA data alone will not

likely tell the entire story of the lending in specific metro areas. Many states, regions and

metropolitan areas had significantly higher rates of subprime refinance lending than the

national aggregate figures suggest.

About CFA’s Research and Findings

CFA examined nearly five million (4,911,681) conventional, single-family (1-4 unit) first

lien loans of all types (purchase, home improvement and refinance) originated in 2005.

CFA compared this sample of loans to a 2004 sample to compare changes in subprime

refinance lending over time and region.

7

7

Fishbein, Allen and Patrick Woodall, Consumer Federation of America, “Subprime Cities: Patterns of

Geographic Disparity in Subprime Lending,” September 9, 2005.

Subprime Share of Lending by Borrower Race and

Loan Type, 2005

59.7%

44.0%

19.4%

14.1%

50.4%

31.3%

27.4%

13.0%

48.9%

32.6%

23.0%

12.7%

0%

10%

20%

30%

40%

50%

60%

70%

African American Latino White Asian

Purchase HI Refi

6

The distribution of subprime loans in 2005 is comparable to the overall distribution of

loan types, meaning more purchase mortgages are subprime in 2005. In 2004, CFA

found that refinance loans made up 59 percent of all subprime conventional loans, home

improvement loans accounted for 9 percent of the subprime loans and home purchase

mortgages were 32 percent of the subprime loans. Refinance and home improvement

mortgages made up a smaller share of the total conventional mortgages sampled (61.9

percent) than of the subprime mortgages (68.0 percent). In 2005, 43.1 percent of

subprime mortgages were purchase mortgages and 44.4 percent of all mortgages were

purchase mortgages. Similarly, 52.6 percent of subprime loans were refinance loans and

51.9 percent of all mortgages were refinance loans.

Consumer Federation of America examined HMDA Loan Application Register (LAR)

data from 22 major lenders and their 312 total affiliates. These lenders made a total of

4.9 million conventional, first lien mortgages on single family (1-4 unit) properties in

2005. More than half of the loans (52 percent) were refinance, more than two fifths (44

percent) were home purchase, and fewer than one in twenty (4 percent) were home

improvement loans. This sample

represents more than half the

conventional home purchase

mortgages made in 2004, more

than two fifths of the refinance

mortgages made in 2004 and about

half the home improvement

mortgages made in 2004.

8

A large portion of the loans in 2005

were high-cost loans. More than

one in four (1.2 million or 26.5

percent) of these loans were

“reportable” mortgages with

interest rates higher than three percent above comparable Treasury long-term securities.

HMDA reporting does not delineate between fixed rate and adjustable rate mortgages

(ARMs) or other mortgage products such as interest-only or payment option/negative

amortization loans which can have their payment schedules recast to a higher monthly

amount or interest rate. In 2006, $300 billion in non-traditional, hybrid ARM mortgages

will readjust for the first time; in 2007, $1 trillion in mortgages will readjust.

9

That

means that the number of high-interest rate loans will significantly increase, perhaps

beyond what borrowers can afford to pay.

The Federal Reserve delineates HMDA loans into two broad categories: prime and near

prime (below 3 percentage points of the comparable Treasury yield threshold, which

compares mortgages to comparable Treasury long-term securities) and higher-priced

subprime (loans above 3 percentage points above the threshold). Additionally, CFA also

8

See Avery, Robert B. and Glenn B. Canner, Federal Reserve, “New Information Reported Under HMDA

and Its Application in Fair Lending Enforcement,” Federal Reserve Bulletin, Summer 2005.

9

Elphinstone, J.S., “Foreclosures May Jump as ARMs Recast,” Associated Press, June 19, 2006.

Distribution of Mortgage Type, Subprime and

Total, 2005

43.1%

4.3%

52.6%

44.4%

3.7%

51.9%

0%

10%

20%

30%

40%

50%

60%

Purchase HI Refi

SP Tot al

7

coded the loans for highest-cost subprime loans (loans 5 percentage points or higher than

the threshold). The subprime loans are categorized as any reported over-threshold

interest rate, i.e. 3 percentage points or higher than the Treasury threshold and include the

highest-cost subprime loans.

The average 2005 30-year Treasury yield threshold was 4.66 percent, meaning lenders

reported loans with interest rates higher than about 7.66 percent.

10

The highest-cost loans

that are 5 percentage points higher than the Treasury threshold generally had interest

rates higher than 9.66 percent. In 2004, the average Treasury yield threshold was slightly

higher, at 5.03 percent.

Interpreting Year-To-Year Changes in the Proportion of Higher Priced Subprime

Loans

It should be noted that in 2005, the short-term and long-term interest rate yield curve

flattened and ultimately inverted, meaning the shorter-term interest rates which lenders

often use to set mortgage prices rose above longer-term interest rates that HMDA

regulations use to set “reportable” high-cost or subprime loans.

11

This means that some

of the increase in reportable loans was the result of changes in the interest rate

environment and does not necessarily mean that subprime lending substantially

increased. However, as the Federal Reserve noted in its HMDA guidance in April 2006,

“business practices of lenders or the risk profiles or the borrowing practices borrowers,

also could have affected the proportion of loans reported as higher-priced loans.”

12

Keeping in mind that multiple factors including the inverted yield curve contributed to

the annual change in “reportable” subprime loans, a much larger percentage of loans

were subprime in 2005 than 2004. The share of reported subprime loans (those more

than 3 percent above comparable Treasury notes) increased by 79.9 percent between

2004 and 2005 from 14.7 percent of refinance mortgages in 2004 to 26.5 percent of

refinance loans in 2005. Over the same period, reported refinance loans priced at more

than 5 percent above Treasury securities more than doubled from 4.2 percent of refinance

lending to 8.8 percent of refinance mortgages in 2005.

Regional Variety in Subprime Refinance Lending

Subprime lending rates vary widely across different regions of the country. For refinance

mortgages in 2005, borrowers in the Pacific and Northwest regions were half as likely to

receive subprime refinance loans as borrowers in the Southwest or Great Plains. Fewer

than one in five refinance borrowers in the Pacific region (18.1 percent) and the

Northwest (18.5 percent) received subprime loans compared to nearly two in five

borrowers in the Great Plains (36.6 percent) and the Southwest (37.3 percent). Although

lenders maintain that the incidence of subprime lending is solely related to risk-based

10

Federal Financial Institutions Examination Council, Rate Spread Calculator available at

http://www.ffiec.gov/ratespread/YieldTable.CSV.

11

Federal Reserve Board, “Frequently Asked Questions About the New HMDA Data,” April 3, 2006 at 9-

10.

12

Federal Reserve Board, “Frequently Asked Questions About the New HMDA Data,” April 3, 2006 at 10.

8

factors, such as credit histories, loan to value ratios and borrower debt loads, the

significant regional variety suggests that other factors may come into play in the way that

some lenders or mortgage brokers price loans. (See Table 1.)

There is also significant variety between the regional shares of highest-cost subprime

lending. In MSAs in the Great Plains and Southwest, about one in seven (14.0 and 13.9

percent respectively) of borrowers was paying interest rates more than 5 percentage

points higher than the Treasury

note threshold. This rate is nearly

three times higher than the one in

twenty of borrowers in MSAs in

the Northwest and Pacific (4.7

percent and 4.9 percent

respectively) region who were

receiving high-cost subprime

refinance loans.

The highest statewide incidence of

subprime refinance lending was in

the Gulf states and the Great

Plains. In five states, more than

two fifths of refinance loans were

subprime in 2005. More than half

(51.8 percent) of refinance loans in

Mississippi were subprime. Rounding out the highest subprime refinance rates were

Oklahoma with 44.3 percent subprime, Alabama with 41.6 percent, Nebraska with 41.4

percent and Louisiana with 40.0 percent. Western states had the lowest subprime

refinance rates. Fewer than one in five refinance loans were subprime in Hawaii (19.5

percent), Washington (18.2 percent), Oregon (17.8 percent) and California (16.2 percent).

(See Table 2.)

National Subprime Refinance Lending Patterns

Nationally, one quarter (26.3) of borrowers received subprime conventional refinance

loans in 2005. This compares to one in seven (14.7 percent) borrowers that received

subprime conventional refinance loans reported under HMDA in 2004. In 2005, the

sampled lenders made 2.5 million conventional refinance loans. There were a total of 6.1

million conventional refinance loans in 2004, so the sampled lenders account for nearly

two-fifths (41.7 percent) of the previous year’s national lending activity. In 2005, 1.9

million of the sampled refinance borrowers (73.7 percent) received prime refinance loans

below the interest rate threshold, 671,425

borrowers (26.3 percent) received subprime

refinance loans at interest rates over 3 percentage points above the threshold and 223,000

borrowers (8.8 percent) received highest-cost refinance loans at interest rates 5

percentage points or higher than the threshold.

2005 Regional Incidence of Subprime Refinance

Lending

37.3%

36.6%

32.1%

30.5%

24.5%

24.4%

24.1%

23.4%

18.5%

18.1%

0% 5% 10% 15% 20% 25% 30% 35% 40%

Southwest

Great Plains

Midwest

Southeast

Mid Atlantic

Northeast

New York/New Jersey

Rocky Mountains

Northwest

Pacific

9

The national figures tend to underestimate the incidence of subprime refinance loans

because of the larger markets with smaller shares of subprime lending, especially in

California which has many of the MSAs which make the lowest percentages of subprime

refinance loans, and the inclusion of non-MSA lending in the national figure. When the

MSA averages and medians are

calculated, larger shares of refinance

mortgages were subprime loans. The

average and median share of subprime

refinance mortgages was 31.1 and 31.2

percent respectively. The sampled

lenders made a median of 2,328

conventional refinance mortgage

originations in the studied MSAs. On

average, the sampled lenders made 7,096

refinance loans in each MSA in 2005.

