PRUDENT

DEVELOPMENT

Realizing the Potential of North America’s Abundant

Natural Gas and Oil Resources

National Petroleum Council • 2011

PRUDENT

DEVELOPMENT

Realizing the Potential of North America’s Abundant

Natural Gas and Oil Resources

A report of the National Petroleum Council

September 2011

Committee on Resource Development

James T. Hackett, Chair

NATIONAL PETROLEUM COUNCIL

David J. O’Reilly, Chair

Douglas L. Foshee, Vice Chair

Marshall W. Nichols, Executive Director

U.S. DEPARTMENT OF ENERGY

Steven Chu, Secretary

e National Petroleum Council is a federal

advisory committee to the Secretary of Energy.

e sole purpose of the National Petroleum Council

is to advise, inform, and make recommendations

to the Secretary of Energy on any matter

requested by the Secretary

relating to oil and natural gas

or to the oil and gas industries.

All Rights Reserved

Library of Congress Control Number: 2011944162

© National Petroleum Council 2011

Printed in the United States of America

e text and graphics herein may be reproduced

in any format or medium, provided they are reproduced accurately,

not used in a misleading context, and bear acknowledgement of

the National Petroleum Council’s copyright

and the title of this report.

OUTLINE OF REPORT MATERIALS i

Summary Report Volume (also available

online at www.npc.org)

y Report Transmittal Letter to the

Secretary of Energy

y Outline of Report Materials

y Preface

y Executive Summary

y Study Request Letters

y Description of the National Petroleum Council

y Roster of the National Petroleum Council

Full Report Volume (printed and available

online at www.npc.org)

y Outline of Full Report (see below)

Additional Study Materials (available online

at www.npc.org)

y Summary and Full Report (pdfs with hyperlinks)

y Report Slide Presentations

y Webcasts of NPC Report Approval Meeting and

Press Conference

y Study Topic and White Papers (see page vi for list)

y Study Survey Data Aggregations

Outline of Full Report

Preface

Executive Summary

America’s Energy Future

Core Strategies

Support Prudent Natural Gas and Oil Resource Development and Regulation

Better Reect Environmental Impacts in Markets and Fuel/Technology Choices

Enhance the Ecient Use of Energy

Enhance the Regulation of Markets

Support the Development of Intellectual Capital and a Skilled Workforce

Conclusions

Outline of Report

Materials

ii PRUDENT DEVELOPMENT: Realizing the Potential of North America’s Abundant Natural Gas and Oil Resources

Chapter One: Crude Oil and Natural Gas Resources and Supply

Abstract

Introduction and Summary

Summaries and Key Findings

Summary of Scope and Objectives

Summary of Methodology

North American Oil and Natural Gas Resource Endowment

Hydrocarbon Resource Assessment Uses and Denitions

Overview of Recent and Current North American Oil and Gas Resource Assessments

Key Findings and Observations

Analysis of Resource and Production Outlooks and Studies

Overview

Crude Oil

Natural Gas

Prospects for North American Oil Development

Overview

Oshore

Arctic

Onshore Oil

Unconventional Oil

Crude Oil Pipeline Infrastructure

Prospects for North American Gas Development

Overview

Oshore

Arctic

Onshore Gas

Natural Gas Infrastructure

North American Oil and Gas Production Prospects to 2050

Chapter Two: Operations and Environment

Abstract

Introduction and Summary

Environmental Challenges

Prudent Development

Major Findings: Assuring Prudent Development

Chapter Organization

Resource Play Variations and Associated Environmental Challenges

Overview of the Life Cycle of Natural Gas and Oil Exploration and Production

Developing Onshore Conventional Natural Gas and Oil Resources

OUTLINE OF REPORT MATERIALS iii

Developing Oshore Conventional Natural Gas and Oil Resources

Developing Unconventional Natural Gas and Oil Resources

History of Innovation in Environmental Stewardship

Onshore Development of Natural Gas and Oil

Oshore Development of Natural Gas and Oil

Future Expectations

History of Natural Gas and Oil Environmental Laws

Prior to 1935

Initiation of Natural Gas and Oil Conservation

U.S. Oil Production Dominance

Environmental Movement

Environmental Regulation Renement

Sustainable Strategies and Systems for the Continued Prudent Development of

North American Natural Gas and Oil

Life-Cycle Assessments and Footprint Analyses

Environmental Management Systems

Public-Private Partnerships

Data Management Systems

Oshore Safety and Environmental Management

Center for Oshore Safety

Outer Continental Shelf Safety Oversight Board

Regulatory Framework on the Outer Continental Shelf

Lease Sale Planning Process

Coastal Marine Spatial Planning

Consideration of Studies on the Deepwater Horizon Incident

Oshore Operations and Environmental Management Findings

Key Findings and Policy Recommendations

Key Findings

Denitions of Sustainable Development

Chapter ree: Natural Gas Demand

Abstract

Summary

Back to the Future: Two Decades of Natural Gas Studies

Range of U.S. and Canadian Natural Gas Demand Projections

Potential U.S. and Canadian Total Natural Gas Requirements

Compared to Natural Gas Supply

U.S. Power Generation Natural Gas Demand

Natural Gas Demand Summary

Drivers of Power Generation Natural Gas Demand

iv PRUDENT DEVELOPMENT: Realizing the Potential of North America’s Abundant Natural Gas and Oil Resources

Power Generation Natural Gas Demand Projections

Harmonization of U.S. Natural Gas and Power Markets

U.S. Residential and Commercial Natural Gas, Distillate, and Electricity Demand

U.S. Residential Energy

U.S. Industrial Natural Gas and Electricity Demand

Industrial Natural Gas Demand

Industrial Electricity Demand

U.S. Transmission Natural Gas Demand

U.S. Transmission Natural Gas Demand

Other Transmission Issues

Full Fuel Cycle Analysis

Canadian Natural Gas and Electricity Demand

Canadian Natural Gas Demand

Canadian Residential Natural Gas and Electricity Demand

Canadian Commercial Natural Gas and Electricity Demand

Canadian Industrial Natural Gas and Electricity Demand

Canadian Power Generation Demand

A View on 2050 Natural Gas Demand

Potential Vehicle Natural Gas and Electricity Demand

NGV Natural Gas Demand

PEV Electricity Demand

Total Potential Natural Gas Demand for Vehicles

LNG Exports

Exports to Mexico

U.S. Liquids Demand

Policy Recommendations

Increase Energy Eciency

Promote Ecient and Reliable Energy Markets

Increase Eectiveness of Energy Policies

Support Carbon Capture and Sequestration Research and Development

Description of Projection Cases

Chapter Four: Carbon and Other Emissions in the End-Use Sectors

Abstract

Summary

Emissions Baseline and Projections

Summary of Findings

Greenhouse Gas Emissions: Unconstrained Cases

Greenhouse Gas Emissions: Constrained Scenarios

Sulfur Dioxide, Nitrogen Oxides, and Mercury

OUTLINE OF REPORT MATERIALS v

Life-Cycle Emissions of Natural Gas and Coal in Power Generation

Life-Cycle Analysis of Natural Gas and Coal in Power Generation

Other LCA Studies

Methane Reduction Programs and Technologies

Conclusions

Recommendations

Natural Gas End-Use Technologies

Methodology

Findings

Impact of Non-GHG EPA Rules on the Power Sector

Retirement Decision

Methodology

Results

Intra-Study emes

Other Considerations

Limitations

Policy Considerations

Methodology

Findings

Evaluation of Policy Options and Frameworks

Recommendations

Chapter Five: Macroeconomics

Abstract

Summary

Macroeconomic Impacts of the Natural Gas and Oil Industry on the Domestic Economy

Related Industries

Taxes and the Natural Gas and Oil Industry

Federal Corporate Income Taxes

Severance Taxes

Royalties

Other Taxes Generated Directly by the Industry

Tax Deductions for the Natural Gas and Oil Industry

Natural Gas and Oil Workforce Challenges

Challenge #1 – Aging Natural Gas and Oil Workforce

Challenge #2 – Long Decline in University-Level Population Seeking

Natural Gas and Oil Careers

Challenge #3 – e U.S. Need for Increased Investment in

K-12 Mathematics and Science Education

Responding to the Workforce Challenges

vi PRUDENT DEVELOPMENT: Realizing the Potential of North America’s Abundant Natural Gas and Oil Resources

Natural Gas and Crude Oil Volatility Impacts on Producers and Consumers

Commodity Price Volatility

Background: Commodity Prices

Macroeconomic Impacts of Changing Commodity Prices

Energy Sector-Specic Impacts of Changing Commodity Prices

Impacts on Volatility

Assessing the Business Model of the Natural Gas and Oil Industry

Company Roles within the Unconventional Natural Gas Business

How the Business Model Works: Process of Unconventional Development

International Unconventional: Will It Work?

