Instructions to Intermediaries:

• The enclosed Helpful Start Application form needs to be completed in full and

submitted at the same time as the mortgage application.

• The prospective Helpful Start Account holder(s) need to visit a Barclays branch, for

Identification purposes, only in the event they do not have a Barclays mortgage or

current account. There is no requirement for existing Barclays mortgage or current

account customers to visit a Barclays branch.

• Please see the Barclays Intermediary website for acceptable Client identification

documents which need to be taken into the branch at the same time with this

Instruction Guide and Helpful Start Account Application Form.

If there is any doubt on the correct process, please contact the Intermediary

Partnership Support Team via web chat or call 0345 073 3330.

Instructions for Barclays Staff:

• This is an application form for a Helpful Start Account through a mortgage

intermediary. A Helpful Start Account is needed for a Family Springboard mortgage.

• Do not refer these customers to a Barclays mortgage advisor.

• You are required to provide assistance to complete the Helpful Start Application

form, and ensure these customers have the necessary documents to enable them

to be entered and validated onto Fullserve.

• Enter and validate the customer details onto Fullserve and note the CIS number for

each customer on the Helpful Start Application form. Complete page 4 ‘Branch Use

only’ with the branch certification stamp and your details.

• Please ensure the customer profile is set up correctly, with a full set of ID&V

documents entered, with these marked as Validated or Management Validated, and

all KYC fields completed.

• Return this application to the customer(s); there is no requirement to keep a copy

of the application form.

If there is any doubt on the correct process, please refer to Branch KIT:

‘Helpful Start Account’ or’ Family Springboard Mortgage’ pages.

Please read carefully to ensure the correct process is followed for the

Helpful Start Account holders

C M

Y K

PMS ???

PMS ???

PMS ???

PMS ???

Non-print 1

Non-print 2

JOB LOCATION:

PRINERGY 3

Non-printing

Colours

Barclays Bank UK PLC. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (Financial Services

Register No. 759676). Registered in England. Registered No. 9740322. Registered Office: 1 Churchill Place, London E14 5HP.

Item ref: 9912959 Artwork: Created: 06/19

BAR_9912959_0619.indd 1 17/06/2019 14:09

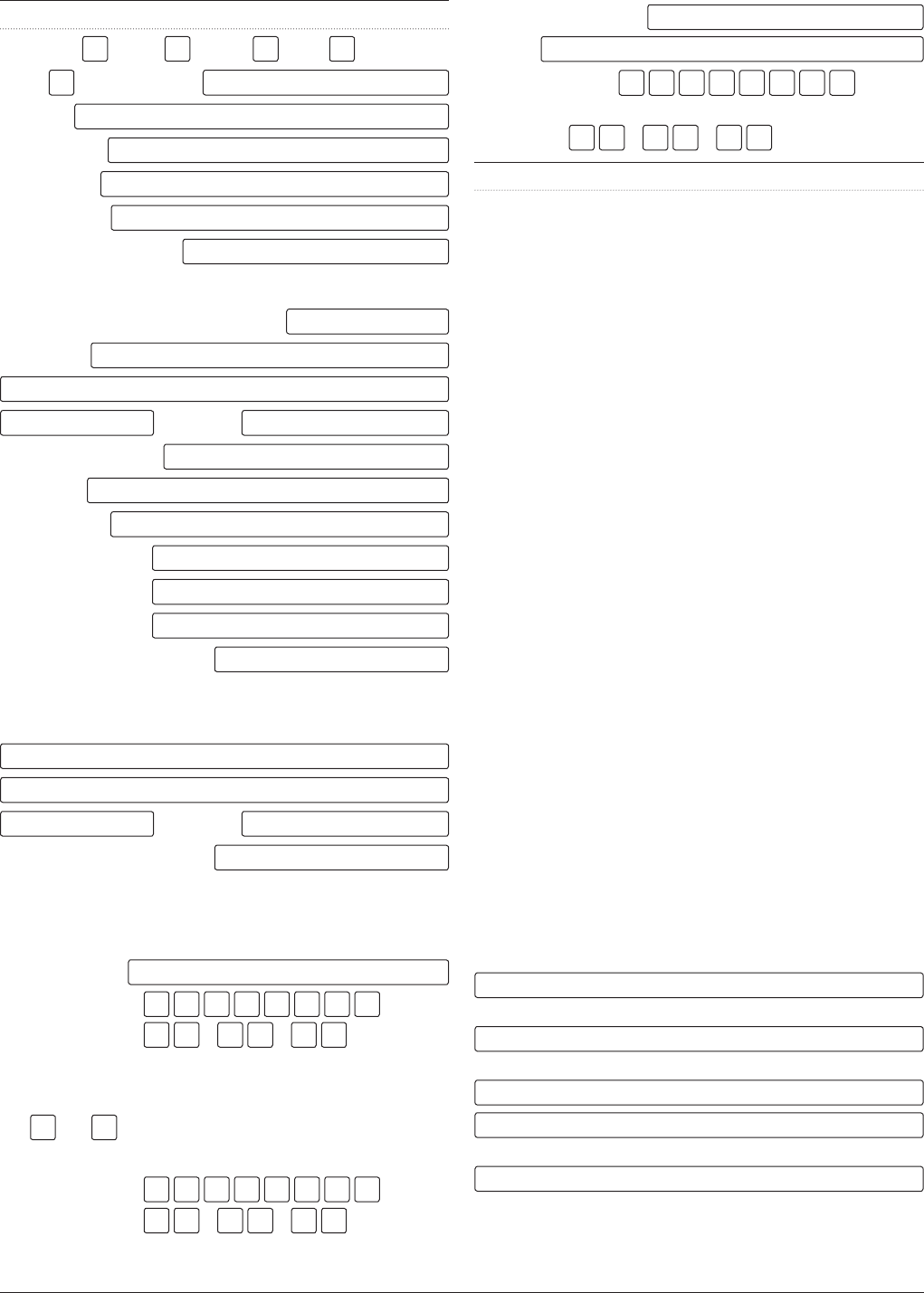

Savings Account – Application Form

Please complete this form in block capitals.