The national aggregate refinance originations by the sampled lenders went predominantly

to white borrowers. The extent to which refinance mortgages benefited consumers who

could improve the terms of their loan or consolidate debt at lower interest rates, the racial

breakdown of refinance lending may suggest that not all homeowners were benefiting

from the 2005 refinance boom. More than half (63.3 percent) of conventional refinance

mortgages were made to white borrowers in 2005, about the same as the 65.6 percent

figure in 2004. African Americans received about one in ten (9.6 percent) and Latinos

received about one in eight (12.3 percent) of the refinance mortgages made by the

sampled lenders in 2005. (The remaining borrowers are Native American, other race, race

unknown or race undisclosed.)

Whites were also the most likely to receive prime refinance mortgages, Latinos were less

likely, and African Americans were significantly less likely to receive prime refinance

mortgages than whites. African American and Latino borrowers were twice as likely to

receive subprime refinance loans as white borrowers. Nearly half (48.9 percent) of

African American refinance borrowers received subprime loans compared to less than a

quarter (23.0 percent) of white refinance borrowers. Nearly a third (32.6 percent) of

Latino refinance borrowers received subprime loans, receiving subprime loans 41 percent

more frequently than the quarter (23.0 percent) of white borrowers.

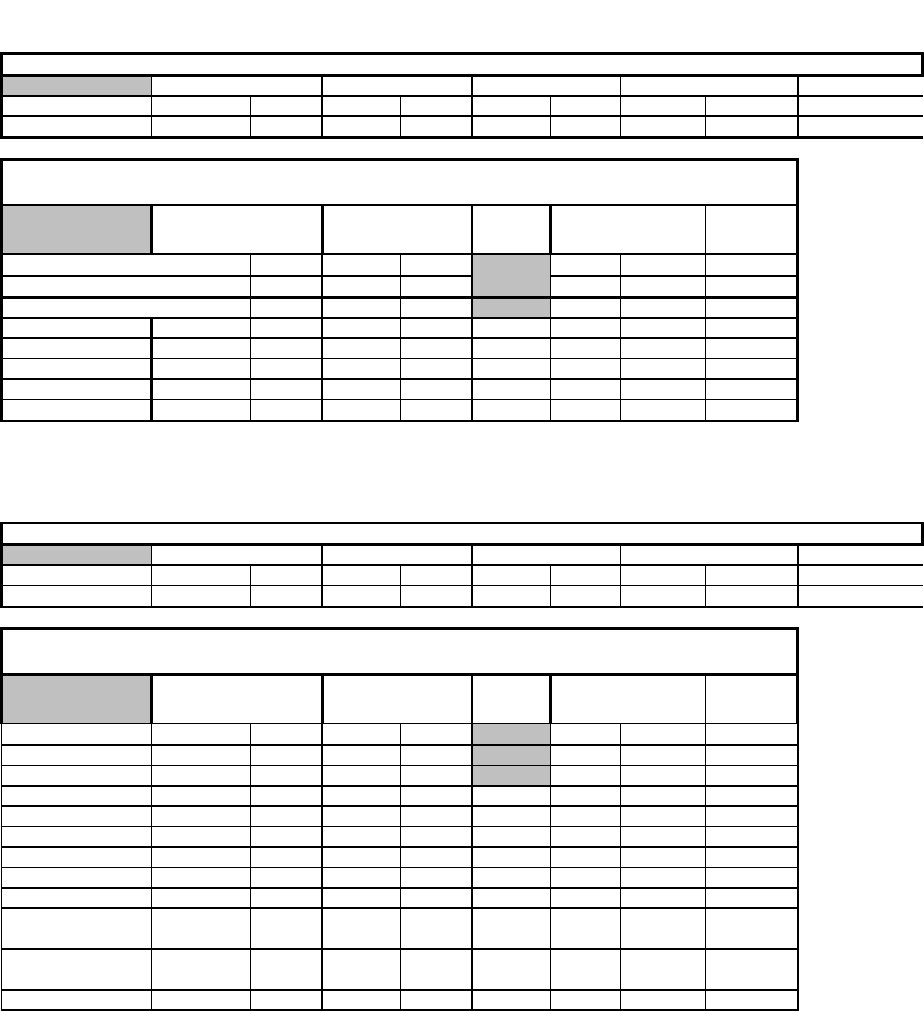

Large Subprime Refinance Variation between Metropolitan Areas

There was wide variety in the pattern of prime, subprime and high-cost refinance

mortgages between metropolitan areas. In 2005, the ten MSAs with the smallest share of

subprime refinance lending had fewer than 10 percent of borrowers received subprime

loans. In contrast, in the twelve MSAs which have the highest share of subprime

refinance lending, more than half of all refinance borrowers received subprime loans.

(See Table 3.)

2005 Distribution of Conventional Refinance Borrowers

9.6%

12.3%

63.3%

3.6%

0%

10%

20%

30%

40%

50%

60%

70%

African American Latino White Asian

10

The metropolitan areas with

the highest share of

subprime refinance lending

were concentrated in the

Southeast, Southwest and

Midwest Regions. In 2005,

of the 30 MSAs with the

highest share of subprime

refinance loans (about 10%

of the 317 MSAs studied),

80 percent were in the

Southeast (from Kentucky

east to the Carolinas and

south through Mississippi),

Southwest (Louisiana,

Arkansas, Texas and New

Mexico), or Midwest (Ohio

through Minnesota). The

five cities with the highest

incidence of subprime

refinance lending are all in

Texas (Brownsville,

McAllen, El Paso,

Lubbock, and Longview). In 2004, the highest shares of subprime lending were

predominantly in the Southeast and Southwest; in 2005, the metropolitan areas in the

Midwestern joined these regions in high levels of subprime refinance lending.

The lowest rates of subprime refinance lending were in the West, predominantly in

California. More than half of the 30 MSAs with the lowest incidence of subprime

lending are in the Pacific Region (Arizona, Nevada, California and Hawaii). The five

cities with the lowest incidence of subprime lending were all in California (San

Francisco, Santa Rosa-Petaluma, San Jose, Santa Cruz-Watsonville, and Santa Barbara).

In 26 metropolitan areas, more than one in five refinance loans were highest-cost

refinance loans, 5 percentage points and above the Treasury threshold of 4.66 percent.

These refinance borrowers received interest rates approaching 10 percent (at least 9.66

percent). In seven markets, at least one in four refinance borrowers received highest-cost

loans (Dothan AL, Muskegon MI, McCallen TX, Decatur AL, Midland TX, Lubbock TX

and Brownsville TX) – more than three times the national incidence of high-cost

subprime refinance lending. In comparison, seven metropolitan areas in California (San

Luis Obispo-Paso Robles, Santa Barbara-Santa Maria-Goleta, Napa, Santa Rosa-

Petaluma, Santa Cruz-Watsonville, San Jose-Sunnyvale-Santa Clara and San Francisco-

San Mateo) had fewer than one in fifty (below 2 percent) of refinance loans priced above

5 percent over the Treasury threshold – ten times smaller than the cities with the highest

rates. Again, the gulf between the high share of high-cost refinance mortgage markets

2005 Share of Subprime Refinance Lending by

Metropolitan Area

57.3%

56.4%

55.0%

55.0%

51.9%

51.4%

51.0%

50.9%

50.8%

50.8%

10.2%

9.6%

9.5%

9.1%

7.8%

7.7%

7.6%

7.2%

6.9%

6.9%

5.160%

0% 10% 20% 30% 40% 50% 60% 70%

Brow nsv ille TX

McAllen TX

El Pa s o TX

Lubbock TX

Longview TX

Battle Creek MI

Muskegon MI

Dec atur A L

Jackson MS

Muncie IN

San Diego-Carlsbad-San Marcos CA

Boulder CO

Oxnard-Thousand Oaks-Ventura CA

Santa Ana-Anaheim CA

San Luis Obispo-Paso Robles CA

Napa CA

Santa Barbara-Santa Maria-Goleta CA

Santa Cruz-Watsonville CA

San Jose-Sunnyvale-Santa Clara CA

Santa Rosa-Petaluma CA

San Francisco-San Mateo CA

11

and the low share of these loans

belies the contention that these

mortgages are priced primarily on

the risk of the borrower.

Conclusions

CFA’s HMDA analysis suggests

that in addition to the pricing of

mortgages between borrower

groups sizable variable exists by

geography as well. Just as with

pricing disparities between

borrower groups, the regional and

local variations found may be

based upon legitimate price

determinants reflecting higher

borrower risks that exist in these

areas. However, it should not be

assumed that the variations CFA

found are solely attributable to

higher risk factors. Last year’s

Federal Reserve analysis and the

recent Center for Responsible Lending study cited previously, provide strong indication

that pricing in the subprime market is not simply a function of risk.

A lack of competition from prime lenders increased the chances that borrowers in certain

communities pay more for credit. Unlawful discrimination, the prevalence of predatory

lending, differences in borrower knowledge, the existence of broad pricing discretion by

loan brokers and loan officers, and the lack of consumer-friendly support systems in

certain geographic areas may also account for at least some of the geographic variation in

pricing patterns.

There is general agreement among experts who follow homeownership trends that, over

the years, HMDA reporting has helped to transform the home loan market, making it a

fairer and more transparent, while also improving credit opportunities provided to

underserved households and communities. The new pricing data now reported under

HMDA can help to make the pricing of subprime loans more transparent for consumers

and increase these markets efficiencies, which ultimately benefits borrowers. Regulators,

lenders, consumer and community advocates, the news media are encouraged to

undertake their own research and analysis to examine local markets using HMDA data.