Implications of the Shift to an Unconventional Natural Gas Business Model

e U.S. Government’s Role in the Business Model for Unconventional Gas Development

Governing Principles for the Government

e Government’s Choice of Tools to Employ in the Natural Gas and Oil Industry

Business Model

Bibliography

Appendices

Appendix A: Request Letters and Description of the NPC

Appendix B: Study Group Rosters

Appendix C: Additional Materials Available Electronically

Acronyms and Abbreviations

Conversion Factors

List of Study Topic and White Papers

Resource & Supply Task Group

Subgroup Topic Papers

Paper #1-1: Oil and Gas Geologic Endowment

Paper #1-2: Data and Studies Evaluation

Paper #1-3: Oshore Oil and Gas Supply

Paper #1-4: Arctic Oil and Gas

Paper #1-5: Onshore Conventional Oil Including EOR

Paper #1-6: Unconventional Oil

Paper #1-7: Crude Oil Infrastructure

Paper #1-8: Onshore Natural Gas

Paper #1-9: Natural Gas Infrastructure

Task Group White Papers

Paper #1-10: Liqueed Natural Gas (LNG)

Paper #1-11: Methane Hydrates

OUTLINE OF REPORT MATERIALS vii

Paper #1-12: Mexico Oil & Gas Supply

Paper #1-13: Natural Gas Liquids (NGLs)

Operations & Environment Task Group

Environmental & Regulatory Subgroup Topic Papers

Paper #2-1: Water/Energy Nexus

Paper #2-2: Regulatory Framework

Paper #2-3: U.S. Oil and Gas Environmental Regulatory Process Overview

Paper #2-4: U.S. Environmental Regulatory and Permitting Processes

Paper #2-5: Canadian and Provincial Permitting and Environmental Processes

Paper # 2-6: Evolving Regulatory Framework

Oshore Operations Subgroup Topic Papers

Paper #2-7: Safe and Sustainable Oshore Operations

Paper #2-8: Oshore Environmental Footprints and Regulatory Reviews

Paper #2-9: Oshore Environmental Management of Seismic and Other Geophysical

Exploration Work

Paper #2-10: Oshore Production Facilities and Pipelines, Including Arctic Platform Designs

Paper #2-11: Subsea Drilling, Well Operations and Completions

Paper #2-12: Oshore Transportation

Paper #2-13: Oshore Well Control Management and Response

Paper #2-14: Oshore Data Management

Technology Subgroups Topic Papers

Paper #2-15: Air Emissions Management

Paper #2-16: Biodiversity Management and Technology

Paper #2-17: Management of Produced Water from Oil and Gas Wells

Paper #2-18: Oil Production Technology

Paper #2-19: Natural Gas Pipelines Challenges

Paper #2-20: Regulatory Data Management

Paper #2-21: Research, Development and Technology Transfer

Paper #2-22: Siting and Interim Reclamation

Paper #2-23: Sustainable Drilling of Onshore Oil and Gas Wells

Paper #2-24: Waste Management

Paper #2-25: Plugging and Abandonment of Oil and Gas Wells

Onshore Operations Subgroup

Paper #2-26: Life Cycle of Onshore Oil and Gas Operations

Paper #2-27: North American Oil and Gas Play Types

Task Group White Papers

Paper #2-28: Environmental Footprint Analysis Framework

Paper #2-29: Hydraulic Fracturing: Technology and Practices Addressing Hydraulic Fracturing

and Completions

viii PRUDENT DEVELOPMENT: Realizing the Potential of North America’s Abundant Natural Gas and Oil Resources

Demand Task Group

Subgroup Topic Papers

Paper #3-1: Power Generation Natural Gas Demand

Paper #3-2: Residential and Commercial Natural Gas and Electricity Demand

Paper #3-3: Industrial Natural Gas and Electricity Demand

Paper #3-4: Transmission Natural Gas Demand

Task Group White Papers

Paper #3-5: What Past Studies Missed

Paper #3-6: Natural Gas Exports to Mexico

Paper #3-7: Liquids Demand

Carbon and Other End-Use Emissions Subgroup

Subgroup Topic Papers

Paper #4-1: Baseline and Projections of Emissions from End-Use Sectors

Paper # 4-1a: Addendum: GHG Constrained Cases

Paper #4-2: Life-Cycle Emissions of Natural Gas and Coal in the Power Sector

Paper #4-3: Natural Gas End-Use GHG Reduction Technologies

Paper #4-4: Impact of EPA Regulations on the Power Sector

Paper #4-5: Policy Options for Deployment of Natural Gas End-Use GHG Reduction

Technologies

Macroeconomic Subgroup

Subgroup Topic Papers

Paper #5-1: Macroeconomic Impacts of the Domestic Oil & Gas Industry

Paper #5-2: Commodity Price Volatility

Paper #5-3: U.S. Oil & Gas Industry Business Models

PREFACE 1

studies on two topics: (1) Future Transportation

Fuels; and (2) Prudent Development of North Ameri-

can Natural Gas and Oil Resources. e Secretary

stated that the Council is uniquely positioned to pro-

vide advice to the Department of Energy on these

important topics.

In the Fuels Study request, Secretary Chu asked

the Council to “conduct a study which would analyze

U.S. fuels prospects through 2030 for auto, truck, air,

rail, and waterborne transport,” with advice sought

on “policy options and pathways for integrating

new fuels and vehicles into the marketplace includ-

ing infrastructure development.” Expanding on his

September 2009 request, in a supplemental letter

dated April 30, 2010, Secretary Chu further asked

that the Fuels Study examine actions industry and

government could take to stimulate the technologi-

cal advances and market conditions needed to reduce

life-cycle greenhouse gas emissions in the U.S. trans-

portation sector by 50% by 2050, relative to 2005

levels, while enhancing the nation’s energy security

and economic prosperity. at study is now under-

way, with an anticipated completion in the rst half

of 2012.

is North American Resources Study report is

the Council’s response to the second study request,

in which Secretary Chu asked the NPC to “reassess

the North American natural gas and oil resources

supply chain and infrastructure potential, and the

contribution that natural gas can make in a transition

to a lower carbon fuel mix.” He further expressed his

interest in “advice on policy options that would allow

prudent development of North American natural

gas and oil resources consistent with government

objectives of environmental protection, economic

growth, and national security.” In his supplemental

letter of April 2010, Secretary Chu stated: “the

NatioNal Petroleum CouNCil

e National Petroleum Council (NPC) is an organiza-

tion whose sole purpose is to provide advice to the fed-

eral government. At President Harry Truman’s request,

this federally chartered and privately funded advisory

group was established by the Secretary of the Interior

in 1946 to represent the oil and natural gas industry’s

views to the federal government: advising, inform-

ing, and recommending policy options. During World

War II, under President Franklin Roosevelt, the federal

government and the Petroleum Industry War Council

worked closely together to mobilize the oil supplies that

fueled the Allied victory. President Truman’s goal was

to continue that successful cooperation in the uncertain

postwar years. Today, the NPC is chartered by the Sec-

retary of Energy under the Federal Advisory Committee

Act of 1972, and the views represented are considerably

broader than those of the oil and natural gas industry.

About 200 in number, Council members are ap-

pointed by the Energy Secretary to assure well-

balanced representation from all segments of the

oil and natural gas industry, from all sections of

the country, and from large and small companies.

Members are also appointed from outside the oil and

natural gas industry, representing related interests

such as states, Native Americans, and academic,

nancial, research, and public-interest organizations

and institutions. e Council provides a forum

for informed dialogue on issues involving energy,

security, the economy, and the environment of an

ever-changing world.