Do you already hold an account with Barclays?

Yes

Please complete this form and submit as part

of the Family Springboard Mortgage application.

You may be asked to provide identification and

verification of address.

No

You will be required to visit a branch with your

driving licence or passport and proof of your

current address as part of the account opening

process. You are able to book an appointment and

arrange your visit by calling 0345 734 5345.

Alternatively, you are able to go to your local

branch. You should then complete the application

form and submit as part of the Family Springboard

Mortgage application.

Branch Staff:

Please ensure you follow instructions on the first page

of pack under ‘Instructions for Barclays staff’.

Application form

Helpful Start Account

Interest will be paid to the Helpful Start Account.

Do you wish interest to be paid into this account?

Yes

No

If you wish the interest to be paid to another

Barclays account please complete the following:

Sort Code

2

0

–

–

Account

Please ensure correct details are input, as incorrect details

could result in delay of application.

First applicant

Title Mr Mrs Miss Ms

Other

(please specify)

Surname

First name(s)

Date of birth

Marital status

Mother’s maiden name

(Occasionally this information may be required to identify you when

authorisation of a transaction is necessary)

Relationship to mortgage borrower(s)

UK address

Postcode

Country of residence

Nationality

email address

Telephone: Home

Work

Mobile

Date moved to this address

Previous address

(If less than three years at current address please provide all addresses for

the last three years, using a separate sheet of paper if necessary)

Postcode

Date moved to this address

Please confirm the source of funds (i.e. savings, secondary

borrowing) to be placed in the Helpful Start account and

the account the funds are currently deposited:

Source of Funds

Account Number

Sort Code

–

–

Banking details:

Do you presently have any accounts with Barclays?

Yes

No

If yes then please give details of one of these accounts here:

Account Number

Sort Code

–

–

If no, please give alternative banking details:

Bank/Building Society

Address

Account Number

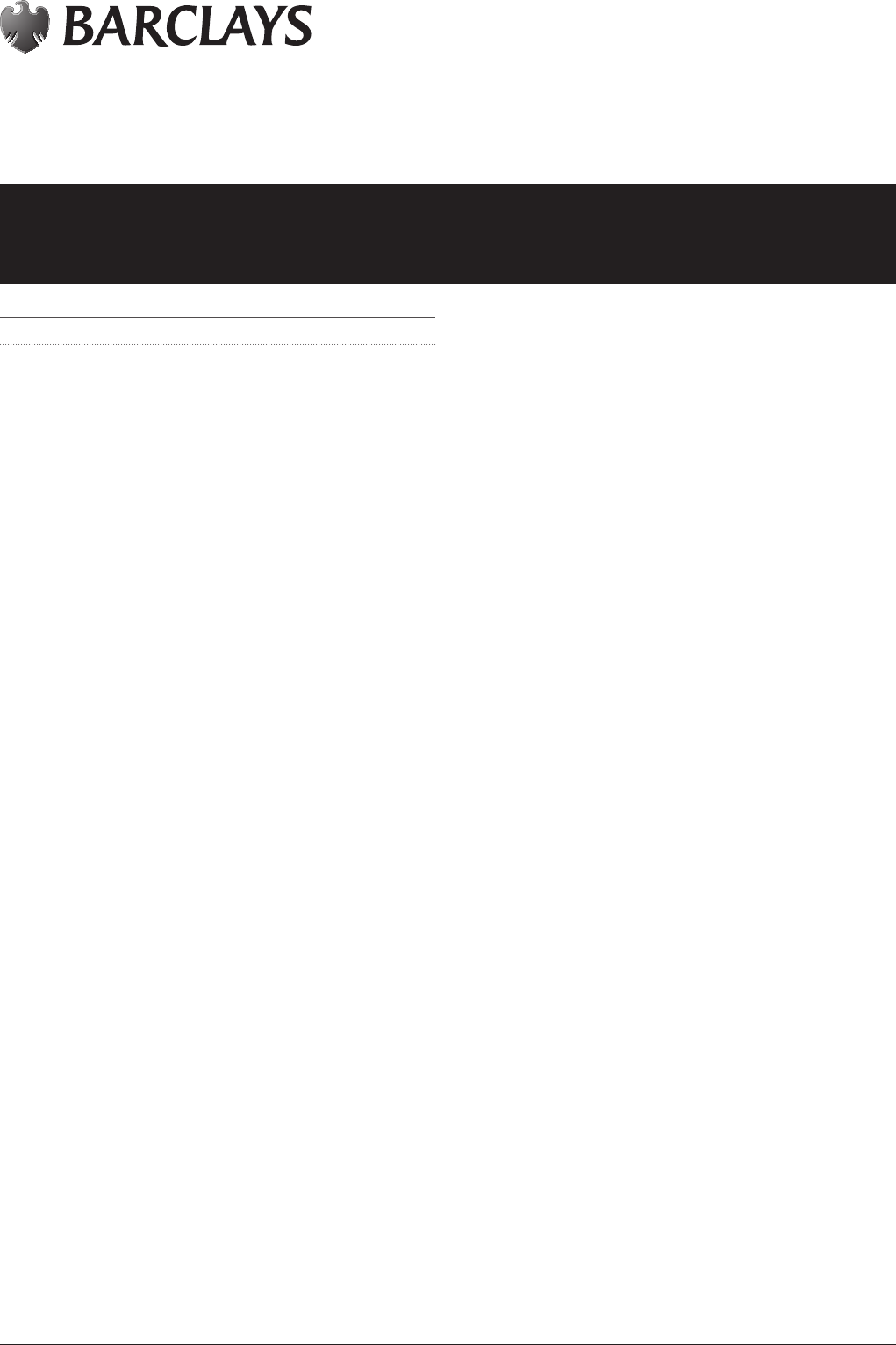

Application Form

Helpful Start Account

Helpful Start Account including Independent Legal Advice details

MAX Reference Number

C M

Y K

PMS ???