CFA believes consumers – regardless of their race, ethnicity or the community in which

they reside – have every right to expect that the mortgages they obtain will be priced

fairly, based on legitimate underwriting standards. Mortgage pricing should neither be

opportunistic nor take advantage of consumers’ lack of financial sophistication.

2005 Highest-Cost Subprime Refinance Lending

Metropolitan Areas (>5% above Treasury)

26.3%

25.6%

25.6%

25.3%

24.9%

24.7%

24.6%

24.4%

23.2%

23.0%

22.7%

22.2%

22.1%

22.1%

22.0%

21.8%

21.5%

21.5%

21.4%

21.4%

21.2%

21.2%

20.6%

20.3%

20.1%

20.0%

0% 5% 10% 15% 20% 25% 30%

Brownsville TX

Lubbock TX

Midland TX

Decatur AL

McAl l e n TX

Muskegon MI

Dothan AL

Longview TX

Battle Creek MI

El Paso TX

Waco TX

Maco n GA

Florence SC

Detroit-Dearborn MI

Muncie IN

Montgomery AL

Jackson TN

Wichita Falls TX

Corpus Christie TX

Jacks on MS

Amarillo TX

Mobile AL

Birmingham AL

Weirton-Steubenville WV-OH

Warner Robbins GA

Tuscaloosa AL

12

Accordingly, CFA recommends a number of positive steps to ensure fairness in consumer

pricing. These include:

1. Strengthened consumer protections to curb predatory lending.

The HMDA pricing data contained in this study also underscores the need to maintain

and strengthen anti-predatory laws and other related consumer protections to ensure that

borrowers are priced fairly. While all subprime lending may not be predatory, much of

abusive lending practices appear to be concentrated in the subprime segment of the

mortgage market. Stronger protections should:

• Require lenders and mortgage brokers to act in the best interest of

borrowers by providing suitable loan products;

• Expand and revise the Federal Home Ownership and Equity Protection

Act (HOEPA), among other things, to restrict the use of yield spread

premiums and prepayment penalties, which reward brokers for increasing

the loan price for subprime borrowers.

• Preserve the authority of states to continue to establish meaningful

consumer protections in this area.

Twenty four states have passed anti-predatory lending laws and at least 12 more have

statutes that provide meaningful protections to borrowers but were not enacted as part of

an anti-predatory law, according to the Center for Responsible Lending.

13

Many of these

protections far exceed the federal standards in place and are tailored to address problems

encountered by borrowers’ in particular local markets. CFA supports HR 1182,

introduced in the U.S. House of Representatives and sponsored by Reps. Miller, Watt,

and Frank which would strengthen HOEPA and allow states to keep strong laws to

protect their citizens.

2. Ensure adequate regulatory oversight and enforcement of fair lending laws to deter

discrimination in mortgage pricing.

Federal and state regulators, state attorneys-generals, and other enforcement officials now

have an improved analytical tool for identifying pricing differentials for individual

lenders. Readily available software developed by the Federal Reserve Board can equip

these oversight agencies with a screening mechanism to identify lenders for closer

inspection. At the time of release of last year’s HMDA data, the Fed referred some 200

lenders to federal and state regulators for further review. To date, no enforcement actions

have been reported from these reviews. The CFA study indicates that the new 2005

HMDA data is likely to indicate similar disparities across borrower groups. CFA believes

there is a role for ongoing Congressional oversight in this area to ensure that regulators

13

Li, Wei and Kieth S. Ernst, Center for Responsible Lending, “The Best Value in the Subprime Market,”

February 23, 2006.

13

are taking the necessary steps to ferret out illegal discriminatory treatment in mortgage

pricing decisions by individual lenders.

3. Make the subprime market more competitive.

By helping to identify areas with high concentration of high-cost loans, the HMDA data

can be used to encourage mainstream lenders to enter new markets and increase

competition in providing reasonably priced mortgage credit.

4. Increase accountability for lenders.

Public disclosure of loan data under HMDA has already led some lenders to beef up their

internal review and increase their due diligence to detect unlawful pricing practices.

HMDA data also provides the means for lenders to identify and correct any problems to

avoid bad publicity or legal liability. However, improvements in prevailing industry

practices still are needed.

5. Increased understanding of local credit markets and community credit needs.

HMDA pricing data provides the opportunity to generate a valuable dialogue between

lenders and the communities they serve about what these patterns reveal. These

discussions can provide insights about credit risks associated with different types of

borrowers and foster strategies for reducing pricing disparities that exist. CFA

encourages expanded efforts in this area.

Methodology

In 2005, Consumer Federation of America compiled HMDA Loan Application Register

(LAR) data from 22 lenders and their 312 total affiliates. These lenders made a total of

4.9 million conventional, first lien mortgages on single family (1-4 unit) properties in

2005. CFA compared this lending pattern to a similar sampling from 2004 which

sampled 26 lenders and their 160 total affiliates.

Sampling the Metropolitan Statistical Areas (MSAs): CFA only included MSAs

where the sampled lenders made a sufficient number of conventional refinance and home

improvement mortgage originations in the study. CFA excluded MSAs where the

sampled lenders did not make 500 or more refinance loans in 2004 and exceeded 10

percent of the lending from 2003.

Regional Comparisons: CFA also used the Census Bureaus regional division

classification to assess the average metropolitan prime, subprime, and high-cost lending

patterns by region. The ten regions are: New England (Connecticut, Maine,

Massachusetts, New Hampshire, Rhode Island and Vermont); New York and New

Jersey; Mid-Atlantic (Delaware, District of Columbia, Maryland, Pennsylvania, Virginia

and West Virginia); Southeast (Alabama, Florida, Georgia, Kentucky, Mississippi, North

Carolina, South Carolina and Tennessee); Midwest (Illinois, Indiana, Michigan,

14

Minnesota, Ohio and Wisconsin); Southwest (Arkansas, Louisiana, New Mexico,

Oklahoma and Texas); Great Plains (Kansas, Iowa, Missouri and Nebraska); Rocky

Mountains (Colorado, Montana, North Dakota, South Dakota, Utah and Wyoming);

Pacific (Arizona, California, Hawaii and Nevada); and Northwest (Alaska, Idaho, Oregon

and Washington. Some MSAs cross the Census Bureau’s regional divisions; in those

cases the MSAs were assigned to the region where the primary city is located. For

example, the St. Louis MSA is in the Great Plains and Midwest regional divisions and it

was assigned to the Great Plains.

National versus Average and Median: The national aggregate calculation is based on

the total sampled conventional refinance lending across the country. This includes

lending in non-metropolitan statistical areas (MSAs), lending in smaller metropolitan

areas with a small sample size, and metropolitan areas which are incorrectly coded by

lenders (i.e. the codes supplied by the lenders do not match any known MSA code

provided by the Office of Management and Budget, which designates MSAs). This

national figure provides some weighting for the size of the MSA. Larger MSAs have a

larger impact on the aggregate data. For example, the larger California MSAs generally

have a larger share of prime refinance lending than other places, so Los Angeles,

Oakland, San Diego and San Francisco will tend to increase the share of national prime

refinance lending compared to the smaller impact of Laredo, Texas on the national

aggregate.

The average and median share of prime or subprime loans calculation is an average or

median of the percentage of loans originated at each price band for each MSA. This

figure represents the average shares of prime and subprime lending at average

metropolitan areas. This figure does not take the volume of lending in different MSAs

into account, so smaller MSAs are overrepresented in this figure. For example,

averaging Missoula, Montana with Los Angeles-Long Beach would provide a figure that

was the share of prime or subprime lending that is halfway between the two, although

there were nearly 100 times as many refinance loans made in Los Angeles-Long Beach

as Missoula.

Prime, Subprime and High-Cost Loans: For the first time in 2004, the Federal

Financial Institutions Examination Council (FFIEC) required lenders to report a proxy

measure for the interest rates of the first lien loans they originated. Loans with interest

rates below 3 percentage points above of a comparable Treasury issue (in theory a thirty

year bond for most mortgages) were not required to report any interest rate information,

but loans that were 3 percentage points above the comparable Treasury rate were

required to report the spread between the Treasury note and the mortgage. The FFIEC

intended this reporting structure to help identify subprime lenders. CFA delineates the

loans into three broad categories: prime and near-prime (below 3 percentage points of the

Treasury threshold), subprime (loans above 3 percentage points above the threshold), and

high-cost (loans 5 percentage points or higher than the threshold). The subprime loans

are categorized as any reported over-threshold interest rate, i.e. 3 percentage points or

higher than the Treasury threshold.

15

Race and Ethnicity: In 2004, the FFIEC also began to require separate reporting of race

and Latino ethnicity, because Latinos can be of any race. CFA coded non-Latino whites

as white, African Americans of any ethnicity as African American, and non-African

American Latinos as Latino. CFA recoded the race and ethnicity reporting into a single

category to ensure that the total aggregate lending figures did not double count Latinos.