Study requeSt

By letter dated September 16, 2009, Secretary of

Energy Steven Chu requested the NPC to conduct

Preface

2 PRUDENT DEVELOPMENT: Realizing the Potential of North America’s Abundant Natural Gas and Oil Resources

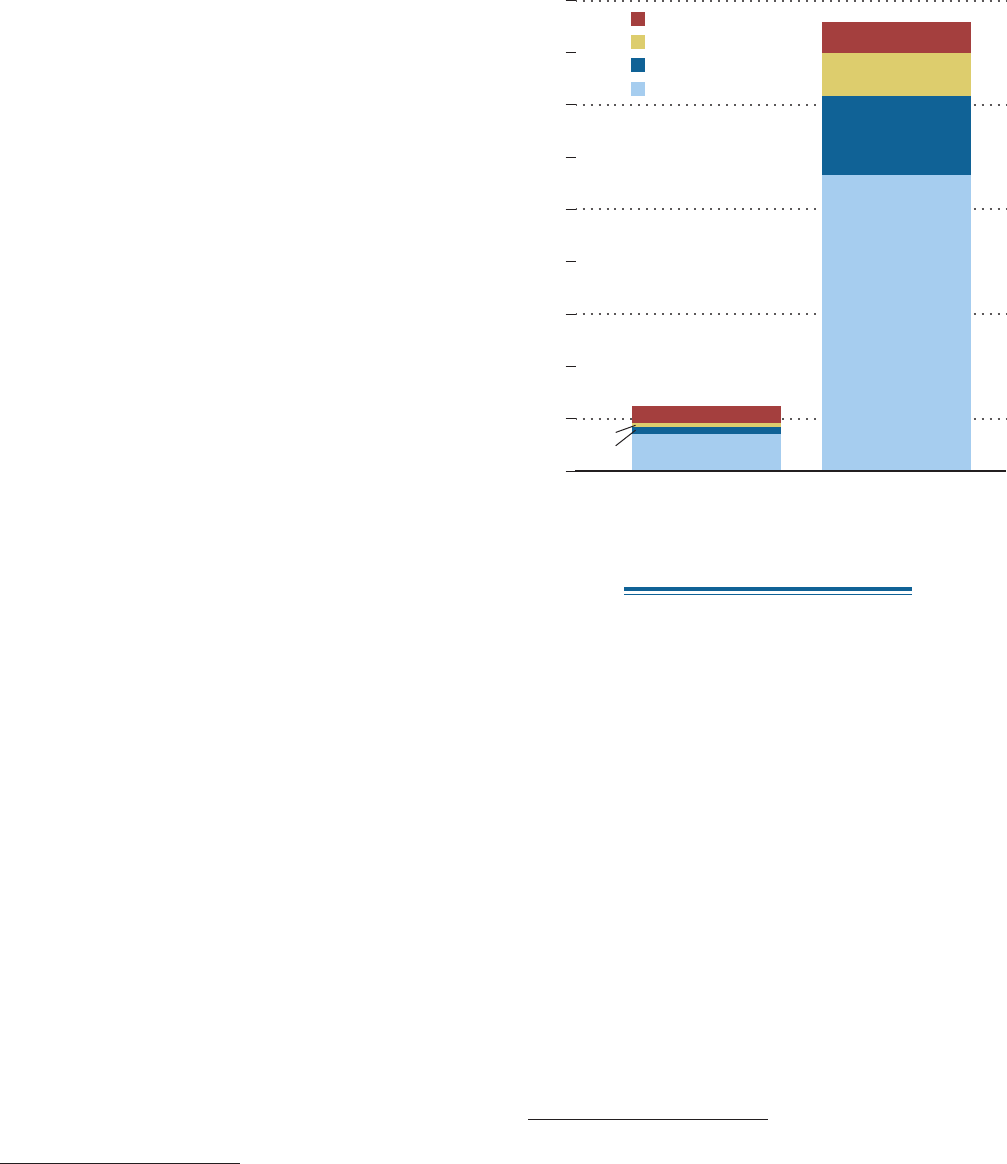

Subgroups focused on specic subject areas. Figure1

provides an organization chart for the study and

Table1 lists those who served as leaders of the groups

that conducted the study’s analyses.

e members of the various study groups were

drawn from NPC members’ organizations as well as

from many other industries, state and federal agen-

cies, environmental nongovernmental organiza-

tions (NGOs), other public interest groups, nancial

institutions, consultancies, academia, and research

groups. More than 400 people served on the study’s

Committee, Subcommittee, Task Groups, and Sub-

groups and while all have relevant expertise for the

study, fewer than 50% work for natural gas and oil

companies. Appendix B contains rosters of these

study groups and Figure 2 depicts the diversity of par-

ticipation in the study process. In addition to these

study group participants, many more people were

involved through outreach activities. ese eorts

were an integral part of the study with the goal of

informing and soliciting input from an informed

range of interested parties.

Study group and outreach participants contrib-

uted in a variety of ways, ranging from full-time

work in multiple study areas, to involvement on a

United States sees a future in which valuable

domestic energy resources are responsibly produced

to meet the needs of American energy consumers

consistent with national, environmental, economic

and energy security goals, … [and the United States]

has the opportunity to demonstrate global leadership

in technological and environmental innovation.

Accordingly, I request the Council’s advice on potential

technology and policy actions capable of achieving

this vision.” Appendix A contains full copies of both

letters from the Secretary.

Study orgaNizatioN

In response to the Secretary’s requests, the Council

established a Committee on Resource Development

to study this topic and to supervise preparation of a

draft report for the Council’s consideration. e Com-

mittee leadership consisted of a Chair, Government

Cochair, and four subject-area Vice Chairs. e Coun-

cil also established a Coordinating Subcommittee,

three Task Groups, and three Coordinating Subcom-

mittee level analytical Subgroups to assist the Com-

mittee in conducting the study. ese study groups

were aided by four Coordinating Subcommittee level

support Subgroups and twenty-one Task Group-level

Figure P-1. Structure of the North American Resource and Development Study Team

COORDINATING SUBCOMMITTEE

COMMITTEE ON RESOURCE DEVELOPMENT

ANTITRUST

ADVISORY

SUBGROUP

REPORT

WRITING

SUBGROUP

INTEGRATION

SUBGROUP

MACROECONOMIC

SUBGROUP

END-USE EMISSIONS

AND CARBON

REGULATION SUBGROUP

POLICY

SUBGROUP

RESOURCE & SUPPLY

TASK GROUP

OPERATIONS & ENVIRONMENT

TASK GROUP

DEMAND

TASK GROUP

Figure 1. Structure of the North American Resource Development Study Team

PREFACE 3

lation of data and other information, they did not take

positions on the study’s policy recommendations. As a

federally appointed and chartered advisory commit-

tee, the NPC is solely responsible for the nal advice

provided to the Secretary of Energy. However, the

Council believes that the broad and diverse study

group and outreach participation has informed and

specic topic, to reviewing proposed materials, or to

participating solely in an outreach session. Involve-

ment in these activities should not be construed as

endorsement or agreement with all the statements,

ndings, and recommendations in this report. Addi-

tionally, while U.S. government participants provided

signicant assistance in the identication and compi-

Chair – Committee

James T. Hackett

Chairman and Chief Executive Ocer

Anadarko Petroleum Company

Chair – Coordinating Subcommittee

D. Clay Bretches

Vice President, E&P Services and Minerals

Anadarko Petroleum Company

Government Cochair – Committee

Daniel P. Poneman

Deputy Secretary of Energy

U.S. Department of Energy

Government Cochair – Coordinating Subcommittee

Christopher A. Smith

Deputy Assistant Secretary for Oil and Natural Gas

U.S. Department of Energy

Vice Chair – Resource & Supply

Marvin E. Odum

President

Shell Oil Company

Chair – Resource & Supply Task Group

Andrew J. Slaughter

Business Environment Advisor – Upstream Americas

Shell Exploration & Production Company

Vice Chair – Operations & Environment

Aubrey K. McClendon

Chairman of the Board and Chief Executive Ocer

Chesapeake Energy Corporation

Chair – Operations & Environment Task Group

Paul D. Hagemeier

Vice President, Regulatory Compliance

Chesapeake Energy Corporation

Vice Chair – Demand

Daniel H. Yergin

Chairman

IHS Cambridge Energy Research Associates, Inc.

Chair – Demand Task Group

Kenneth L. Yeasting

Senior Director, Global Gas and North America Gas

IHS Cambridge Energy Research Associates, Inc.

Vice Chair – Policy

Philip R. Sharp

President

Resources for the Future

Chair – Policy Subgroup

Susan F. Tierney

Managing Principal

Analysis Group, Inc.

Chair – End-Use Emissions & Carbon Subgroup

Fiji C. George

Carbon Strategies Director

El Paso Corporation

Chair – Macroeconomic Subgroup

Christopher L. Conoscenti

Exective Director, Energy Investment Banking

J.P. Morgan Securities LLC

Table 1. North American Resource Development Study Leaders

4 PRUDENT DEVELOPMENT: Realizing the Potential of North America’s Abundant Natural Gas and Oil Resources

4. Consider the evolutionary path of technology and

the ability of the United States to demonstrate

technological leadership.