PMS ???

PMS ???

PMS ???

Variable

COLOUR

JOB LOCATION:

PRINERGY 3

Non-printing

Colours

Customer(s) CIS number(s):

BAR_9912780LP_UK.indd 1 20/05/2019 15:15

Second applicant (if applicable)

Title Mr Mrs Miss Ms

Other

(please specify)

Surname

First name(s)

Date of birth

Marital status

Mother’s maiden name

(Occasionally this information may be required to identify you when

authorisation of a transaction is necessary)

Relationship to mortgage borrower(s)

UK address

Postcode

Country of residence

Nationality

email address

Telephone: Home

Work

Mobile

Date moved to this address

Previous address

(If less than three years at current address please provide all addresses for

the last three years, using a separate sheet of paper if necessary)

Postcode

Date moved to this address

Please confirm the source of funds (i.e. savings, secondary

borrowing) to be placed in the Helpful Start account and

the account the funds are currently deposited:

Source of Funds

Account Number

Sort Code

–

–

Banking details:

Do you presently have any accounts with Barclays?

Yes

No

If yes then please give details of one of these accounts here:

Account Number

Sort Code

–

–

If no, please give alternative banking details:

Bank/Building Society

Address

Account Number

(if applicable)

Sort Code

–

–

Independent Legal Advice

As you will not be benefitting from the proposed mortgage it is

important that you understand the nature of the commitment

you are making and the risks connected with this transaction.

You must fully understand the circumstances surrounding this

mortgage and the account attached to it and the effects of the

legal document you will be required to complete in respect of

the charge over the credit balance in the Helpful Start Account.

What this means to you

Before the mortgage can be drawn, we require written

confirmation from a Solicitor, Licensed Conveyancer, or Fellow

of the Institute of Legal Executives acting for you to the effect

that they have fully explained the nature and effect to you

of the legal charge you will be required to sign and the setting

up of Helpful Start account and the implications this may

have for you.

What we need

We need you to let us know the name and address of

the legal advisor you intend to use that will give you

independent legal advice.

You can, if you wish, instruct the legal firm shown on the

mortgage application form to act for you, if they are willing to

provide independent legal advice or you are entitled to instruct

a different legal advisor.

Alternatively you may wish to consider using Enact, an

independent legal firm who Barclays have an arrangement

with to provide independent legal advice services to its

customers via telephone for a fee of £125 + VAT and

disbursements per person. Further information can be

provided by your advisor.

You will be responsible for the cost of obtaining this advice.

Please note that we will not be able to set up the mortgage

until we receive written confirmation that legal advice has

been given in accordance with our requirements.

Legal advisor details

My Solicitor/Licensed Conveyancer/Fellow of the Institute

of Legal Executives is:

Name of legal advisor

Name of firm

Address of firm

Telephone number of firm

HELPFUL START ACCOUNT 2

BAR_9912780LP_UK.indd 2 20/05/2019 14:03

Your feedback

We want to hear from you if you feel unhappy with the

service you have received from us. Letting us know your

concerns gives us the opportunity to put matters right for

you and improve our service to all our customers.

You can complain in person at your branch, in writing, by

email or by telephone. A leaflet detailing how we deal with

complaints is available on request in any of our branches,

from the Barclays Information Line on 0800 400 100 2

or at barclays.co.uk. Alternatively you can write to

Barclays, Leicester LE87 2BB.

If we do not resolve your complaint internally to your

satisfaction, you may be able to refer it to the Financial

Ombudsman Service at South Quay Plaza, 183 Marsh Wall,

London E14 9SR (Tel: 0845 080 1800). The Financial

Ombudsman Service is an organisation set up by law

to give consumers a free and independent service for

resolving disputes with financial firms. Details of those

who are eligible complainants can be obtained from the

Financial Ombudsman Service.

Information on Financial Services

Compensation Scheme

Barclays is covered by the Financial Services Compensation

Scheme (FSCS), the UK’s statutory deposit guarantee

scheme. The FSCS pays compensation to eligible

depositors if a bank is unable to meet its financial

obligations. Most depositors are covered by the scheme.

As one of our regulators, the Prudential Regulation

Authority requires us to give you the FSCS Information

Sheet and accompanying Exclusions List to help you

understand whether and how your deposits are protected.

This information is included in the Rates for Savers leaflet

and the Flexible Bond interest rate leaflet. You should read

the relevant leaflet carefully and then keep it safe for

future reference.

HELPFUL START ACCOUNT 3

Agreement and authorisation –

Barclays Helpful Start Account

By signing the declaration, you confirm you

understand that:

• A deposit of 10% of the purchase price of the

property being purchased must be placed in the

Helpful Start Account before mortgage

completion.

• The funds deposited in the Helpful Start Account

cannot be accessed for a minimum period of

60 months (Deposit Term from the date of the

mortgage advance) or redemption of the

mortgage, whichever is sooner.