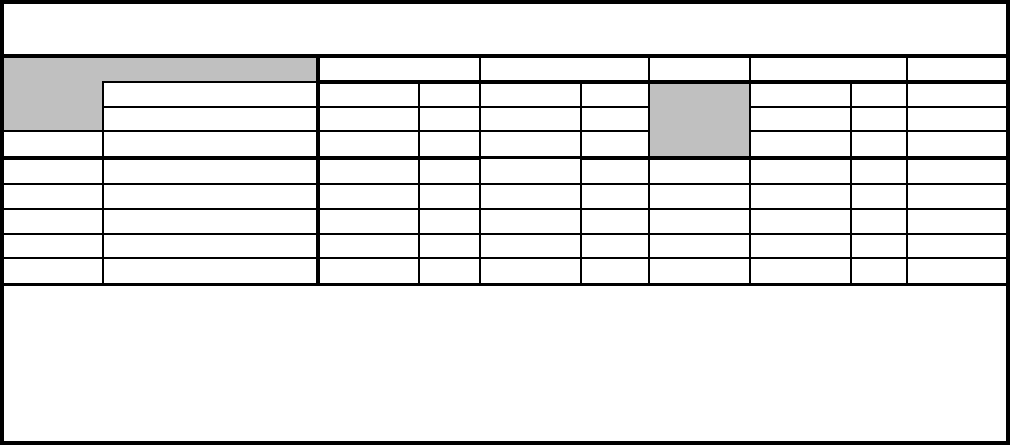

Table 1. Regional Subprime Refinance Lending by Region 2005

2005 Prime

2005 Subprime

>3% 2005 >5% 2005 Total

Southwest 78365 62.7% 46594 37.3% 17377 13.9% 124959

Great Plains 43251 63.4% 24989 36.6% 9545 14.0% 68240

Midwest 214301 67.9% 101358 32.1% 33642 10.7% 315659

Southeast 254022 69.5% 111414 30.5% 39162 10.7% 365436

Mid Atlantic 196938 75.5% 63967 24.5% 21747 8.3% 260905

Northeast 80216 75.6% 25927 24.4% 8286 7.8% 106143

New York/New Jersey 110991 75.9% 35286 24.1% 10694 7.3% 146277

Rocky Mountains 52456 76.6% 16001 23.4% 4082 6.0% 68457

Northwest 88381 81.5% 20073 18.5% 5079 4.7% 108454

Pacific 561237 81.9% 123730 18.1% 33507 4.9% 684967

Prime Subprime >3% SP Rank >5% >7%

AK 2,442 64.1% 1,369 35.9% 16 318 8.3% 30 0.8% 3,811

AL 11,380 58.4% 8,090 41.6% 3 3,913 20.1% 571 2.9% 19,470

AR 5,260 71.0% 2,149 29.0% 28 944 12.7% 141 1.9% 7,409

AZ 68,974 72.6% 25,999 27.4% 32 9,449 9.9% 515 0.5% 94,973

CA 469,696 83.8% 90,815 16.2% 52 22,137 3.9% 836 0.1% 560,511

CO 39,331 78.0% 11,085 22.0% 47 2,780 5.5% 159 0.3% 50,416

CT 22,889 77.5% 6,643 22.5% 43 2,258 7.6% 217 0.7% 29,532

DC 5,915 80.7% 1,411 19.3% 49 394 5.4% 6 0.1% 7,326

DE 7,246 76.8% 2,186 23.2% 41 722 7.7% 70 0.7% 9,432

FL 149,280 71.0% 60,965 29.0% 29 19,869 9.5% 1,568 0.7% 210,245

GA 38,395 67.2% 18,716 32.8% 25 7,114 12.5% 672 1.2% 57,111

HI 8,291 80.5% 2,006 19.5% 48 530 5.1% 31 0.3% 10,297

IA 9,930 61.0% 6,357 39.0% 7 2,695 16.5% 307 1.9% 16,287

ID 10,480 77.5% 3,035 22.5% 44 885 6.5% 67 0.5% 13,515

IL 78,969 68.8% 35,817 31.2% 26 10,321 9.0% 187 0.2% 114,786

IN 22,577 62.0% 13,818 38.0% 11 5,058 13.9% 539 1.5% 36,395

KS 8,783 66.3% 4,471 33.7% 24 1,773 13.4% 243 1.8% 13,254

KY 13,318 65.3% 7,083 34.7% 21 2,390 11.7% 332 1.6% 20,401

LA 10,493 60.0% 6,997 40.0% 5 2,453 14.0% 292 1.7% 17,490

MA 40,452 75.7% 13,002 24.3% 38 4,006 7.5% 255 0.5% 53,454

MD 65,126 75.3% 21,389 24.7% 36 6,955 8.0% 161 0.2% 86,515

ME 5,773 64.8% 3,141 35.2% 20 1,138 12.8% 141 1.6% 8,914

MI 51,987 64.2% 29,039 35.8% 18 11,828 14.6% 1,172 1.4% 81,026

MN 36,929 74.0% 12,960 26.0% 35 3,934 7.9% 280 0.6% 49,889

MO 27,375 63.4% 15,803 36.6% 13 6,199 14.4% 695 1.6% 43,178

MS 3,198 48.2% 3,434 51.8% 1 1,560 23.5% 240 3.6% 6,632

MT 4,825 76.2% 1,508 23.8% 40 462 7.3% 71 1.1% 6,333

NC 40,371 73.2% 14,743 26.8% 34 5,695 10.3% 704 1.3% 55,114

ND 1,347 60.8% 869 39.2% 6 362 16.3% 44 2.0% 2,216

NE 4,900 58.6% 3,466 41.4% 4 1,240 14.8% 143 1.7% 8,366

NH 9,255 75.9% 2,931 24.1% 39 941 7.7% 78 0.6% 12,186

NJ 70,296 77.2% 20,726 22.8% 42 6,451 7.1% 470 0.5% 91,022

NM 7,410 65.8% 3,844 34.2% 23 1,468 13.0% 77 0.7% 11,254

NV 32,304 77.9% 9,157 22.1% 45 2,551 6.2% 123 0.3% 41,461

NY 66,520 73.2% 24,344 26.8% 33 7,264 8.0% 667 0.7% 90,864

OH 47,830 63.8% 27,124 36.2% 14 8,890 11.9% 968 1.3% 74,954

OK 7,896 55.7% 6,281 44.3% 2 2,545 18.0% 368 2.6% 14,177

OR 29,340 82.2% 6,344 17.8% 51 1,576 4.4% 94 0.3% 35,684

PA 63,338 71.1% 25,706 28.9% 30 9,464 10.6% 1,386 1.6% 89,044

PR 912 61.8% 563 38.2% 10 309 20.9% 167 11.3% 1,475

RI 8,798 72.2% 3,383 27.8% 31 1,030 8.5% 87 0.7% 12,181

SC 13,567 63.8% 7,691 36.2% 15 3,067 14.4% 434 2.0% 21,258

SD 2,500 70.3% 1,058 29.7% 27 324 9.1% 41 1.2% 3,558

TN 19,798 61.1% 12,631 38.9% 8 5,159 15.9% 632 1.9% 32,429

TX 58,118 61.7% 36,106 38.3% 9 14,181 15.1% 2,332 2.5% 94,224

UT 14,853 75.5% 4,824 24.5% 37 1,277 6.5% 58 0.3% 19,677

VA 67,535 78.0% 19,061 22.0% 46 6,437 7.4% 742 0.9% 86,596

VT 2,015 64.1% 1,129 35.9% 17 503 16.0% 81 2.6% 3,144

WA 58,668 81.8% 13,012 18.2% 50 3,342 4.7% 179 0.2% 71,680

WI 23,879 64.3% 13,281 35.7% 19 5,464 14.7% 650 1.7% 37,160

WV 4,556 62.4% 2,741 37.6% 12 1,016 13.9% 145 2.0% 7,297

WY 2,155 65.8% 1,122 34.2% 22 359 11.0% 31 0.9% 3,277

Total 1,877,476 73.5% 671,425 26.5% 223,000 8.7% 20,499 0.8% 2,548,901

Average 36,105 69.3% 12,912 30.7% 4,288 11.1% 394 1.4% 49,017

Median 14,210 69.5% 7,040 30.5% 2,548 10.5% 229 1.1% 20,830

Table 2. 2005 Subprime Share of Refinance Lending by State

SP RANK 2005 Total

National Aggregate

1,894,269 73.5% 684,038 26.5% 226724 8.8% 2,578,307

Average

5,300 68.9% 1,819 31.1% 584 11.3% 7,096

Region

Median

1,612 68.8% 654 31.2% 221 10.5% 2,328

NW

Anchorage AK

1,708 66.0% 880 34.0% 129 197 7.6% 2,588

SE

Anniston AL

290 64.3% 161 35.7% 108 79 17.5% 451

SE

Birmingham AL

3,201 55.7% 2,547 44.3% 34 1183 20.6% 5,748

SE

Decatur AL

270 49.1% 280 50.9% 8 139 25.3% 550

SE

Dothan AL

337 57.2% 252 42.8% 46 145 24.6% 589

SE

Gadsden AL

305 62.8% 181 37.2% 94 95 19.5% 486

SE

Huntsville AL

1,075 65.3% 570 34.7% 122 240 14.6% 1,645

SE

Mobile AL

987 56.0% 776 44.0% 36 373 21.2% 1,763

SE

Montgomery AL

859 58.1% 619 41.9% 51 322 21.8% 1,478

SE

Tuscaloosa AL

361 55.5% 289 44.5% 33 130 20.0% 650

SW

Fayetteville AR-MO

1,204 72.7% 452 27.3% 198 198 12.0% 1,656

SW

Fort Smith AR-OK

450 60.9% 289 39.1% 77 133 18.0% 739

SW

Little Rock AR

1,671 71.8% 657 28.2% 190 248 10.7% 2,328

Pac.

Flagstaff AZ

962 86.5% 150 13.5% 303 36 3.2% 1,112

Pac.

Phoenix-Mesa-Scottsdale AZ

53,135 72.0% 20,711 28.0% 192 7669 10.4% 73,846

Pac.

Prescott AZ

2,138 83.5% 423 16.5% 292 136 5.3% 2,561

Pac.