5. Develop policy recommendations following and

deriving from the development of facts.

6. Provide and adhere to clear objectives and a

detailed scope of work.

7. Set clear expectations for study participants –

commitment level and duration.

8. Communicate regularly with leadership, team

members, and external stakeholders.

As part of providing a broad review of current

knowledge, the study groups examined available

analyses on North American oil and gas resources,

supply, demand, and industry operations. e main

focus of the analysis review was on the United States

and Canada, as both countries are very large oil and

natural gas producers and both have very large future

supply potential in those resources. Mexico is geo-

graphically part of North America and is recognized

as an important crude oil supplier to the United

States as well as a current importer of approximately

1billion cubic feet per day of natural gas. ese link-

ages are discussed in more detail in the Demand and

Resources and Supply chapters. e study team did

not, however, attempt to undertake an in-depth

review of future resources and supply potential from

Mexico.

e varied analyses reviewed during the study

included those produced by the Energy Information

Administration, International Energy Agency, and

National Energy Board of Canada, among others. In

addition, the study incorporated the January 2011

Report of the Presidential Oil Spill Commission, the

National Academy of Engineering Macondo Study, the

(as then incomplete) Joint Investigation Teamstudy

by the Bureau of Ocean Energy Management (BOEM)

and U.S. Coast Guard, and other studies.

e NPC also conducted a broad survey of propri-

etary energy outlooks. As an integral part of this pro-

cess, the public accounting rm Argy, Wiltse & Rob-

inson, P.C. received, aggregated, and protected the

proprietary data responses.

Using these datasets, both public and private, the

study groups organized the material to compare and

contrast the views through 2050, the period selected

in the request from Secretary Chu. Most of the

enhanced its study and advice. e Council is very

appreciative of the commitment and contributions

from all who participated in the process.

Study aPProaCh

A central goal of the study was to fully comply with

all regulations and laws that cover a project of this

type. For that reason, every eort was made to con-

form to all antitrust laws and provisions as well as

the Federal Advisory Committee Act. As part of this

compliance eort, this study does not include a direct

evaluation of commodity prices despite the extremely

important role these play in balancing supply and

demand.

After careful thought, the Council decided upon the

following principles to guide the study:

1. Identify and involve a broad and diverse set of

interests to participate in the study.

2. Utilize consensus-based leadership to produce the

best results.

3. Provide a broad review of current research and

conduct new studies only as needed.

>400 PARTICIPANTS; >50% PARTICIPANTS FROM OUTSIDE

THE OIL AND GAS INDUSTRY

Figure P-2. Study Participant Diversity

ACADEMIA AND PROFESSIONAL SOCIETIES

OIL AND GAS

INDUSTRY

GOV'T –

FEDERAL

AND STATE

NGOs

END

USERS

CONSULTANT/

FINANCIAL/

LEGAL

Figure 2. Study Participant Diversity

PREFACE 5

review this Integrated Report and supporting details

in dierent levels of detail, the report is organized in

multiple layers as follows:

y Executive Summary is the rst layer and pro-

vides a broad overview of the study’s princi-

pal ndings and resulting policy recommen-

dations. It describes the signicant increases

in estimates of recoverable natural gas and oil

resources and the contributions they can make to

the nation’s economic, security, and environmental

well-being if properly produced and transported.

y Report Chapters provide a more detailed discussion

of the data, analyses, and additional background

on the ndings. ese individual chapters of the

Integrated Report are titled by subject area – i.e.,

Demand, Macroeconomics, etc. ese chapters pro-

vide supporting data and analyses for the ndings

and recommendations presented in the Executive

Summary.

y Appendices are at the end of the Integrated Report

to provide important background material, such as

Secretary Chu’s request letters; rosters of the Coun-

cil and study groups’ membership; and descriptions

of additional study materials available electroni-

cally. Also included are conversion factors used by

all study groups in the creation of the report, as

well as a list of acronyms and abbreviations.

y Topic and White Papers provide a nal level of detail

for the reader. ese papers, developed by or for

the study’s Task Groups and Subgroups, formed

the base for the understanding of each study seg-

ment, such as Onshore Gas and Industrial Demand,

and were heavily utilized in the development of the

chapters of the Integrated Report. A list of short

abstracts of these papers appears in Appendix C

and the full papers can be viewed and downloaded

from the NPC website (http://www.npc.org).

e Council believes that these materials will be of

interest to the readers of the report and will help

them better understand the results. e members

of the NPC were not asked to endorse or approve

all of the statements and conclusions contained in

these documents but, rather, to approve the publi-

cation of these materials as part of the study pro-

cess. e papers were reviewed by the Task Groups

and Subgroups but are essentially stand-alone anal-

yses of the studies used by each group. As such,

statements and suggested ndings that appear in

these papers are not endorsed by the NPC unless

they were incorporated into the Integrated Report.

outlooks evaluated, however, extended only through

2035 and a number ended before that date. For that

reason, the material framing many aspects of the

study for the 15 years between 2036 and 2050 are

more qualitative than quantitative in nature.

To avoid overlap and leverage resources, both the

Fuels Study and North American Resources Study

teams created Integration Subgroups to coordinate

work within and between the two parallel projects.

e Resources Study thus evaluated the petroleum

resource base and the infrastructure necessary to

bring petroleum to the renery while the Fuels Study

focused on renery capacity, upgrading, and down-

stream infrastructure. e Fuels Study also exam-

ined the demand for petroleum motor transportation

fuels as well as natural gas demand for transporta-

tion. With regard to the latter, the Resources Study

received access to the Fuels Study’s initial view on

high potential natural gas vehicle demand and the

eect of electric vehicles on natural gas consumption,

but the Resource Study advanced timeline did not

allow for inclusion of the nal Fuels Study analysis in

these areas. By addressing these potential overlaps

and establishing rm means of communication, the

results of both studies were signicantly improved

and the time necessary for completing each of the

Council’s studies was shortened.

e Resources Study Task Groups and Subgroups

carefully evaluated the numerous studies available

within their respective areas using the grounded per-

spective resulting from their combined hundreds of

years of experience. ey determined the key drivers

for each outlook and developed a fact-based under-

standing of the key issues within demand and sup-

ply as well as end-use emissions, the economy and

prudent environmental operations. From this back-

ground, the Committee on Resource Development

brought important ndings to the attention of the

Council. ese ndings led to the creation of recom-

mendations on government policy that could favor-

ably aect the ability of natural gas to manage the

country’s “transition to a lower carbon fuel mix.”

Study rePort StruCture

In the interest of transparency and to help readers

better understand this study, the NPC is making the

study results and many of the documents developed

by the study groups available to all interested par-

ties. To provide interested parties with the ability to

6 PRUDENT DEVELOPMENT: Realizing the Potential of North America’s Abundant Natural Gas and Oil Resources

visit the site to download the entire report or indi-

vidual sections for free. Also, published copies of the

report can be purchased from the NPC.

e Integrated Report and the Topic and White

Papers are publicly available. ey may be individu-

ally downloaded from the NPC website (http://www.

npc.org). Readers are welcome and encouraged to

EXECUTIVE SUMMARY 7

energy and feedstocks required by America’s indus-

tries. What happens to natural gas supplies aects

all Americans.

Other events have detracted from these positive

developments. Consumers have been coping with

the eects of high petroleum prices. ere have been

tragic accidents, such as the Macondo oil spill in the

deepwater Gulf of Mexico and the natural gas pipe-

line explosion in San Bruno, California. Concerns

have been raised about the environmental impacts

of oil sands and shale gas extraction. Some are

questioning the industry’s ability to develop North

American oil and gas resources in an environmen-

tally acceptable and safe manner.

All this sets the context for this study, highlight-

ing the need to continue to develop America’s natu-

ral gas and oil resources in a manner that will balance

energy, economic, and environmental security needs

as part of a transition to a lower carbon energy mix.

In his letter asking the NPC to conduct this study,

the Secretary of Energy requested that the assess-

ment concentrate on two tasks: developing an up-

to-date understanding of the potential natural gas

and oil supply opportunities in North America

2

; and

examining the contribution that natural gas could

make in a transition to a lower carbon fuel mix. He

focused the NPC’s attention on interrelated national

objectives of enhancing the nation’s energy security

and economic competitiveness while minimizing

environmental impacts, including climate change.

He instructed the NPC to use a study process to

“venture beyond business-as-usual industry and

government assessments.”