• The rate of interest on our Helpful Start Accounts

(or rates of interest if more than one rate applies)

is a tracker rate which follows the Bank of England

(BoE) rate.

• In the event of three or more missed Monthly

Payments during the Five Year Period, the Deposit

Term will continue beyond the Five Year Period

and will end on the first date on which all

of the following conditions are satisfied:

(a) the Mortgage account is up to date; and

(b) no Monthly Payments have been missed during

the previous 12 months; and

(c) no more than two Monthly Payments have been

missed during the previous 60 months.

• We will contact you at least 30 days before we

expect the Deposit Term to end, in order to set

out the options for the proceeds of your maturing

Helpful Start Account. We will offer you a new

instant access savings account, and the

information we send you will provide full details

of the account including the interest rate(s),

features and terms and conditions. You do not

have to accept the instant access savings account

we offer you.

BAR_9912780LP_UK.indd 3 20/05/2019 14:03

By signing below, you, the individual(s) named in this

application form, are:

(i) applying to us, Barclays Bank UK PLC, for Barclays

Helpful Start Account;

(ii) confirming that any details you have supplied are true

and complete;

(iii) confirming you have received the following

documents (please tick each box that applies):

Helpful Start Account Terms;

Retail Customer Agreement;

Rates for Savers interest rate leaflet containing

the Financial Services Compensation Scheme

Information Sheet; and

Helpful Start Charge Over Deposit

For Barclays Helpful Start Account held in joint names

(i) You agree we may accept instructions from you in

accordance with section 2 of the Retail Customer

Agreement.

(ii) You agree that we can update our records using

information given by any one of you about

the other(s).

The funds in your Helpful Start Account may be at risk if

any contractual monthly payments on the connected

mortgage are missed.

Cancellation Rights

A legally binding agreement to open a Helpful Start

Account will come into force as soon as you sign this

application form. If you wish to change your mind, you

have a 14-day period in which to contact us to cancel the

agreement. This period begins on the date you sign this

application form. If you contact us within this period to

cancel, the agreement between us will be cancelled and

any balance on your account, together with any interest

earned, will be paid to you. However, we will not reimburse

you for any fees you may have incurred for obtaining

Independent Legal Advice. If you wish to cancel your

account, you should tell us by writing to Barclays Mortgage

Services, PO Box 8575, Leicester, LE18 9AW.

This cancellation right applies to your Helpful Start

Account in place of any cancellation right in the Retail

Customer Agreement or in Rates for Savers.

Signature(s) – Both parties must sign if this is a joint

account.

Signature 1.

Date

Barclays and other members of the Barclays Group may

contact you with information about products and services

(including those of others) that may be of interest to you.

If you would prefer not to receive this information by one

or more of the following means, please tick below:

Please don’t contact me by:

Telephone

Mail

email

SMS

Signature 2.

Date

Barclays and other members of the Barclays Group may

contact you with information about products and services

(including those of others) that may be of interest to you.

If you would prefer not to receive this information by one

or more of the following means, please tick below:

Please don’t contact me by:

Telephone

Mail

email

SMS

Bank use only

Please ensure you follow instructions on the first page

of pack under ‘Instructions for Barclays staff’.

Customer System number

Customer identified and validated

Address confirmed

I confirm that the above checks have been completed

Name of branch staff

Contact telephone no.

no.

Branch stamp (if applicable)

HELPFUL START ACCOUNT 4

BAR_9912780LP_UK.indd 4 20/05/2019 14:03

HELPFUL START ACCOUNT 5

You can get this in Braille, large print or audio by calling 0800 022 4022* (via Text Relay

if appropriate) or by ordering online from barclays.co.uk/accessibleservices

Call monitoring and charges information

* To keep a high quality of service, your call may be monitored or recorded for training and security. Calls to 0800 numbers are free if made from a UK landline.

Barclays Bank UK PLC. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (Financial Services Register

No. 759676). Registered in England. Registered No. 9740322. Registered Office: 1 Churchill Place, London E14 5HP.

Item ref: 9912780LP_UK Artwork: Created: 05/19

Your information

Barclays is committed to protecting your personal data.

We will use your information for a number of different

purposes, for example, to manage your account(s), to

provide our products and services to you and others

and to meet our legal and regulatory obligations.

We may also share your information with our trusted

3rd parties for these purposes. For more detailed

information on how and why we use your information,

including the rights in relation to your personal data,

and our legal grounds for using it, please go to

barclays.co.uk/important-information/control-your-data

or you can request a copy from us.

Credit Reference Agencies and Fraud Prevention

Agencies

In order to process your application we will supply your

personal information to credit reference agencies and

fraud prevention agencies and they will give us information

about you, such as about your financial history. We do this

to assess creditworthiness and product suitability, check

your identity, manage your account, trace and recover

debts and prevent criminal activity. These agencies may in

turn share your personal information with other

organisations. If fraud is detected, you could be refused

certain services, finance or employment. Once you open

an account with us, we will share account data with the

credit reference agencies on an ongoing basis.

If false or inaccurate information is provided to us and

fraud is identified, details may be passed to credit

reference and fraud prevention agencies to prevent fraud

and money laundering and to verify your identity.

The Credit Reference Agency Information Notice (CRAIN)

describes how the three main credit reference agencies in

the UK each use and share personal data. The CRAIN is

available on the credit reference agencies’ websites:

• transunion.co.uk/crain

• equifax.co.uk/crain

• experian.co.uk/crain

Or you can ask us for a copy of these.

For more details on how information held by

credit reference agencies and fraud prevention

agencies may be used, please go to

barclays.co.uk/important-information/control-your-data

or you can request a copy from us.