Tucson AZ

7,645 72.1% 2,959 27.9% 193 1050 9.9% 10,604

Pac.

Yuma AZ

1,020 66.1% 522 33.9% 130 146 9.5% 1,542

Pac.

Bakersfield CA

8,342 68.5% 3,837 31.5% 156 1088 8.9% 12,179

Pac.

Chico CA

1,872 81.2% 433 18.8% 279 115 5.0% 2,305

Pac.

El Centro CA

1,092 60.6% 709 39.4% 75 217 12.0% 1,801

Pac.

Fresno CA

9,064 71.6% 3,589 28.4% 189 1055 8.3% 12,653

Pac.

Hanford CA

1,013 67.7% 483 32.3% 149 125 8.4% 1,496

Pac.

Los Angeles-Long Beach CA

99,005 81.7% 22,125 18.3% 282 5498 4.5% 121,130

Pac.

Madera CA

1,732 73.6% 621 26.4% 205 166 7.1% 2,353

Pac.

Merced CA

3,390 74.5% 1,163 25.5% 217 271 6.0% 4,553

Pac.

Modesto CA

8,450 78.2% 2,353 21.8% 259 558 5.2% 10,803

Pac.

Napa CA

2,120 92.3% 178 7.7% 312 32 1.4% 2,298

Pac.

Oakland-Fremont-Howard CA

44,816 89.1% 5,490 10.9% 306 1169 2.3% 50,306

Pac.

Oxnard-Thousand Oaks-Ventura CA

12,868 90.5% 1,352 9.5% 309 296 2.1% 14,220

Pac.

Redding CA

1,971 80.6% 474 19.4% 277 126 5.2% 2,445

Pac.

Riverside-San Bernadino-Ontario CA

57,207 75.3% 18,753 24.7% 226 4789 6.3% 75,960

Pac.

S

acramento-

A

r

d

en-

A

rca

d

e-

R

osev

ill

e

CA

33,617 82.9% 6,951 17.1% 289 1618 4.0% 40,568

Pac.

Salinas CA

5,651 88.5% 732 11.5% 305 156 2.4% 6,383

Pac.

San Diego-Carlsbad-San Marcos CA

38,609 89.8% 4,408 10.2% 307 892 2.1% 43,017

Pac.

San Francisco-San Mateo CA

22,000 94.8% 1,197 5.160% 317 221 1.0% 23,197

Pac.

San Jose-Sunnyvale-Santa Clara CA

26,329 93.1% 1,954 6.9% 315 367 1.3% 28,283

Pac.

San Luis Obispo-Paso Robles CA

3,430 92.2% 291 7.8% 311 62 1.7% 3,721

Pac.

Santa Ana-Anaheim CA

35,908 90.9% 3,578 9.1% 310 794 2.0% 39,486

Pac.

Santa Barbara-Santa Maria-Goleta CA

5,315 92.4% 435 7.6% 313 86 1.5% 5,750

Pac.

Santa Cruz-Watsonville CA

3,841 92.8% 300 7.2% 314 54 1.3% 4,141

Pac.

Santa Rosa-Petaluma CA

7,361 93.1% 542 6.9% 316 108 1.4% 7,903

Pac.

Stockton CA

12,390 78.9% 3,323 21.1% 264 825 5.3% 15,713

Table 3:2005 Subprime Share of Refinance Lending by MSA

2005 Prime 2005 Subprime >3% 2005 >5%

SP RANK 2005 Total

National Aggregate

1,894,269 73.5% 684,038 26.5% 226724 8.8% 2,578,307

Average

5,300 68.9% 1,819 31.1% 584 11.3% 7,096

Region

Median

1,612 68.8% 654 31.2% 221 10.5% 2,328

Table 3:2005 Subprime Share of Refinance Lending by MSA

2005 Prime 2005 Subprime >3% 2005 >5%

Pac.

Vallejo-Fairfield CA

8,021 83.3% 1,607 16.7% 291 356 3.7% 9,628

Pac.

Visalia-Porterville CA

3,909 70.1% 1,665 29.9% 171 539 9.7% 5,574

Pac.

Yuba City-Marysville CA

1,707 75.8% 545 24.2% 233 142 6.3% 2,252

RM

Boulder CO

2,546 90.4% 271 9.6% 308 63 2.2% 2,817

RM

Colorado Springs CO

4,402 75.5% 1,428 24.5% 230 396 6.8% 5,830

RM

Denver CO

20,820 77.4% 6,094 22.6% 247 1382 5.1% 26,914

RM

Fort Collins CO

2,602 83.7% 505 16.3% 293 101 3.3% 3,107

RM

Grand Junction CO

942 69.9% 406 30.1% 169 118 8.8% 1,348

RM

Greeley CO

1,868 75.1% 619 24.9% 224 152 6.1% 2,487

RM

Pueblo CO

881 60.6% 572 39.4% 76 198 13.6% 1,453

NE

Bridgeport CT

8,357 86.0% 1,359 14.0% 300 448 4.6% 9,716

NE

Hartford CT

5,555 71.3% 2,237 28.7% 185 767 9.8% 7,792

NE

New Haven CT

5,716 75.4% 1,860 24.6% 229 665 8.8% 7,576

NE

Norwich CT

1,342 72.7% 505 27.3% 197 151 8.2% 1,847

MA

Dover DE

1,039 74.0% 366 26.0% 209 126 9.0% 1,405

MA

Wilmington DE-MD-NJ

5,651 74.3% 1,952 25.7% 215 660 8.7% 7,603

SE

Cape Coral FL

6,409 73.4% 2,322 26.6% 203 747 8.6% 8,731

SE

Deltona-Daytona Beach FL

4,182 68.0% 1,968 32.0% 151 686 11.2% 6,150

SE

Fort Walton Beach FL

1,512 76.2% 471 23.8% 238 153 7.7% 1,983

SE

Ft. Lauderdale FL

19,608 71.5% 7,806 28.5% 187 2439 8.9% 27,414

SE

Jacksonville FL

7,254 65.1% 3,893 34.9% 117 1367 12.3% 11,147

SE

Lakeland FL

2,749 59.2% 1,897 40.8% 64 642 13.8% 4,646

SE

Miami-Miami Beach FL

18,819 66.4% 9,503 33.6% 134 2808 9.9% 28,322

SE

Naples FL

3,977 82.0% 875 18.0% 284 261 5.4% 4,852

SE

Ocala FL

1,498 66.9% 741 33.1% 137 272 12.1% 2,239

SE

Orlando FL

18,597 71.1% 7,560 28.9% 183 2479 9.5% 26,157

SE

Palm Bay-Melbourne FL

5,742 74.3% 1,982 25.7% 216 604 7.8% 7,724

SE

Panama City FL

1,028 71.2% 415 28.8% 184 147 10.2% 1,443

SE

Pensacola-Ferry Pass-Brent FL

2,384 67.3% 1,160 32.7% 141 401 11.3% 3,544

SE

Port St. Lucie FL

3,625 72.9% 1,349 27.1% 199 476 9.6% 4,974

SE

Punta Gorda FL

1,592 77.4% 466 22.6% 246 132 6.4% 2,058

SE

Sarasota-Bradenton-Venice FL

6,867 78.6% 1,865 21.4% 261 614 7.0% 8,732

SE

Tallahassee FL

1,530 68.8% 693 31.2% 160 230 10.3% 2,223

SE

Tampa-St. Petersburg-Clearwater FL

20,609 69.3% 9,110 30.7% 164 3091 10.4% 29,719

SE

Vero Beach FL

1,086 78.8% 293 21.2% 263 93 6.7% 1,379

SE

W. Palm Beach-Boca Raton FL

14,512 77.2% 4,289 22.8% 243 1393 7.4% 18,801

SE

Athens GA

565 73.4% 205 26.6% 202 100 13.0% 770

SE

Atlanta GA

28,278 70.2% 12,008 29.8% 172 4156 10.3% 40,286

SE

Augusta GA-SC

1,569 64.0% 884 36.0% 106 371 15.1% 2,453

SE

Dalton GA

362 59.2% 250 40.8% 62 91 14.9% 612

SE

Gainesville GA

656 71.0% 268 29.0% 182 93 10.1% 924

SE

Macon GA

498 52.6% 449 47.4% 21 210 22.2% 947

SE

Savannah GA

1,312 64.3% 727 35.7% 109 307 15.1% 2,039

SE

Warner Robbins GA

257 53.2% 226 46.8% 23 97 20.1% 483

Pac.