2 This study generally focuses on resources in the United States

and Canada.

E

xtraordinary events have aected energy mar-

kets in the years since the National Petroleum

Council (NPC) reported on the Hard Truths

about energy in 2007.

1

at study concluded that

the world would need increased energy eciency

and all economic forms of energy supply. is is still

true today, but in the few years since then, signicant

technology advances have unlocked vast natural gas

and oil resources. e newly and greatly expanded

North American natural gas and oil resources are

already beneting our country economically and

increasing employment. Growing supplies of natural

gas have resulted in lower prices, helping to revital-

ize many U.S. industries and, in some parts of the

country, lower the cost of producing electricity. e

increased competitiveness of natural gas could lead

to greater use for power generation, helping to fur-

ther reduce emissions from electricity production.

Technological advances and the expansion of eco-

nomically recoverable natural gas and oil reserves

can substantially improve America’s energy security.

North America has also become much more inte-

grated in energy terms; Canada provides a quarter of

America’s total oil imports, almost double that of the

next largest source.

e great expansion of economically recoverable

natural gas is central to meeting America’s over-

all needs, as natural gas is one of the cornerstone

fuels on which the nation’s economy depends.

Natural gas provides a quarter of America’s over-

all energy and is used to generate a quarter of the

nation’s electricity. It provides the heat for 56 mil-

lion homes and apartments and delivers 35% of the

1 National Petroleum Council, Hard Truths: Facing the Hard

Truths about Energy, July 2007 (“Hard Truths”).

E S

8 PRUDENT DEVELOPMENT: Realizing the Potential of North America’s Abundant Natural Gas and Oil Resources

Fourth, realizing the benefits of natural gas and

oil depends on environmentally responsible devel-

opment. In order to realize the benets of these

larger natural gas and oil resources, safe, responsi-

ble, and environmentally acceptable production and

delivery must be ensured in all circumstances. Many

natural gas and oil companies are committed to such

goals and work hard to achieve them. e critical path

to sustained and expanded resource development in

North America includes eective regulation and a

commitment of industry and regulators to continuous

improvement in practices to eliminate or minimize

environmental risk. ese steps are necessary for pub-

lic trust. Recognizing that access to available resources

can be undermined by safety and environmental inci-

dents, all industry participants must continuously

improve their environmental, safety, and health prac-

tices, preserving the benets of greater access for the

industry, consumers, and all other stakeholders.

In making these core ndings, the NPC examined a

broad range of energy supply, demand, environmen-

tal, and technology outlooks through 2050. e study

participants addressed issues relating to public health,

safety, and environmental risks associated with natu-

ral gas and oil production and delivery practices, as

well as opportunities for natural gas to reduce emis-

sions from energy use. e NPC’s ndings and recom-

mendations are summarized below and explained in

detail in the report chapters.

1. NATURAL GAS IS A VERY ABUNDANT

RESOURCE

America’s natural gas resource base is enor-

mous. It offers significant, potentially trans-

formative benefits for the U.S. economy,

energy security, and the environment. anks

to the advances in the application of technol-

ogy pioneered in the United States and Canada,

North America has a large, economically acces-

sible natural gas resource base that includes

significant sources of unconventional gas such

as shale gas. is resource base could supply

over 100 years of demand at today’s consump-

tion rates. Natural gas, properly produced and

delivered, can play an important role in helping

the United States reduce its carbon and other

emissions. But these potentially transforma-

tive benefits cannot happen without access to

resource-rich basins and the consistent appli-

cation of responsible development practices.

AMERICA’S ENERGY FUTURE

is study came to four conclusions about natural

gas and oil. ese ndings can help guide the nation’s

actions.

First, the potential supply of North American

natural gas is far bigger than was thought even a

few years ago. As late as 2007, it was thought that

the United States would have to become increasingly

dependent on imported liqueed natural gas, owing

to what appeared to be a constrained domestic supply.

at is no longer the case. It is now understood that

the natural gas resource base is enormous and that its

development – if carried out in acceptable ways – is

potentially transformative for the American econ-

omy, energy security, and the environment, includ-

ing reduction of air emissions. ese resources have

the potential to meet even the highest projections of

demand reviewed by this study.

Second – and perhaps surprising to many –

America’s oil resources are also proving to be much

larger than previously thought. e North American

oil resource base oers substantial supply for decades

ahead and could help the United States reduce, but not

eliminate, its requirements and costs for oil imported

from outside of North America. e United States

and Canada together produce 4% more oil than Rus-

sia, the world’s largest producer. However, as Hard

Truths stated, “energy independence is not realistic

in the foreseeable future,” although economic and

energy security benets ow from reducing imports

through eciency and increasing domestic produc-

tion. Realizing the potential of oil, like natural gas, in

the future will depend on putting in place appropriate

access regimes that can allow sustained exploration

and development activity to take place in resource-

rich areas.

ird, we need these natural gas and oil resources

even as efficiency reduces energy demand and alter-

natives become more economically available on a

large scale. Even presuming that the United States

uses energy much more eciently, diversies its

energy mix, and transitions to a lower carbon fuel mix,

Americans will need natural gas and oil for much of

their energy requirements for the foreseeable future.

Moreover, the natural gas and oil industry is vital to

the U.S. economy, generating millions of high-paying

jobs and providing tax revenues to federal, state, and

local governments.

EXECUTIVE SUMMARY 9

decades at current or greatly expanded levels of use.

Figure ES-3 shows estimates of the wellhead devel-

opment cost from three estimates of future natural

gas resources derived from the recent Massachusetts

Institute of Technology (MIT) study

4

on natural gas,

along with low and high estimates of cumulative, total

demand from 2010 to 2035.

5

e wellhead develop-

ment cost, as estimated by the MIT study, should not

be read as an expected market price, since many fac-

tors determine the price to the consumer in competi-

tive markets. In the longer term, there are additional

potential major resources in Arctic and other oshore

4 MIT Energy Initiative, The Future of Natural Gas: An Inter-

disciplinary MIT Study, Massachusetts Institute of Tech-

nology, 2011 (MIT 2011 Gas Report). As presented on

Figure ES-3, the MIT “Mean Resource Case” shows the

mean resource estimate, based on 2007 technology levels;

the “Advanced Technology Case” shows the mean resource

estimate based on advanced technologies; and the “High

Resource Technology Case” shows the high resource estimate

using advanced technologies, as defined in that study.

5 Figure ES-3 also shows the range of cumulative natural gas

demand for 2010 through 2035. The range is based on the

NPC Demand Task Group estimate that North American nat-

ural gas demand for 2035 could range from 25 to 45 trillion

cubic feet per year, with a 2010 beginning point of 26 trillion

cubic feet per year.

e United States is now the number one natural

gas producer in the world and together with Canada

accounts for over 25% of global natural gas production

(Figure ES-1). While shale and other unconventional

gas resources are the new game changers, signicant

conventional resources are being produced in onshore

and oshore areas. Lower and less volatile prices for

natural gas in the past two years reect these new real-

ities, with benets for American consumers and the

nation’s competitive and strategic interests, including

the revitalization of several domestic industries.

New applications of technologies such as horizontal

drilling and hydraulic fracturing have brought about

this recent increase in natural gas production and

the reassessment of the size of the U.S. recoverable

natural gas resource base. Figure ES-2 shows how the

estimates of U.S. technically recoverable resources

have greatly increased over the past decade, with esti-

mates of recoverable shale gas being the most striking

reason for changes over the decade.

3

e natural gas

resource base could support supply for ve or more

3 Technically recoverable resources are resources that can be

produced using current technology, as defined by the Energy

Information Administration (EIA).

Figure ES-1. United States and Canada Are Among Leading Natural Gas Producers

Figure ES-1. United States and Canada Are Among Leading Natural Gas Producers

0

20

40

60

USA RUSSIA CANADA IRAN NORWAYQATAR CHINA ALGERIASAUDI

ARABIA

INDONESIA

Source: BP Statistical Review of World Energy.

BILLION CUBIC FEET PER DAY

10 PRUDENT DEVELOPMENT: Realizing the Potential of North America’s Abundant Natural Gas and Oil Resources

0

1,000

2,000

3,000

4,000

Figure ES-2. U.S. Natural Gas Technically Recoverable Resources Are Increasing

TRILLION CUBIC FEET

YEAR

Notes: Minerals Management Service (MMS) no longer exists; its functions are now administered by the Bureau of Ocean Energy Ma

nagement, Regulation and Enforcement (BOEMRE).