BAR_9912780LP_UK.indd 5 20/05/2019 14:03

Mortgage Borrower(s) App 1 please sign below: App 2 please sign below (if applicable):

By signing this declaration you (the mortgage borrower(s)) are agreeing that Barclays will provide the Helpful Start

Account holder (the saving account holders) and the solicitor providing the Independent Legal Advice with the

following personal and financial information prior to mortgage completion:

• A copy of the mortgage offer and mortgage application form and any associated documentation if necessary.

In addition, you are also agreeing that Barclays will provide personal and financial information relating to your

mortgage to the associated Helpful Start Account holder(s) in the following circumstance:

• When Barclays sends correspondence(s) to you (the mortgage borrower(s)) regarding missed payments

or arrears on the mortgage, copies of these communications will also be sent to the Helpful Start Account holders

until which time the Helpful Start Account has closed.

You can withdraw your consent to us providing the above personal and financial information at any time. However,

following completion of your mortgage, we will continue to provide personal and financial information relating to your

mortgage to the Helpful Start Account Holder where we have a lawful basis to do so.

Barclays is committed to protecting your personal data. We will use your information for a number of different purposes,

for example, to manage your account(s), to provide our products and services to you and others and to meet our legal

and regulatory obligations. We may also share your information with our trusted 3rd parties for these purposes. For

more detailed information on how and why we use your information, including the rights in relation to your personal

data, and our legal grounds for using it, please go to barclays.co.uk/important-information/control-your-data or you can

request a copy from us.

Credit Reference Agencies and Fraud Prevention Agencies

In order to process your application we will supply your personal information to credit reference agencies and fraud

prevention agencies and they will give us information about you, such as about your financial history. We do this to

assess creditworthiness and product suitability, check your identity, manage your account, trace and recover debts and

prevent criminal activity. These agencies may in turn share your personal information with other organisations. If fraud

is detected, you could be refused certain services, finance or employment. Once you open an account with us, we will

share account data with the credit reference agencies on an ongoing basis.

If false or inaccurate information is provided to us and fraud is identified, details may be passed to credit reference and

fraud prevention agencies to prevent fraud and money laundering and to verify your identity.

The Credit Reference Agency Information Notice (CRAIN) describes how the three main credit reference agencies in the

UK each use and share personal data. The CRAIN is available on the credit reference agencies’ websites:

• transunion.co.uk/crain

• equifax.co.uk/crain

• experian.co.uk/crain

Or you can ask us for a copy of these.

For more details on how information held by credit reference agencies and fraud prevention agencies may be used,

please go to barclays.co.uk/important-information/control-your-data or you can request a copy from us.

Helpful Start Declaration

Application (MAX) Reference Number

Customer(s) CIS number(s):

C M

Y K

PMS ???

PMS ???

PMS ???

PMS ???

COLOUR

COLOUR

JOB LOCATION:

PRINERGY 3

Non-printing

Colours

BAR_9912789LP_UK.indd 1 17/06/2019 13:21

Barclays Bank UK PLC. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (Financial Services Register

No. 759676). Registered in England. Registered No. 9740322. Registered Office: 1 Churchill Place, London E14 5HP.

Item Ref: 9912789LP_UK 06/19

Signed:

Print name 1st Applicant:

Date:

Signed:

Print name 2nd Applicant:

Date:

BAR_9912789LP_UK.indd 2 18/06/2019 11:21

Barclays Bank UK PLC –

Helpful Start Account Issue 1

Additional Conditions

These additional conditions apply to your Helpful Start

Account and supplement and amend the general

conditions of the Retail Customer Agreement (the

“Customer Agreement”) with us (Barclays Bank UK PLC).

In the event of any inconsistency between these additional

conditions and the Customer Agreement, these additional

conditions will apply in relation to any Helpful Start

Accounts you open with us.

1. Eligibility and non-transferability

1.1 The Helpful Start Account is available to persons aged

18 years or over (solely or jointly) who are UK residents,

to be used together with a Family Springboard

Mortgage (the “Mortgage”).

1.2 We are offering to make a larger loan than we would

normally offer to the Borrower(s) under the Mortgage,

based on the value of the property the Borrower(s)

intend to buy. Our offer is based on the Special

Conditions of the Mortgage. In particular, our offer is

based on the condition that we would be able to use

the balance of your Helpful Start Account to pay

towards any amount still owing if the Borrower(s)

do not make all the mortgage payments under the

Mortgage and we have to sell the mortgaged property.

You must sign a legal charge in the form provided to

you by us (the “Charge”), allowing us to use the

money in your Helpful Start Account in this way.

1.3 Each Helpful Start Account issue will be limited and

is therefore subject to availability.

1.4 We will open your Helpful Start Account after we have

sent a written mortgage offer to the Borrower. If we are

not able to make a mortgage offer to the Borrower, we

will not open a Helpful Start Account.

1.5 You may not transfer the ownership of your Helpful

Start Account to anyone else or use your Helpful Start

Account as security for any borrowing other than as

expressly set out below.

1.6 If you apply by post, we will not be responsible if your

application is lost or delayed in the post and will not

accept proof of posting as proof of delivery.

2. Additional Deposits

You are not allowed to make additional deposits at any

time during the term of your Helpful Start Account.

Condition 5 explains when and how we pay interest

into the account.

3. Withdrawals

No withdrawals are permitted during the

Deposit Term.

4. The Deposit Term

4.1 The “Deposit Term” is the 60-month period from the

date we release the First Advance (the “Five-Year

Period”) unless:

(a) the loan and all other amounts owing under the

Mortgage Conditions are repaid before the end of

the Five Year Period, in which case the Deposit

Term will end on the date on which all of those

amounts are finally repaid.