Honolulu HI

5,102 80.9% 1,204 19.1% 278 318 5.0% 6,306

SP RANK 2005 Total

National Aggregate

1,894,269 73.5% 684,038 26.5% 226724 8.8% 2,578,307

Average

5,300 68.9% 1,819 31.1% 584 11.3% 7,096

Region

Median

1,612 68.8% 654 31.2% 221 10.5% 2,328

Table 3:2005 Subprime Share of Refinance Lending by MSA

2005 Prime 2005 Subprime >3% 2005 >5%

GP

Ames IA

280 78.0% 79 22.0% 257 36 10.0% 359

GP

Cedar Rapids IA

1,189 67.3% 579 32.7% 140 215 12.2% 1,768

GP

Davenport IA-IL

1,255 52.4% 1,140 47.6% 20 445 18.6% 2,395

GP

Des Moines IA

3,295 68.7% 1,503 31.3% 157 607 12.7% 4,798

GP

Iowa City IA

404 77.8% 115 22.2% 254 35 6.7% 519

GP

Sioux City IA-NE-SD

378 55.4% 304 44.6% 30 126 18.5% 682

GP

Waterloo-Cedar Falls IA

591 58.6% 418 41.4% 56 194 19.2% 1,009

NW

Boise ID

4,877 79.4% 1,268 20.6% 265 366 6.0% 6,145

NW

Coeur d'Alene ID

1,600 81.3% 369 18.7% 280 107 5.4% 1,969

NW

Idaho Falls ID

591 69.4% 261 30.6% 165 67 7.9% 852

NW

Pocatello ID

417 68.4% 193 31.6% 154 54 8.9% 610

MW

Bloomington-Normal IL

546 66.3% 278 33.7% 132 95 11.5% 824

MW

Champaign-Urbana IL

629 68.8% 285 31.2% 159 117 12.8% 914

MW

Chicago-Naperville IL

63,455 70.8% 26,124 29.2% 180 6637 7.4% 89,579

MW

Peoria IL

910 54.6% 756 45.4% 28 301 18.1% 1,666

MW

Anderson IN

607 59.2% 419 40.8% 63 149 14.5% 1,026

MW

Bloomington IN

439 62.2% 267 37.8% 89 93 13.2% 706

MW

Elkhart IN

568 63.7% 324 36.3% 101 115 12.9% 892

MW

Fort Wayne IN

1,863 67.0% 919 33.0% 138 311 11.2% 2,782

MW

Gary IN

2,715 59.2% 1,872 40.8% 65 701 15.3% 4,587

MW

Holland MI

1,169 71.9% 458 28.1% 191 175 10.8% 1,627

MW

Indianapolis IN

8,320 68.2% 3,883 31.8% 152 1310 10.7% 12,203

MW

Kokomo IN

292 49.6% 297 50.4% 11 116 19.7% 589

MW

Michigan City IN

408 63.0% 240 37.0% 96 99 15.3% 648

MW

Muncie IN

322 49.2% 332 50.8% 10 144 22.0% 654

GP

Lawrence KS

543 82.3% 117 17.7% 285 29 4.4% 660

GP

Topeka KS

719 63.7% 410 36.3% 102 165 14.6% 1,129

GP

Wichita KS

1,589 61.0% 1,014 39.0% 81 391 15.0% 2,603

SE

Bowling Green KY

377 75.6% 122 24.4% 231 39 7.8% 499

SE

Elizabethtown KY

356 62.5% 214 37.5% 92 69 12.1% 570

SE

Lexington KY

2,252 73.8% 801 26.2% 207 242 7.9% 3,053

SE

Louisville KY-IN

6,433 69.3% 2,853 30.7% 162 913 9.8% 9,286

SE

Owensboro KY

307 58.8% 215 41.2% 59 72 13.8% 522

SW

Alexandria LA

305 60.5% 199 39.5% 74 73 14.5% 504

SW

Baton Rouge LA

1,960 60.4% 1,285 39.6% 71 419 12.9% 3,245

SW

Houma LA

408 57.6% 300 42.4% 48 95 13.4% 708

SW

Lafayette LA

791 67.9% 374 32.1% 150 128 11.0% 1,165

SW

Lake Charles LA

460 61.0% 294 39.0% 80 117 15.5% 754

SW

Monroe LA

455 61.2% 289 38.8% 82 84 11.3% 744

SW

New Orleans LA

3,858 61.7% 2,393 38.3% 87 789 12.6% 6,251

SW

Shreveport-Bossier City LA

930 55.9% 733 44.1% 35 255 15.3% 1,663

NE

Barnstable Town MA

2,581 79.5% 664 20.5% 266 195 6.0% 3,245

NE

Boston-Quincy MA

12,861 77.6% 3,712 22.4% 252 1066 6.4% 16,573

NE

Cambridge-Newton MA

8,666 83.0% 1,770 17.0% 290 530 5.1% 10,436

NE

Essex County MA

4,910 76.0% 1,547 24.0% 236 470 7.3% 6,457

SP RANK 2005 Total

National Aggregate

1,894,269 73.5% 684,038 26.5% 226724 8.8% 2,578,307

Average

5,300 68.9% 1,819 31.1% 584 11.3% 7,096

Region

Median

1,612 68.8% 654 31.2% 221 10.5% 2,328

Table 3:2005 Subprime Share of Refinance Lending by MSA

2005 Prime 2005 Subprime >3% 2005 >5%

NE

P

rov

id

ence-

N

ew

B

e

df

or

d

-

F

a

ll

Ri

ver

RI

-

MA

12,297 72.2% 4,728 27.8% 194 1443 8.5% 17,025

NE

Springfield MA

2,330 59.1% 1,615 40.9% 61 581 14.7% 3,945

NE

Worcester MA-CT

4,804 69.6% 2,102 30.4% 167 671 9.7% 6,906

MA

Baltimore MD

27,394 74.7% 9,300 25.3% 220 3177 8.7% 36,694

MA

Bethesda-Frederick MD

14,816 85.2% 2,564 14.8% 298 660 3.8% 17,380

MA

Hagerstown-Martinsburg MD-WV

2,219 73.7% 793 26.3% 206 248 8.2% 3,012

MA

Salisbury MD

692 66.9% 343 33.1% 136 130 12.6% 1,035

NE

Bangor ME

553 61.3% 349 38.7% 83 124 13.7% 902

NE

Lewiston ME

452 61.0% 289 39.0% 79 101 13.6% 741

NE

Portland-South Portland ME

3,370 70.4% 1,415 29.6% 176 498 10.4% 4,785

MW

Battle Creek MI

489 48.6% 517 51.4% 6 233 23.2% 1,006

MW

Bay City-Saginaw MI

323 60.5% 211 39.5% 73 88 16.5% 534

MW

Detroit-Dearborn MI

9,220 51.3% 8,746 48.7% 17 3974 22.1% 17,966

MW

Flint MI

1,926 58.6% 1,363 41.4% 55 597 18.2% 3,289

MW

Grand Rapids MI

4,037 63.4% 2,328 36.6% 99 933 14.7% 6,365

MW

Jackson MI

828 62.3% 501 37.7% 91 195 14.7% 1,329

MW

Kalamazoo MI

1,533 65.2% 818 34.8% 121 332 14.1% 2,351

MW

Lansing MI

2,415 63.0% 1,421 37.0% 95 492 12.8% 3,836

MW

Monroe MI

846 71.5% 337 28.5% 186 134 11.3% 1,183

MW

Muskegon MI

638 49.0% 665 51.0% 7 322 24.7% 1,303

MW

Niles-Benton Harbor MI

682 58.2% 489 41.8% 53 196 16.7% 1,171

MW

Saginaw-Saginaw Township North MI

594 56.8% 451 43.2% 44 174 16.7% 1,045

MW

Warren-Farmington Hills MI

18,123 74.7% 6,125 25.3% 221 2171 9.0% 24,248

MW

Duluth MN-WI

1,488 68.5% 685 31.5% 155 257 11.8% 2,173

MW

Minneapolis-St. Paul MN

26,898 75.2% 8,868 24.8% 225 2456 6.9% 35,766

MW

Rochester MN

956 74.9% 321 25.1% 222 104 8.1% 1,277

MW

St. Cloud MN

953 73.1% 350 26.9% 200 98 7.5% 1,303

GP

Joplin MO

423 58.2% 304 41.8% 52 136 18.7% 727

GP

Kansas City MO-KS

11,115 65.8% 5,770 34.2% 125 2213 13.1% 16,885

GP

Springfield MO

1,327 64.5% 730 35.5% 111 295 14.3% 2,057

GP

St. Joseph MO-IL

546 61.3% 344 38.7% 85 134 15.1% 890

GP

St. Louis MO-IL

16,574 62.6% 9,891 37.4% 93 3734 14.1% 26,465

SE

Gulfport MS

438 61.4% 275 38.6% 86 82 11.5% 713

SE

Jackson MS

728 49.2% 751 50.8% 9 317 21.4% 1,479

SE

Pascagoula MS

221 50.9% 213 49.1% 16 86 19.8% 434

RM

Billings MT

614 74.2% 213 25.8% 213 68 8.2% 827

RM

Great Falls MT

343 69.2% 153 30.8% 161 44 8.9% 496

RM

Missoula MT

832 86.2% 133 13.8% 301 39 4.0% 965

SE

Asheville NC

2,160 75.0% 720 25.0% 223 265 9.2% 2,880

SE

Burlington NC

522 67.0% 257 33.0% 139 111 14.2% 779

SE

Charlotte NC-SC

9,400 75.3% 3,077 24.7% 227 1136 9.1% 12,477

SE

Durham NC

2,067 74.0% 725 26.0% 211 249 8.9% 2,792

SE

Fayetteville NC

830 56.5% 640 43.5% 40 255 17.3% 1,470

SE

Greensboro NC

3,299 70.3% 1,394 29.7% 174 581 12.4% 4,693

SE

Greenville NC

468 66.2% 239 33.8% 131 95 13.4% 707

SP RANK 2005 Total

National Aggregate

1,894,269 73.5% 684,038 26.5% 226724 8.8% 2,578,307

Average

5,300 68.9% 1,819 31.1% 584 11.3% 7,096

Region

Median

1,612 68.8% 654 31.2% 221 10.5% 2,328

Table 3:2005 Subprime Share of Refinance Lending by MSA

2005 Prime 2005 Subprime >3% 2005 >5%

SE

Hickory NC

1,279 65.6% 671 34.4% 123 236 12.1% 1,950

SE

Raleigh-Cary NC

5,632 81.6% 1,271 18.4% 281 455 6.6% 6,903

SE

Rocky Mount NC

384 63.9% 217 36.1% 104 92 15.3% 601

SE

Wilmington NC

2,684 82.6% 566 17.4% 288 221 6.8% 3,250

SE

Winston-Salem NC

2,007 70.1% 856 29.9% 170 315 11.0% 2,863

RM

Bismark ND

309 69.4% 136 30.6% 166 51 11.5% 445

RM

Fargo ND-MN

666 67.6% 319 32.4% 148 129 13.1% 985

GP

Omaha NE-IA

3,023 57.1% 2,271 42.9% 45 790 14.9% 5,294

NE

Manchester NH

3,192 78.7% 863 21.3% 262 261 6.4% 4,055

NE

Rockingham-Stafford Counties NH

3,230 78.0% 912 22.0% 256 315 7.6% 4,142

NYNJ

Atlantic City NJ

2,924 73.6% 1,050 26.4% 204 398 10.0% 3,974

NYNJ

Camden NJ

11,217 72.3% 4,295 27.7% 195 1625 10.5% 15,512

NYNJ

Edison NJ

21,888 80.3% 5,372 19.7% 273 1593 5.8% 27,260

NYNJ

Newark-Union NJ-PA

16,034 76.5% 4,930 23.5% 239 1396 6.7% 20,964

NYNJ

Ocean City NJ

1,937 86.7% 297 13.3% 304 84 3.8% 2,234

NYNJ

Trenton-Ewing NJ

2,838 76.9% 851 23.1% 241 292 7.9% 3,689

NYNJ

Vineland-Millvile-Bridgeton NJ

573 58.7% 403 41.3% 58 137 14.0% 976

SW

Albuquerque NM

4,133 67.5% 1,992 32.5% 144 676 11.0% 6,125

SW

Farmington NM

383 65.9% 198 34.1% 128 69 11.9% 581

SW

Las Cruces NM

523 61.3% 330 38.7% 84 120 14.1% 853

SW

Santa Fe NM

1,084 79.8% 274 20.2% 268 90 6.6% 1,358

Pac.

Carson City NV

571 84.1% 108 15.9% 295 23 3.4% 679

Pac.

Las Vegas NV

23,419 76.0% 7,413 24.0% 235 2153 7.0% 30,832

Pac.