For a detailed discussion of the survey that the NPC used to prepare these “low,” “mid,” and “high” estimates, see the Preface as well as the Resources and Supply chapter.

1999 2000 2003 2004 2005 2006 2007 2008 2009 2010 2011

POTENTIAL GAS COMMITTEE

ENERGY INFORMATION ADMINISTRATION/

DEPARTMENT OF ENERGY/MINERALS MANAGEMENT SERVICE

NATIONAL PETROLEUM COUNCIL (NPC)

ICF INTERNATIONAL, INC.

MASSACHUSETTS INSTITUTE OF TECHNOLOGY

NPC SURVEY LOW

NPC SURVEY MID

NPC SURVEY HIGH

AMERICA’S NATURAL GAS ALLIANCE

INTERSTATE NATURAL GAS ASSOCIATION OF AMERICA

Figure ES-2. U.S. Natural Gas Technically Recoverable Resources Are Increasing

EXECUTIVE SUMMARY 11

around the world – ranging from China to Poland,

Ukraine, and South Africa – are now assessing their

own shale gas resources and development potential.

U.S. companies are playing an important role in these

activities.

Natural gas can also help the United States reduce

greenhouse gas

7

(GHG) and other air emissions in

the near term, especially if methane emissions from

gas production and delivery are reduced. e biggest

opportunity is in the power sector, but there are also

opportunities in the industrial, commercial, and resi-

dential sectors (Figure ES-4). In recent years, rela-

tively favorable prices for natural gas have displaced

some coal-red generation. More natural gas use will

likely result from the electric industry’s response to

upcoming federal environmental regulations that

may encourage retirement of some of the nation’s

coal-red power plants. In the long term, if the nation

7 The major GHG emissions of concern in this report are carbon

dioxide (CO

2

), nitrous oxide (N

2

O), and methane (CH

4

).

regions, or with advances in technology from meth-

ane hydrate deposits in various locations, mainly o-

shore. ese opportunities could allow natural gas to

continue to play a central role in the North American

energy economy into the next century.

Development of these natural gas resources will

require timely investment in the expansion of deliv-

ery infrastructure. To date, market signals and

existing regulatory structures have worked well in

bringing about new natural gas delivery and storage

infrastructure.

e technological success in the United States opens

up signicant new opportunities for global techno-

logical leadership and an expanded global role for

U.S. natural gas and oil companies.

6

Many countries

6 Unless specifically described in context below, the term “nat-

ural gas and oil companies” used in this report includes not

only exploration or production companies, but also service

companies that support drilling and operations, as well as

companies that transport oil and gas.

Figure ES-3. North American Natural Gas Resources Can Meet Decades of Demand

3

6

8

4

10

0 1,000 2,000 3,000

WELLHEAD DEVELOPMENT COST

(2007 DOLLARS PER MILLION CUBIC FEET)

Figure ES-3. North American Technically Recoverable Natural Gas Resources

RANGE OF

CUMULATIVE

DEMAND

2010–2035

TRILLION CUBIC FEET

MIT MEAN RESOURCE CASE

MIT ADVANCED TECHNOLOGY CASE

MIT HIGH RESOURCE TECHNOLOGY CASE

LOW

DEMAND

HIGH

DEMAND

Note: The y-axis represents estimated wellhead cost of supply. The cost of supply can vary over time and place in light of dierent

regulatory conditions, dierent technological developments and deployments, and other dierent technical conditions.

In none of these cases is “cost of supply” to be interpreted as an indicator of market prices or trends in market prices, since many

factors determine prices to consumers in competitive markets.

Source of MIT information: The Future of Natural Gas: An Interdisciplinary MIT Study, 2011.

12 PRUDENT DEVELOPMENT: Realizing the Potential of North America’s Abundant Natural Gas and Oil Resources

GHG REDUCTION POTENTIAL

DIFFICULTY OF IMPLEMENTATION

NATURAL GAS CARBON CAPTURE

AND SEQUESTRATION

NEW NATURAL GAS

POWER PLANTS

COMBINED HEAT & POWER

FUEL CELLS

INDUSTRIAL FUEL SWITCHING

REFUEL OR REPOWER EXISTING

COAL- OR OIL-FIRED PLANTS

Figure ES-4. Natural Gas Technologies Can Help Reduce Greenhouse Gas (GHG) Emissions

WAS Fig. ES-3

RESIDENTIAL/COMMERCIAL

APPLIANCES

LOW MEDIUM HIGH

MEDIUM HIGHLOW

DISPATCHING NATURAL GAS PLANTS

AHEAD OF COAL PLANTS

class resource basins, some of which are

located in remote areas offshore and in

the Arctic. Going forward, access to these

resources depends upon responsible develop-

ment practices being consistently deployed.

After declining in recent years, North American oil

production rose in 2009 and 2010 due to advances in

technology and signicant investment in exploration

and development by companies over a number of pre-

ceding years. As a result, the United States and Can-

ada have several already-producing world-class basins

– in particular in the deepwater Gulf of Mexico and

the Alberta oil sands. ese areas contribute substan-

tially to North American oil production, and could

sustain and grow current production beyond 2030.

In addition, onshore conventional oil is a large sup-

ply source, although made up of a multitude of small

developments. e long-term decline of production

from onshore conventional elds has reversed in

recent years through techniques such as enhanced oil

recovery (EOR) and hydraulic fracturing. e United

States is the third largest oil producer in the world,

after Russia and Saudi Arabia (Figure ES-5).

desires deeper reductions in GHG emissions, it will

need to address the GHG emissions of all fossil fuels,

including natural gas, by putting a price on carbon

8

and advancing other technologies, including those

that can capture and sequester carbon dioxide (CO

2

).

2. SURPRISINGLY, OIL IS ALSO AN

ABUNDANT RESOURCE

Contrary to conventional wisdom, the North

American oil resource base also could pro-

vide substantial supply for decades ahead.

rough technology leadership and sus-

tained investment, the United States and

Canada together now constitute the largest

oil producer in the world. We have world-

8 See http://www.ipcc.ch/pdf/assessment-report/ar4/wg3/

ar4-wg3-annex1.pdf. Generally, the term “price on carbon”

refers to an assessment of the negative externalities of GHG

emissions and the associated economic value of reducing or

avoiding one metric ton of GHG in carbon dioxide equivalent.

Discussions in this report do not differentiate between an

explicit carbon price (e.g., under a cap and trade or carbon tax

policy) and an implied carbon cost (e.g., specific regulatory

limitations on the amounts of emissions).

Figure ES-4. Natural Gas Technologies Can Help Reduce Greenhouse Gas Emissions

EXECUTIVE SUMMARY 13

strong production in the Gulf of Mexico. ird, new

Arctic oil and natural gas supply have a potential of

the equivalent of over 200 billion barrels of oil. is

is in addition to existing oil supply and proven natural

gas reserves on the Alaska North Slope. e new Arc-

tic resources could yield signicant supply after 2025.

Fourth, another very large long-term oil supply source

lies in the shale oil deposits of Colorado, Utah, and

Wyoming. e development of these billions of bar-

rels of oil from these new resource areas will require

sustained investment, substantial advances in tech-

nology, and environmental risk management systems

and approaches.

9

In many instances, there will be the

need for new pipelines and other infrastructure.

9 There are several trillion barrels of “oil-in-place.” How much

can be extracted will greatly depend on the technology and

economics.

Longer-term growth in oil production can come

from several new and emerging North American sup-

ply sources. One source is tight oil, found in geo-

logical formations where the oil does not easily ow

through the rock, such as in the Bakken formation of

North Dakota, Saskatchewan, Montana, and Mani-

toba. Tight oil has also beneted from technologies

similar to those used for shale gas, including hydrau-

lic fracturing. Over the next 20 years, tight oil pro-

duction could continue to grow. A second potentially

large supply source is in new oshore areas, particu-

larly in the Gulf of Mexico and the Atlantic and Pacic

coasts of the United States and Canada. Access to and

potential development of these new U.S. areas would

require an Executive Branch level directive to include

such areas in the 2012–2017 Leasing Program. New

oshore areas could provide both natural gas and oil

in signicant quantities to supplement the continuing

Foundational Concepts

Based on the request from the Secretary of

Energy, the NPC used four key concepts to evaluate

potential policy recommendations that arose in the

study: economic prosperity, environmental sustain-

ability, energy security, and prudent development.

“Economic prosperity” means not just the

level of wealth of a country, but also its economic

growth, economic security, and economic com-

petitiveness. is goal also includes the notion of

balancing the interests of today’s society against

those of tomorrow’s.