(b) Condition 4.2 below applies.

4.2 This condition 4.2 applies if the Borrower misses

three or more Monthly Payments during the

Five-Year Period. In that event, the Deposit Term

will continue beyond the Five-Year Period and will

end on the first date on which all of the following

conditions are satisfied:

(a) the Mortgage account is up to date; and

(b) no Monthly Payments have been missed during

the previous 12 months; and

(c) no more than two Monthly Payments have been

missed during the previous 60 months.

5. Interest

5.1 The rate of interest on our Helpful Start Accounts

(or rates of interest if more than one rate applies) is a

tracker rate. The reference rate and the margin will be

as notified to you at the time of your application for the

Helpful Start Account.

5.2 Interest is calculated on the daily statement balance

of your Helpful Start Account. Interest will be paid

monthly on the working day after the day on which

interest becomes payable and will form part of the

balance of the account into which it is paid. This

means that, if the interest is paid into your Helpful

Start Account, you receive interest on interest but

also means that any interest paid will be subject

to the Charge.

Helpful Start Account Terms

Mortgages

C M

Y K

PMS ???

PMS ???

PMS ???

PMS ???

COLOUR

COLOUR

JOB LOCATION:

PRINERGY 3

Non-printing

Colours

BAR_9912788_UK.indd 1 20/05/2019 13:02

6. Maturity and repayment

6.1 Your Helpful Start Account will mature and will close

at the end of the Deposit Term or the next working day

if that is not a working day.

6.2 We will contact you at least 30 days before we expect

the Deposit Term to end, in order to set out the

options for dealing with the proceeds of your maturing

Helpful Start Account. We will offer you a new instant

access savings account and the information we send

you will provide full details of the account including the

interest rate(s), features and terms and conditions. You

will not have to accept the instant access savings

account we offer you.

6.3 If you do not want to accept the new account offered

in your maturity letter, you should tell us as soon as

possible. You can do this by signing and returning the

instruction form we will send you with your maturity

letter, or in person at a branch or by telephone banking.

Unless you tell us you do not want to accept the

account, we will open the new account, and transfer

your existing Helpful Start Account proceeds into it on

the first working day after your Helpful Start Account

matures. We will confirm the details of the new

account shortly after it has been opened.

7. What happens if you die or become bankrupt

7.1 If you die and the Helpful Start Account is held in your

sole name then, unless we have enforced our Charge,

we will repay the amount of the Deposit and any

interest to your representatives at the end of the

Deposit Term. We will not do this unless we have

received the necessary legal documents to confirm

the death and to confirm the authority of your

representatives. If the Helpful Start Account is held in

joint names, it will continue to be held in the name(s)

of the surviving account holder(s).

7.2 If you become bankrupt then, unless we have enforced

our Charge, we will repay the amount of the Deposit

and any interest that has accrued at the end of the

Deposit Term to the person administering your estate.

We will not do this unless we receive the necessary

legal documents to confirm the bankruptcy and to

confirm the authority of the person administering

your estate.

8. Account closure

You may not close your Helpful Start Account before

the end of the Deposit Term. This means that the part

of section 11 of the Customer Agreement called ‘When

you can close your account’ does not apply to your

Helpful Start Account. We may close your Helpful Start

Account six months or longer after the date the

Borrower applied for the Mortgage if the Mortgage has

not yet completed; or before the end of the Deposit

Term for any of the reasons set out in Section 11 of

the Customer Agreement.

When we can close an account

We can close an account (and stop providing services and

end this agreement) by giving you at least two months’

notice in writing. Any benefit or services linked to your

account will stop at the same time.

We may end this agreement immediately (and stop

providing services and close your account) if we reasonably

believe you have seriously or persistently broken any terms

of the agreement or we have reasonable grounds for

thinking that you have done any of the following things,

which you must not do:

• you put us in a position where we might break a

law, regulation, code or other duty that applies to

us if we maintain your account

• you give us any false information at any time

• you commit (or attempt) fraud against us or

someone else

• you use (or allow someone else to use) your

account illegally or for criminal activity (including

receiving proceeds of crime into your account)

• you inappropriately let someone else use your

account

• you behave in a threatening or abusive manner to

our staff.

If we do, we will return to you the balance of your

Helpful Start Account (including accrued interest to

the date of closure) unless prevented from doing so

by law.

When you can close an account

If you wish to, you can close an account, stop any service

you’ve applied for separately or end this agreement –

which means stopping banking with Barclays completely

– by telling us. We may ask you to confirm it in writing.

If you tell us that you wish to stop banking with us, you

won’t be able to use your account or any services linked to

it any more. Your cards and cheque books will no longer

work after the account is closed. We recommend you cut

them up and dispose of them securely.

Your account will stay open until you’ve repaid any money

you owe us. This includes any payments you have already

made but that have not been taken out of your account.

When you close an account, you are responsible for

cancelling any payments to or from your account.

However, if someone pays money into a closed account,

we’ll try to send the money back to them if we have the

information we need to do so.

HELPFUL START ACCOUNT TERMS 2

BAR_9912788_UK.indd 2 20/05/2019 13:02

Cancellation Rights

A legally binding agreement to open a Helpful Start

Account will come into force as soon as you sign the

Helpful Start Account application form. If you wish to

change your mind, you have a 14-day period in which to

contact us to cancel this agreement. This period begins on

the date you sign the application form. If you contact us

within this period to cancel, this agreement will be

cancelled and any balance on your account, together with

any interest earned, will be paid to you. However, we will

not reimburse you for any fees you may have incurred for

obtaining Independent Legal Advice. If you wish to cancel

your account, you should tell us by writing to Barclays Bank

UK PLC, Mortgage Services, PO Box 8575, Leicester LE18

9AW. This cancellation right applies to your Helpful Start

Account in place of any cancellation right in the Customer

Agreement or in Rates for Savers.