Reno-Sparks NV

6,215 84.4% 1,152 15.6% 296 251 3.4% 7,367

NYNJ

Albany NY

2,540 64.3% 1,412 35.7% 107 460 11.6% 3,952

NYNJ

Buffalo NY

2,308 65.2% 1,233 34.8% 120 456 12.9% 3,541

NYNJ

Kingston NY

853 69.7% 371 30.3% 168 129 10.5% 1,224

NYNJ

New York-White Plains-Wayne NY-NJ

41,609 78.0% 11,770 22.0% 255 3017 5.7% 53,379

NYNJ

P

oug

hk

eeps

i

e-

N

ew

b

urg

h

-

Middl

eton

NY

3,707 70.8% 1,526 29.2% 181 486 9.3% 5,233

NYNJ

Rochester NY

2,164 61.0% 1,385 39.0% 78 464 13.1% 3,549

NYNJ

Utica-Rome NY

399 50.5% 391 49.5% 13 157 19.9% 790

MW

Canton OH

2,063 63.9% 1,163 36.1% 105 444 13.8% 3,226

MW

Cincinnati OH-KY-IN

9,553 67.6% 4,577 32.4% 147 1540 10.9% 14,130

MW

Cleveland OH

9,731 64.9% 5,265 35.1% 116 1271 8.5% 14,996

MW

Columbus OH

9,086 67.5% 4,373 32.5% 145 1378 10.2% 13,459

MW

Dayton OH

3,762 64.8% 2,045 35.2% 114 703 12.1% 5,807

MW

Mansfield OH

443 58.6% 313 41.4% 57 119 15.7% 756

MW

Springfield OH

696 63.3% 403 36.7% 97 132 12.0% 1,099

MW

Toledo OH

2,159 59.7% 1,456 40.3% 67 600 16.6% 3,615

MW

Youngstown-Warren-Boardman OH-PA

1,813 55.5% 1,455 44.5% 32 554 17.0% 3,268

SW

Oklahoma City

3,531 58.1% 2,550 41.9% 50 990 16.3% 6,081

SW

Tulsa OK

2,135 56.4% 1,650 43.6% 39 576 15.2% 3,785

NW

Bend OR

2,076 85.5% 351 14.5% 299 75 3.1% 2,427

NW

Corvalis OR

390 84.1% 74 15.9% 294 12 2.6% 464

SP RANK 2005 Total

National Aggregate

1,894,269 73.5% 684,038 26.5% 226724 8.8% 2,578,307

Average

5,300 68.9% 1,819 31.1% 584 11.3% 7,096

Region

Median

1,612 68.8% 654 31.2% 221 10.5% 2,328

Table 3:2005 Subprime Share of Refinance Lending by MSA

2005 Prime 2005 Subprime >3% 2005 >5%

NW

Eugene OR

2,418 81.8% 539 18.2% 283 156 5.3% 2,957

NW

Medford OR

2,177 82.5% 461 17.5% 287 129 4.9% 2,638

NW

P

ort

l

an

d

-

V

ancouver-

B

eaverton

OR

-

WA

20,370 82.4% 4,340 17.6% 286 1016 4.1% 24,710

NW

Salem OR

2,520 80.2% 624 19.8% 272 154 4.9% 3,144

MA

Allentown PA

6,516 77.3% 1,910 22.7% 244 701 8.3% 8,426

MA

Erie PA

630 56.3% 490 43.8% 38 164 14.6% 1,120

MA

Harrisburg PA

2,303 70.2% 977 29.8% 173 317 9.7% 3,280

MA

Lancaster PA

2,311 78.0% 650 22.0% 258 184 6.2% 2,961

MA

Lebanon PA

573 73.3% 209 26.7% 201 61 7.8% 782

MA

Philadelphia PA

26,985 75.3% 8,829 24.7% 228 3359 9.4% 35,814

MA

Pittsburgh PA

9,199 64.7% 5,014 35.3% 113 1859 13.1% 14,213

MA

Reading PA

2,220 74.0% 781 26.0% 210 271 9.0% 3,001

MA

Scranton-Willes Barre PA

2,179 65.2% 1,165 34.8% 119 432 12.9% 3,344

MA

State College PA

531 80.5% 129 19.5% 274 43 6.5% 660

MA

Williamsport PA

290 54.3% 244 45.7% 27 77 14.4% 534

MA

York-Hanover PA

2,631 77.4% 767 22.6% 249 251 7.4% 3,398

SE

Anderson SC

455 60.0% 303 40.0% 69 129 17.0% 758

SE

Charleston SC

3,278 70.3% 1,384 29.7% 175 473 10.1% 4,662

SE

Columbia SC

2,092 60.4% 1,371 39.6% 72 552 15.9% 3,463

SE

Florence SC

376 55.5% 302 44.5% 31 150 22.1% 678

SE

Greenville SC

1,750 65.1% 939 34.9% 118 320 11.9% 2,689

SE

Myrtle Beach SC

1,280 73.9% 451 26.1% 208 146 8.4% 1,731

SE

Spartanburg SC

711 54.2% 602 45.8% 26 212 16.1% 1,313

RM

Rapid City SD

581 70.8% 240 29.2% 179 70 8.5% 821

RM

Sioux Falls SD

909 74.5% 311 25.5% 218 76 6.2% 1,220

SE

Chattanooga TN

1,839 57.3% 1,373 42.7% 47 562 17.5% 3,212

SE

Clarksville TN-KY

378 52.3% 345 47.7% 19 134 18.5% 723

SE

Jackson TN

298 52.8% 266 47.2% 22 121 21.5% 564

SE

Johnson City TN

636 66.5% 321 33.5% 135 142 14.8% 957

SE

Kingsport TN-VA

951 66.3% 483 33.7% 133 201 14.0% 1,434

SE

Knoxville TN

2,832 64.6% 1,549 35.4% 112 513 11.7% 4,381

SE

Memphis TN-MS-AR

3,845 55.1% 3,135 44.9% 29 1325 19.0% 6,980

SE

Morristown TN

463 64.5% 255 35.5% 110 97 13.5% 718

SE

Nashville TN

6,232 68.2% 2,908 31.8% 153 1088 11.9% 9,140

SW

Amarillo TX

440 56.6% 338 43.4% 42 165 21.2% 778

SW

Austin TX

5,181 75.6% 1,668 24.4% 232 492 7.2% 6,849

SW

Beaumont TX

651 62.1% 398 37.9% 88 165 15.7% 1,049

SW

Brownsville TX

642 42.7% 860 57.3% 1 395 26.3% 1,502

SW

College Station TX

416 64.8% 226 35.2% 115 103 16.0% 642

SW

Corpus Christie TX

737 50.7% 718 49.3% 15 312 21.4% 1,455

SW

Dallas-Plano TX

12,637 67.3% 6,136 32.7% 142 2127 11.3% 18,773

SW

El Paso TX

1,410 45.0% 1,726 55.0% 3 721 23.0% 3,136

SW

Ft. Worth-Arlington TX

6,033 65.9% 3,125 34.1% 127 1144 12.5% 9,158

SW

Houston TX

17,403 63.3% 10,076 36.7% 98 3618 13.2% 27,479

SW

Killeen TX

506 56.5% 390 43.5% 41 154 17.2% 896

SP RANK 2005 Total

National Aggregate

1,894,269 73.5% 684,038 26.5% 226724 8.8% 2,578,307

Average

5,300 68.9% 1,819 31.1% 584 11.3% 7,096

Region

Median

1,612 68.8% 654 31.2% 221 10.5% 2,328

Table 3:2005 Subprime Share of Refinance Lending by MSA

2005 Prime 2005 Subprime >3% 2005 >5%

SW

Laredo TX

289 50.6% 282 49.4% 14 111 19.4% 571

SW

Longview TX

231 48.1% 249 51.9% 5 117 24.4% 480

SW

Lubbock TX

421 45.0% 515 55.0% 4 240 25.6% 936

SW

McAllen TX

916 43.6% 1,183 56.4% 2 523 24.9% 2,099

SW

Midland TX

205 53.5% 178 46.5% 24 98 25.6% 383

SW

San Antonio TX

4,447 59.2% 3,064 40.8% 66 1283 17.1% 7,511

SW

Sherman-Denison TX

293 59.8% 197 40.2% 68 97 19.8% 490

SW

Tyler TX

336 58.5% 238 41.5% 54 94 16.4% 574

SW

Victoria TX

188 58.0% 136 42.0% 49 63 19.4% 324

SW

Waco TX

375 51.5% 353 48.5% 18 165 22.7% 728

SW

Wichita Falls TX

327 54.0% 279 46.0% 25 130 21.5% 606

RM

Logan UT-ID

486 75.8% 155 24.2% 234 48 7.5% 641

RM

Ogden UT

2,343 70.4% 983 29.6% 177 255 7.7% 3,326

RM

Provo-Orem UT

2,378 80.0% 596 20.0% 269 139 4.7% 2,974