“Environmentally sustainable” means allowing

for the maintenance of environmental quality

and resource protection over time. Environmental

sustainability encompasses impacts such as air and

water pollution that directly aect public health, as

well as these and other impacts aecting ecosystem

vitality, biodiversity, habitat, forestry and sher-

ies’ health, agriculture, and the global climate. It is

related to the concept of sustainable development

as dened by the Brundtland Commission, formerly

known as the World Commission on Environment

and Development: “meeting the needs of the pres-

ent without compromising the ability of future gen-

erations to meet their own needs.”

“Energy security” means minimizing vulner-

ability to energy supply disruptions and the

resulting volatile and disruptive energy prices.

Since most of the U.S. energy supply is domestic,

energy security is aected by the development

of domestic resources, as well as the security of

delivery and production systems such as natural

gas pipelines, reneries, power plants, and elec-

tric power transmission. Likewise, as some of the

U.S. energy supply comes from other countries,

energy security also involves geopolitical consid-

erations associated with protecting and enhancing

U.S. strategic interests internationally. Potential

disrupters of energy security cover a range, among

which are turmoil in foreign supplier countries;

the disruption of a major supply source or delivery

infrastructure; assaults on the supply chain; natu-

ral disasters; and global environmental issues and

extreme weather events, as characterized by the

2010 Quadrennial Defense Review Report of the

U.S. Department of Defense.

e concept of “prudent development of

North American natural gas and oil resources”

means development, operations, and deliv-

ery systems that achieve a broadly acceptable

balance of several factors: economic growth,

environmental stewardship and sustainability,

energy security, and human health and safety.

Prudent development necessarily involves trade-

os among these factors. Consideration of the

distribution of costs and benets is a key part of

prudent development.

14 PRUDENT DEVELOPMENT: Realizing the Potential of North America’s Abundant Natural Gas and Oil Resources

substantial advances in technology, and regulatory

burdens that are not signicantly dierent than

today. Even under the high potential scenario, the

United States will still need to import oil for the fore-

seeable future.

Enhanced access is also a key enabler that could

move North American oil production towards the

higher potential pathway indicated here. Resource-

rich areas such as the eastern Gulf of Mexico, the

Atlantic and Pacic continental margins, and the Arc-

tic are capable of delivering new volumes of oil supply,

potentially extending over several decades. Indeed, in

the Arctic, unless new oil production can be developed

as a consequence of sustained exploration, the key

infrastructure link currently operating (the Trans-

Alaska Pipeline System from the Alaska North Slope

to the crude oil loading terminal at Valdez, Alaska)

will have to be decommissioned when the declines

from existing Alaska North Slope production cause

pipeline ows to fall below minimum operating levels.

Such an outcome could leave a huge resource stranded

with deleterious consequences for the economy and

for energy security.

Continuing signicant technological advances

could extend North American oil production for

many decades in various areas, such as other o-

shore areas, other unconventional oil opportunities,

and eventually, oil shale. In recent years, there has

been rapid learning and deployment of new produc-

tion techniques to unlock higher actual and potential

natural gas supply, particularly from tight and shale

gas reservoirs. Such learnings have not yet been fully

applied to new and emerging oil opportunities. As

the emerging oil opportunities develop both onshore

and oshore and with application of some of the

technologies now enabling access to unconventional

natural gas, similar upward re-appraisal of potential

oil supply will likely follow. Such appraisals are an

ongoing process as new resources are brought into

the development phase.

Figure ES-6 shows the various sources of current

supply as well as projected supply in 2035 under

“limited potential” and “high potential” scenarios.

e limited potential scenario is characterized by lim-

ited resource access, constrained technology develop-

ment, as well as greater regulatory barriers. e high

potential scenario is characterized by more access,

MILLION BARRELS PER DAY

0

4

8

12

RUSSIA SAUDI

ARABIA

USA IRAN CHINA CANADA MEXICO UNITED

ARAB

EMIRATES

IRAQVENEZUELA

Figure ES-5. United States and Canada Are among Leading Oil Producers

WAS Figure ES-4

Source: BP Statistical Review of World Energy.

Figure ES-5. United States and Canada Are Among Leading Oil Producers

EXECUTIVE SUMMARY 15

is current and future development of U.S. and

Canadian oil can translate into energy security ben-

ets through reducing oil imports. Other potential

benets include improved balance of trade, jobs, and

economic multiplier eects from domestic drilling,

production, and delivery.

3. AMERICA NEEDS NATURAL GAS AND

OIL EVEN AS ALTERNATIVE RESOURCES

BECOME AVAILABLE

Even as the United States uses energy much

more efficiently and diversifies its energy

mix, Americans will need natural gas and oil

for the foreseeable future. Natural gas can

enable renewable power through manage-

ment of intermittency. Natural gas and oil

are currently indispensable ingredients in the

American economy and Americans’ standard

of living. A vibrant domestic natural gas and

oil industry has the potential to add much-

needed domestic jobs and revenues for federal,

state, and local governments. In a competi-

tive global business environment, where com-

panies have the ability to move capital around

the world, a dependable and affordable supply

of natural gas and oil is important for creating

economic growth, investment, and jobs in the

United States. Abundant supplies of natural

gas are vital to improving the competitiveness

of domestic industries that use natural gas as a

fuel and feedstock. ough North America has

abundant natural gas and oil resources, these

resources must still be used wisely; and energy

efficiency measures should be developed and

implemented wherever they are cost effective.

Together, natural gas and oil make up nearly two-

thirds of U.S. energy use.

10

Even with increasing

energy eciency, buildings, motor vehicles, indus-

trial facilities, and other energy-using equipment

will remain highly dependent on natural gas and oil

10 EIA, Annual Energy Outlook 2011, Reference Case.

UNCONVENTIONAL OIL

{

}

0

10

20

2010 2035 LIMITED 2035 HIGH POTENTIAL

MILLION BARRELS PER DAY

Figure ES-6. More Resource Access and Technology Innovation Could Substantially Increase

North American Oil Production

ALSO used as Figure 1-5

Notes: The oil supply bars for 2035 represent the range of potential supply from each of the individual supply sources and types

considered in this study. The specic factors that may constrain or enable development and production can be dierent for

each supply type, but include such factors as whether access is enabled, infrastructure is developed, appropriate

technology research and development is sustained, an appropriate regulatory framework is in place, and environmental

performance is maintained.

Note that in 2010, oil demand for the U.S. and Canada combined was 22.45 million barrels per day. Thus, even in

the high potential scenario, 2035 supply is lower than 2010 demand, implying a continued need for oil imports

and participation in global trade.

Source: Historical data from Energy Information Administration and National Energy Board of Canada.

ONSHORE CONVENTIONAL

OFFSHORE

ARCTIC

NATURAL GAS LIQUIDS

OIL SANDS

TIGHT OIL

OIL SHALE

Figure ES-6. More Resource Access and Technology Innovation

Could Substantially Increase North American Oil Production

16 PRUDENT DEVELOPMENT: Realizing the Potential of North America’s Abundant Natural Gas and Oil Resources

in combined operational expenses and capital invest-

ment in 2009 – equivalent to over 3% of America’s gross

domestic product (GDP).

12

In the United States, federal,

state, and local governments also benet from the sub-

stantial amount of taxes and royalties paid by natural

gas and oil companies. Taking into account all corpo-

rate income taxes, severance taxes, royalties on federal

lands, sales taxes, payroll taxes, property and use taxes,

and excise taxes, natural gas and oil companies gener-

ate over $250 billion in government revenue annually.

Although natural gas and oil have long been viewed

as related fuels, their uses are quite dierent. Natural

gas is especially important for heating, power genera-

tion, and industrial uses such as chemical manufac-

turing. By contrast, around 97% of all energy used in

the transportation sector comes from oil. e import

picture diers as well. Nearly all of the natural gas con-

sumed in North America is produced within the same

continental boundaries, while about half of the crude

oil processed in North American reneries is imported.

Within North America, Canada is a net exporter of

crude oil and the United States is a net importer.

13

Low natural gas prices make U.S. manufacturers

and farmers more competitive. U.S. rms rely on nat-

ural gas- and oil-derived chemicals as building blocks

for the production of electronics (including comput-

ers and cell phones), plastics, medicines and medical

equipment, cleaning products, fertilizers, building

materials, adhesives, and clothing. When manufac-

turers use natural gas as a fuel and feedstock, they

create a variety of products that are used every day.

ese products are valued at greater than eight times

the cost of the natural gas used to create them, pro-

viding signicant benet to the nation’s economy.