Your feedback

We want to hear from you if you feel unhappy with the

service you have received from us. Letting us know your

concerns gives us the opportunity to put matters right for

you and improve our service to all our customers.

You can complain in person at your branch, in writing, by

email or by telephone. A leaflet detailing how we deal with

complaints is available on request in any of our branches,

from the Barclays Information Line on 0800 400 100 2

or at barclays.co.uk. Alternatively you can write to Barclays,

Leicester LE87 2BB.

If we do not resolve your complaint internally to your

satisfaction, you may be able to refer it to the Financial

Ombudsman Service at South Quay Plaza, 183 Marsh Wall,

London E14 9SR (Tel: 0845 080 1800). The Financial

Ombudsman Service is an organisation set up by law to

give consumers a free and independent service for

resolving disputes with financial firms. Details of those

who are eligible complainants can be obtained from the

Financial Ombudsman Service.

Important information

Barclays is covered by the Financial Services Compensation

Scheme (FSCS), the UK’s statutory deposit guarantee

scheme. The FSCS pays compensation to eligible

depositors if a bank is unable to meet its financial

obligations. Most depositors are covered by the scheme.

As one of our regulators, the Prudential Regulation

Authority requires us to give you the FSCS Information

Sheet and accompanying Exclusions List to help you

understand whether and how your deposits are protected.

This information is included in the Rates for Savers leaflet

and the Flexible Bond interest rate leaflet. You should

read the relevant leaflet carefully and then keep it safe

for future reference.

3

You can get this in Braille, large print or audio by calling 0800 022 4022* (via Text Relay

if appropriate) or by ordering online from barclays.co.uk/accessibleservices

Call monitoring and charges information

*To make sure we maintain a high-quality service, calls may be monitored or recorded for training and security purposes. Charges may apply when

using a mobile phone or when calling from abroad. Calls to 0800 numbers are free from a UK landline. The price on non-BT phone lines may vary.

Opening hours may vary.

Barclays Bank UK PLC. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (Financial Services Register

No. 759676). Registered in England. Registered No. 9740322. Registered Office: 1 Churchill Place, London E14 5HP.

Item ref: 9912788_UK Artwork: Created: 06/19

HELPFUL START ACCOUNT TERMS

BAR_9912788_UK.indd 3 10/06/2019 11:34

Deed Of Charge Over A Sterling Deposit

To Barclays Bank UK PLC (“you” or “your”)

1. In this Deed of Charge:

(a) “I/we”, “my/our” or “me/us” means the

person(s) whose name(s) and address(es) are

set out in Schedule 2 below;

(b) “Borrower” means the person or, where

applicable, each or any of the persons named

in Schedule 1;

(c) “Deposit” means all amounts now and in the

future credited to the account (held with Barclays

Bank UK PLC in England) set out in Schedule 3 (as

may be re-numbered, re-designated or replaced

at any time);

(d) “Mortgage Documents” means the offer letter

addressed by you to the Borrower, the deed of

mortgage or standard security executed by the

Borrower in your favour (and the terms and

conditions referred to in it, including the Mortgage

Terms and Conditions and Mortgage Special

Conditions) in relation to the mortgaged property

specified in Part 2 of Schedule 1, as amended,

extended, supplemented, restated, replaced,

assigned or novated from time to time;

(e) “Secured Sums” means all money and liabilities

now or in the future due, owing or incurred to you

by the Borrower under or in connection with the

Mortgage Documents, whether actually or

contingently and whether alone or together with

any other person, together with all interest, fees

and all other costs, charges and expenses for

which the Borrower may be or become liable

to you;

(f) the expression “this security” shall include each

charge, guarantee and other term contained in this

Deed of Charge; and

(g) the singular shall include the plural and vice versa.

I/we agree that the terms of this security shall override

the terms applicable to the Deposit.

2. Where:

(a) you have the right to take certain action;

(b) you have the right to require us to take or not to

take certain action; or

(c) something must be to your satisfaction or

acceptable to you.

then, unless otherwise specified, you will act

reasonably when exercising these rights.

3. In return for your providing a loan under the Mortgage

Documents to the Borrower, I/we:

(a) guarantee the payment or discharge to you of

(and undertake that I/we will on demand in writing

made on me/us pay or discharge to you) the

Secured Sums; and

(b) with full title guarantee charge to you by way of

fixed charge the Deposit as security for the

payment or discharge to you of the Secured Sums;

provided that the total amount recoverable under the

guarantee and charge contained in paragraphs (a)

and (b) of this Clause shall not exceed the amount

of the Deposit.

4. The Deposit will be released from this security at my/

our written request after all Secured Sums have been

fully and unconditionally paid or discharged to you or,

if earlier, at the time stated in the Special Conditions

of the Mortgage Documents.

5. I/we agree that, as long as this security is in force, the

Deposit shall only be repayable at the time and on the

terms stated in Clause 4 (irrespective of any other

terms that apply to the Deposit). Any repayment(s)

you allow shall not release this security over the

remainder of the Deposit.

6. If, following repossession and sale by you of the

mortgaged property specified in Part 2 of Schedule 1,

part or all of the Secured Sums remains outstanding,

you may, without giving notice to, or seeking consent

from, me/us, enforce this security by applying or

transferring all or part of the Deposit in full or part

payment of the amount outstanding.

7. You shall not be liable for any loss sustained by me/us

in consequence of the exercise of your rights under

Clause 6, including any loss of interest caused by you

terminating all or part of the Deposit before its maturity.