RM

Salt Lake City UT

7,045 76.1% 2,207 23.9% 237 568 6.1% 9,252

RM

St. George UT

1,419 78.4% 391 21.6% 260 113 6.2% 1,810

MA

Blacksburg VA

610 74.3% 211 25.7% 214 62 7.6% 821

MA

Charlottesville VA

1,409 79.6% 361 20.4% 267 110 6.2% 1,770

MA

Harrisonburg VA

433 77.6% 125 22.4% 251 43 7.7% 558

MA

Lynchburg VA

1,093 70.6% 456 29.4% 178 161 10.4% 1,549

MA

Richmond VA

8,204 67.4% 3,961 32.6% 143 1357 11.2% 12,165

MA

Roanoke VA

1,612 69.3% 713 30.7% 163 259 11.1% 2,325

MA

Vi

rg

i

n

i

a

B

eac

h

-

N

or

f

o

lk

-

N

ewport

N

ews

VA

15,014 71.6% 5,964 28.4% 188 2164 10.3% 20,978

MA

Washington-Arlington DC-VA-MD-WV

56,960 80.5% 13,790 19.5% 275 4212 6.0% 70,750

MA

Winchester VA-WV

1,075 77.4% 314 22.6% 248 102 7.3% 1,389

NW

Bellingham WA

1,554 84.6% 283 15.4% 297 58 3.2% 1,837

NW

Bremerton WA

2,446 80.0% 611 20.0% 270 136 4.4% 3,057

NW

Kennewick WA

905 77.7% 260 22.3% 253 74 6.4% 1,165

NW

Longview WA

699 74.0% 245 26.0% 212 72 7.6% 944

NW

Mount Vernon WA

884 80.1% 219 19.9% 271 57 5.2% 1,103

NW

Olympia WA

2,250 80.6% 543 19.4% 276 130 4.7% 2,793

NW

Seattle-Bellevue-Everett WA

28,035 86.4% 4,400 13.6% 302 1084 3.3% 32,435

NW

Spokane WA

3,203 77.3% 938 22.7% 245 268 6.5% 4,141

NW

Tacoma WA

7,967 74.6% 2,714 25.4% 219 700 6.6% 10,681

NW

Wenatchee WA

551 77.2% 163 22.8% 242 52 7.3% 714

NW

Yakima WA

743 68.8% 337 31.2% 158 115 10.6% 1,080

MW

Appleton WI

985 72.4% 376 27.6% 196 142 10.4% 1,361

MW

Fond du Lac WI

317 63.8% 180 36.2% 103 79 15.9% 497

MW

Green Bay WI

2,286 77.5% 664 22.5% 250 230 7.8% 2,950

MW

Lake County-Kenosha IL-WI

7,533 76.7% 2,291 23.3% 240 653 6.6% 9,824

MW

Milwaukee WI

7,544 60.2% 4,984 39.8% 70 2165 17.3% 12,528

MW

Oshkosh WI

547 62.3% 331 37.7% 90 148 16.9% 878

MW

Racine WI

1,144 65.6% 600 34.4% 124 270 15.5% 1,744

MW

Sheboygen WI

447 65.8% 232 34.2% 126 95 14.0% 679

MA

Charleston WV

793 67.6% 380 32.4% 146 123 10.5% 1,173

SP RANK 2005 Total

National Aggregate

1,894,269 73.5% 684,038 26.5% 226724 8.8% 2,578,307

Average

5,300 68.9% 1,819 31.1% 584 11.3% 7,096

Region

Median

1,612 68.8% 654 31.2% 221 10.5% 2,328

Table 3:2005 Subprime Share of Refinance Lending by MSA

2005 Prime 2005 Subprime >3% 2005 >5%

MA

Huntington WV-KY-OH

675 59.0% 470 41.0% 60 165 14.4% 1,145

MA

Parkersburg-Marietta WV-OH

356 56.7% 272 43.3% 43 86 13.7% 628

MA

Weirton-Steubenville WV-OH

250 49.8% 252 50.2% 12 102 20.3% 502

MA

Wheeling WV-OH

275 56.1% 215 43.9% 37 81 16.5% 490

RM

Cheyenne WY

470 63.6% 269 36.4% 100 72 9.7% 739

NOTES: MSAs listed alphabetically by state and region. Regions: NE - Northeast (CT, ME, MA, NH, RI, & VT); NYNJ - New York/New

Jersey; MA - Mid-Atlantic (DE, DC, MD, VA, & WV); SE - Southeast (AL, FL, GA, KY, MS, NC, SC, & TN); MW - Midwest (IL, IN, MI, MN,

OH, & WI); SW - Southwest (AR, LA, NM, OK, & TX); GP - Great Plains (IA, KS, MO, & NE); RM - Rocky Mountains (CO, MT, ND, SD, UT,

& WY); Pac. - Pacific (AZ, CA, HI, & NV); NW - Northwest (AK, ID, OR, & WA). SP Rank: MSAs are ranked based on the subprime share of

refinance lending in 2004, with the highest rank of 1 having the highest subprime share of refinance lending. 2003 MSA Total: NEW

designates new MSAs created under the 2000 Census; italics designates MSAs which have been split in two or have been broken into

metropolitan divisions. 2004 data is available in CFA's Subprime Cities study released last year.

Appendix A: Selected States and Metropolitan Areas

Alabama

Prime Subprime >3% >5% >7% Total

Alabama Ranked 3 11,380 58.4% 8,090 41.6% 3,913 20.1% 571 2.9% 19,470

Nationwide 1,894,269 73.5% 684,038 26.5% 226,724 8.8% 21,181 0.8% 2,578,307

SP

RANK 2005 Total

MSA Averag

e

5,339 68.6% 1,819 31.4% 584 11.5% 7,158

MSA Median

1,636 68.7% 654 31.3% 221 10.7% 2,393

Alabama MSA 854 58.2% 631 41.8% 301 20.6% 1,484

Anniston AL

290 64.3% 161 35.7% 108 79 17.5% 451

Birmingham AL

3,201 55.7% 2,547 44.3% 34 1183 20.6% 5,748

Decatur AL

270 49.1% 280 50.9% 8 139 25.3% 550

Dothan AL

337 57.2% 252 42.8% 46 145 24.6% 589

Gadsden AL

305 62.8% 181 37.2% 94 95 19.5% 486

Huntsville AL

1,075 65.3% 570 34.7% 122 240 14.6% 1,645

Mobile AL

987 56.0% 776 44.0% 36 373 21.2% 1,763

Montgomery AL

859 58.1% 619 41.9% 51 322 21.8% 1,478

Tuscaloosa AL

361 55.5% 289 44.5% 33 130 20.0% 650

Arizona

Prime Subprime >3% >5% >7% Total

Arizona Ranked 31 68,974 72.6% 25,999 27.4% 9,449 9.9% 515 0.5% 94,973

Nationwide 1,894,269 73.5% 684,038 26.5% 226,724 8.8% 21,181 0.8% 2,578,307

SP

RANK 2005 Total

MSA Averag

e

5,339 68.6% 1,819 31.4% 584 11.5% 7,158

MSA Median

1,636 68.7% 654 31.3% 221 10.7% 2,393

Arizona MSA 12,980 76.0% 4,953 24.0% 1,807 7.7% 17,933

Flagstaff AZ

962 86.5% 150 13.5% 303 36 3.2% 1,112

Phoenix-Mesa-

Scottsdale AZ

53,135 72.0% 20,711 28.0% 192 7669 10.4% 73,846

Prescott AZ

2,138 83.5% 423 16.5% 292 136 5.3% 2,561

Tucson AZ

7,645 72.1% 2,959 27.9% 193 1050 9.9% 10,604

Yuma A

Z

1,020 66.1% 522 33.9% 130 146 9.5% 1,542

Statewide Subprime Refinance Lending in Arizona, 2005

2005 Subprime Share of Refinance Lending by MSA

2005 Prime

2

005 Subprime >3

%

2005 >5%

Statewide Subprime Refinance Lending in Alabama, 2005

2005 Subprime Share of Refinance Lending by MSA

2005 Prime

2

005 Subprime >3

%

2005 >5%

Appendix A: Selected States and Metropolitan Areas

California

Prime Subprime >3% >5% >7% Total

California Ranked

5

469,696 83.8% 90,815 16.2% 22,137 3.9% 836 0.1% 560,511