14

12 PricewaterhouseCoopers, “The Economic Impacts of the

Oil and Natural Gas Industry on the U.S. Economy in 2009:

Employment, Labor Income, and Value Added,” May 2011.

13 In 2010, U.S. net crude oil imports were 9.1 million barrels

per day, which was about 62% of its total refinery crude oil

inputs. Canada, in contrast, is a net crude oil exporter, as it

imports crude oil into eastern Canadian refineries but exports

crude oil to the United States from western Canadian produc-

tion. On a net basis, Canada exports 1.4million barrels per

day, but its crude oil exports to the U.S. total 1.99 million bar-

rels/day, 22% of U.S. crude oil imports. So, for both coun-

tries together, net crude oil imports total 7.7 million barrels

per day, or about 47% of combined refinery crude oil runs.

Source: BP and EIA.

14 Based on information in the American Chemistry Coun-

cil, “Guide to the Business of Chemistry,” 2011; and Ameri-

can Chemistry Council, “Shale Gas and New Petrochemicals

Investment: Benefits for the Economy, Jobs, and US Manu-

facturing,” Economics & Statistics, March 2011.

for many years to come. us, these fuels are criti-

cal in the U.S. economy, particularly as part of a strat-

egy to transition towards a low-carbon energy mix in

the future. ere is enough supply to meet a range of

demand levels for decades – from business as usual,

to scenarios with much greater penetrations of natu-

ral gas in the power, industrial, and transportation

sectors. And, using these resources much more e-

ciently will strengthen the nation’s economic resil-

iency, reduce environmental impacts, and enhance

energy security. As noted in Hard Truths and other

studies, investment in and deployment of energy e-

ciency measures is frequently cost eective and will

reduce demands for fossil fuels and the impacts of

their associated emissions. Energy eciency deserves

continued and increased eorts.

11

At the same time, in meeting the needs of U.S. con-

sumers, the American natural gas and oil industry

plays an essential role in the U.S. economy. Compa-

nies directly engaged in the oil and natural gas indus-

try employ over 2 million Americans who earn over

$175 billion in labor income. e employment gure

jumps to over 9 million Americans with $533 billion in

labor income when including the jobs created by the

spending on goods and services of natural gas and oil

companies and their employees. PricewaterhouseCoo-

pers has estimated that the domestic oil and natural gas

industry directly generated approximately $464 billion

11 Hard Truths recommended that the United States moderate

demand by increasing energy efficiency through improved

vehicle fuel economy and by reducing energy consumption

in the residential and commercial sectors. Hard Truths con-

cluded that:

“… anticipated energy use in the residential and commercial

sectors could be reduced by roughly 15 to 20 percent through

deployment of cost-effective energy-efficiency measures that

use existing, commercially available technologies. Assuming

that all these measures are put in place over the next decades

and that all other factors such as level of services are held

constant, U.S. residential/commercial energy consumption

could be reduced by 7 to 9 quadrillion Btu. Technologies to

accomplish savings of these magnitudes are indicated to be

available in the marketplace.” (page 43)

“… a doubling of fuel economy of new cars and light trucks

by 2030 is possible through the use of existing and antici-

pated technologies, assuming vehicle performance and other

attributes remain the same as today…. Depending upon

how quickly new vehicle improvements are incorporated in

the on-road light duty vehicle fleet, U.S. oil demand would

be reduced by about 3-5 million barrels per day in 2030.

Additional fuel economy improvements would be possible

by reducing vehicle weight, horsepower, and amenities,

or by developing more expensive, step-out technologies.”

(pages 14-15)

EXECUTIVE SUMMARY 17

Observers of natural gas markets forecast a

wide range of future natural gas demand for

the United States and a narrower range for

Canada.

15

For the United States, most of the varia-

tion in natural gas demand comes from the power

sector; for Canada, it comes from the industrial

sector. Figure ES-7 shows demand in 2010, along

with several projections for 2020 and 2030.

16

Over

120 gigawatts (GW) of natural gas combined cycle

capacity was added from 2000 to 2008. e power

sector has already substituted the use of natural gas

for some coal because of low natural gas prices. e

increased use of these new and ecient natural gas

units decreased the GHG emissions from U.S. power

plants by about 83 million metric tons of CO

2

, or

15 The NPC assessed the numerous recent forecasts of demand

for U.S. and Canadian natural gas that exist in the public

domain. Additionally, the NPC studied a number of propri-

etary forecasts and conducted a survey. The study subgroups

also examined aggregated proprietary data collected via a con-

fidential survey of private organizations, primarily gas and oil

companies and specialized consulting groups. The propri-

etary data were collected by a third party and aggregated to

disguise individual responses.

16 The AEO cases are from the Annual Energy Outlook, prepared

by the EIA. The proprietary cases are aggregated third-party

forecasts.

about 1% of total U.S. emissions in 2005.

17

Com-

pared to 2000, natural gas use for power genera-

tion has grown by almost 45% from 2000 to 2010.

It is projected to increase as much as another 75%

by 2030.

18

e availability of abundant low cost natural gas is

helping to revitalize several industries, including pet-

rochemicals, leading to several billions of dollars of

new investment in domestic industrial operations that

would not have been anticipated half a decade ago.

Upcoming environmental regulations aecting

power plants, combined with expectations for future

natural gas prices informed by published forecasts, will

have an impact on the use of natural gas in the power

sector. Relatively old and inecient coal-red power

plants with limited emission controls will likely retire,

with various studies estimating retirements ranging

17 Based on EIA, U.S. Carbon Dioxide Emissions in 2009: A Retro-

spective Review, http://www.eia.doe.gov/oiaf/environment/

emissions/carbon/ and NPC analysis of EIA, Monthly Energy

Review, April 2011.

18 Compared to 2000, natural gas use for power generation has

grown from 14 billion cubic feet per day (Bcf/d) in 2000 to

20 Bcf/d in 2010, and is projected to be between 19 and

35 Bcf/d by 2030 (see Figure ES-7).

0

20

40

60

80

100

BILLION CUBIC FEET PER DAY

Figure ES-7. The Power Sector Shows the Most Variation in Projected U.S. Natural Gas Demand

WAS Figure ES-6, ALSO Figure 3-2

AEO

2010

AEO

2011

REFERENCE CASE

MAX. MED. MIN.

2030

PROPRIETARY

AEO

2010

AEO

2011

REFERENCE CASE

MAX. MED. MIN.

2020

PROPRIETARY

2010 2000

Notes: AEO2010 = EIA’s Annual Energy Outlook (2010); AEO2011 = EIA’s Annual Energy Outlook (2011).

DO NOT OVERWRITE 3-2 WITH THIS FIGURE -

SLIGHT DIFFERENCE IN NOTES @ BOTTOM

VEHICLE

TRANSMISSION

RESIDENTIAL

COMMERCIAL

INDUSTRIAL

POWER

Figure ES-7. The Power Sector Shows the Most Variation in Projected U.S. Natural GasDemand

18 PRUDENT DEVELOPMENT: Realizing the Potential of North America’s Abundant Natural Gas and Oil Resources

U.S. GHG emissions in 2009. ere is, however, a very

high degree of uncertainty around estimates of meth-

ane emissions and, therefore, better data are needed

while eorts continue to reduce such emissions.

Taking into account EPA’s recently revised esti-

mates of methane emissions during production and

delivery, the life-cycle emissions for natural gas are

about 35% lower than coal on a heat-content (British

thermal unit [Btu]) basis.

21

In terms of the production

of electricity, for eciencies typical of coal- and

natural gas-red plants, natural gas has about

50–60% lower GHG emissions than those of a coal-

red plant (Figure ES-9).

22

Beyond the power sector, there is potential for

increased use of natural gas to displace oil in the trans-

portation sector. e NPC Future Transportation

21 Life-cycle emissions include those from the direct combustion

of natural gas, as well as methane emissions from the produc-

tion and delivery of natural gas.

22 The natural gas combined cycle turbine unit has a heat rate of

7,000 Btu/kWh, while the coal plant at 30% efficiency has a

heat rate of 11,377 Btu/kWh and the coal plant at 38% effi-

ciency has a heat rate of 9,000 Btu/kWh.

from 12 to 101 GW of capacity by 2020. e study

average of 58 GW of coal-red capacity retirements

represents about 6% of total U.S. generating capacity,

or around 18% of coal-red capacity. is will likely

increase demand for natural gas at power plants, lead

to new investment in natural gas-red generation, and

lower GHG emissions from the power sector (on aver-