8. This security shall be in addition to and shall not affect

or be affected by any rights of set-off, combination, lien

or other rights exercisable by you as bankers against

the Borrower or by any security, guarantee or

indemnity (a promise to pay, as a debt, the full amount

of a particular liability that may arise) now or in the

future held by you.

Helpful Start Charge Over Deposit

Mortgages

WARNING

This security covers the liabilities of somebody else. If they do not repay, you may lose some or

all of the money charged. You ARE REQUIRED to seek independent legal advice before signing.

C M

Y K

PMS ???

PMS ???

PMS ???

PMS ???

Non-print 1

Non-print 2

JOB LOCATION:

PRINERGY 3

Non-printing

Colours

BAR_9912793A_UK.indd 1 04/01/2018 19:49

9. My/our liability under this security shall not be avoided,

invalidated or impaired by reason of the invalidity,

unenforceability or impairment of any security,

guarantee and/or indemnity given by any other person

providing security for the Secured Sums.

10. This security shall be a continuing security. This means

that it will not be affected by any intermediate

payments or settlement of accounts or other matters.

You may, without affecting your rights under this

security, take any steps which, without this Clause,

might relieve or discharge me/us from any of my/our

obligations under this security, including:

(a) granting, varying, renewing, increasing,

determining or refusing credit, facilities or

accommodation to the Borrower under the

Mortgage Documents;

(b) compounding with or giving time for payment or

any other indulgence to the Borrower or any other

person providing security or otherwise answerable

for the Secured Sums;

(c) making any arrangement, compromise or

settlement with the Borrower or any other person

providing security or otherwise answerable for the

Secured Sums;

(d) taking, holding, modifying, exchanging, releasing,

abstaining from perfecting or enforcing any

security, guarantee or indemnity or other contract

or discharging any parties to them;

(e) realising any security in such manner as you may

think fit; or

(f) otherwise making any concession.

This Clause does not apply to a specific written release

given by you of my/our obligations under this security.

11. The continuing nature of this security shall not be

affected by my/our death or mental incapacity.

12. For so long as any Secured Sum remains unpaid, I/we

shall not:

(a) take any steps to enforce any right or claim against

the Borrower in respect of any money charged by

me/us to you under this security;

(b) be entitled to share in or take the benefit of any

security held by you or any dividends,

compositions or money recoverable by you from

the Borrower or any other person;

(c) be entitled to take or enforce any security against

the Borrower or any other person providing

security for the Secured Sums in competition with

or in priority to you; or

(d) exercise any other right or remedy which may

accrue to me/us in respect of any money charged

by me/us to you under this security.

13. If the Borrower becomes insolvent, I/we shall remain

liable for all Secured Sums up to the amount of the

Deposit, as if the insolvency had not occurred, until

actually paid and satisfied in full. In the meantime you

may hold the money received from me/us under this

security on “suspense account” to enable you as a

creditor to prove against the Borrower’s estate for the

full amount of your claim. However, when working

out interest accruing on the Secured Sums, you will

treat them as reduced by the amount you hold on

suspense account.

14. If you receive any payment or security from any person

and are later required under insolvency law to restore

the position to what it would have been if you had not

received that payment or security, we will be liable to

you as if you had never received the payment or

security. If any claim of this kind is made against you,

you may agree or settle it on any terms you choose.

15. You may receive and retain all proceeds recovered from

other sources to the exclusion of my/our rights (if any)

in competition with you until your claim against the

Borrower is fully satisfied.

16. I/we shall not assign, transfer, charge or otherwise

alienate, deal with or encumber any or all of the money

subject to this security or my/our right, title or interest

to it, or agree to do so.

17. Where this security is signed by or on behalf of two

persons, each of us is liable to you individually as well

as jointly.

18. Where this security is to be signed by or on behalf

of two persons, each of us may sign separate copies.

Each copy will be an original and together be the

one agreement.

19. This Deed shall be governed by and construed in

accordance with English law and I/we hereby submit

to the jurisdiction of the English courts, except where

I/we are resident in Scotland or Northern Ireland in

which case I/we may choose to submit to the

jurisdiction of our local courts.

BAR_9912793A_UK.indd 2 04/01/2018 19:49

IN WITNESS whereof these presents were executed as a deed this

day of

201_______

Schedule 1

Part 1 – The Borrower

Full Name(s) Address(es)

Part 2 – The Mortgaged Property

Address Land Registration Number

Schedule 2

The Chargor(s)

Full Name(s) Address(es)

Schedule 3

Details of Charged Account

The deposit account held with Barclays Bank UK PLC and designated as follows:

Sort Code

Account Number

Name(s) of account holder(s)

and/or (where the context permits) any additional and/or substitute account(s) opened with you at a later date for

the deposit or holding of all or part of the money or interest subject to this security (i) whether such money has been

deposited or paid (if the undersigned are more than one) on behalf of all of us or any of us jointly with another or

others of us and (ii) whether any such account is opened in the name of all or any of us or in your name or otherwise.

SIGNED as a deed by the above named

In the presence of Signature of Witness

Name of Witness

Address

Occupation

SIGNED as a deed by the above named

In the presence of Signature of Witness

Name of Witness

Address

Occupation

Barclays Bank UK PLC. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (Financial Services

Register No. 759676). Registered in England. Registered No. 9740322. Registered Office: 1 Churchill Place, London E14 5HP.

Item Ref: 9912793A_UK Sol. 05/18

WARNING – This security covers the liabilities of somebody else. If they do not repay, you may lose

some or all of the money charged. You ARE REQUIRED to seek independent legal advice before signing.

BAR_9912793A_UK.indd 3 04/05/2018 08:49