1

Direct Deposit Help

Using Payroll Direct Deposit is the safe, private, and convenient way to get paid, and it puts

you in control!

Note: Due to banking rules, your payment could be returned to the State of Michigan if your

deposit is directed to a foreign account. Contact your bank for questions about the status of

your bank account.

Table of Contents:

Hold the ‘Ctrl’ key and click the hyperlink to access each section

• Getting Started

o Adding Your First Direct Deposit

• Managing Your Direct Deposit

o Add Additional Direct Deposit Accounts

o Change a Deposit Amount

o Select a New Default Account

o Reorder Your Accounts

o Close (Delete) an Account

o Buy U.S. Savings Bonds

• Questions?

If you have questions or need help, please contact:

MI HR Service Center

Phone: (877) 766-6447

Fax: (517) 241-5892

Hours: 8:00am – 5:00pm (ET), Monday through Friday except State Holidays

Address: P.O. Box 30002

Lansing, MI 48909

House, Senate, Judicial or MEDC Corporate employees contact your HR Office

Getting Started

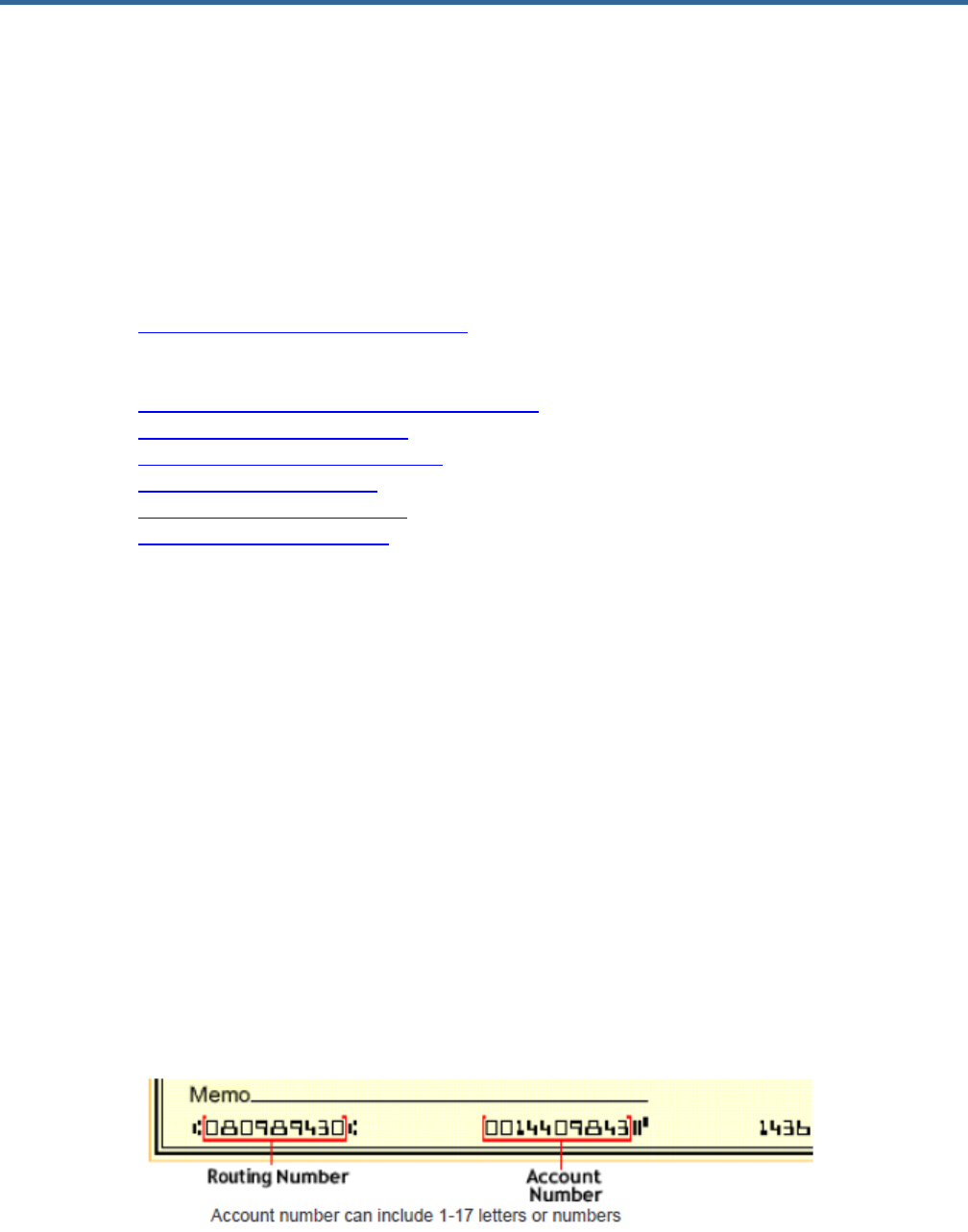

Three things you need to add a Direct Deposit Account:

• Bank Name or Routing Number

• Account Number

• Account Type: Checking or Savings

(Routing and checking account numbers are on your checks)

2

Adding Your First Direct Deposit

1. Log into your HR Self-Service Account

2. In the upper left-hand corner, click Bookmarks

3. Navigate to Employee Self-Service, Pay, and then Direct Deposit

4. Click the Add button

5. Read the authorization disclosure; click I agree, or I do not agree with this statement. If

you agree, it gives the same weight as your written signature. If you don’t agree, the

Direct Deposit process is cancelled. If you have already agreed to this during your

session, you will not receive this message a second time.

6. Enter the number of accounts you are prepared to add; you can add up to five active

direct deposits; click Continue

7. The first account you will add is your default account which is designated at 100%

8. To add an Account, complete the following fields:

3

a. Bank – Click the Search button on the right side of this field to open the dialog

box; search for your Routing Number or Bank by name and click the hyperlink to

select

b. Effective Date – Today’s date or any date going forward

c. Description – This is used for your personal reference and is limited to 8

characters

d. Account Type – Checking or Savings

e. Account Number

f. Amount - Percent of Net is automatically set at 100% when you only have one

account

9. Click Update

**REMEMBER**

o The first payroll processed by the State after the added date is for the

prenotification process

o Prenotification is when a test deposit is sent to your bank to ensure the routing

and bank account numbers are correct

o The payroll after the prenotification process your money will be deposited to your

account

o In order to revoke a default account, you should add another account first

Managing Your Direct Deposit Accounts

When managing your accounts, you can:

• Add Additional Direct Deposit Accounts

• Change a Deposit Amount

• Select a New Default Account

• Reorder Your Accounts

• Close (Delete) an Account

• Buy U.S. Savings Bonds

4

Add Additional Direct Deposit Accounts

You may have up to five active Direct Deposits; you will need:

• Bank Name or Routing Number

• Account Number

• Account Type: Checking or Savings

1. From the Direct Deposit Screen, click Add

2. Read the authorization disclosure; click I agree, or I do not agree with this statement. If

you agree, it gives the same weight as your written signature. If you don’t agree, the

Direct Deposit process is cancelled. If you have already agreed to this during your

session, you will not receive this message a second time.

3. To Add an Account, complete the following fields:

a. Bank – Click the Search button on the right side of this field to open the dialog

box; search for your Routing Number or Bank by name and click the hyperlink to

select

b. Effective Date – Today’s date or any date going forward

c. Description – This is used for your personal reference and is limited to 8

characters

d. Account Type – Checking or Savings

e. Account Number

f. Amount –

i. Percent of Net is automatically set at 100% when you only have one

account.

ii. Flat amount is the amount that will be deposited to the account; only to

be used when you are entering multiple accounts for deposits

4. Click Update

Note:

o Additional accounts will be added in proceeding order; the default account will

always be last because 100% of the remaining net pay is deposited to that

account

o If you would like your accounts deposited in a different order, click Reorder

o To view account details or change the amount, click the account number which is

a hyperlink; changes do not require prenotification and will take effect the next

payroll

5

o Once you have more than one account you are able to click the Select A New

Default button to designate a new default account

o Due to banking rules, your payment could be returned to the State of Michigan if

your deposit is directed to a foreign account; contact your bank for questions

about the status of your bank account.

Multiple Account Tips:

o If you have five direct deposits, you must revoke an existing direct deposit before

adding a new one

o Before selecting a new default account, you must first designate a new one

o Net pay is deposited in the account order you designate. If there isn’t enough net

pay to honor a designated amount or percent, that account is skipped. Once all

your account distributions have been fulfilled the remaining amount of your check

will be deposited into your default account

Change a Deposit Amount

When you have more than one account, you can change the Flat Amount, or the Percentage

of Net Pay deposited to any account other than your default account.

1. From the Direct Deposit Screen, click the blue account number of the account you want

to change

2. Read the authorization disclosure; click I agree, or I do not agree with this statement. If

you agree, it gives the same weight as your written signature. If you don’t agree, the

Direct Deposit process is cancelled. If you have already agreed to this during your

session, you will not receive this message a second time.

3. From the detail screen you can change the Account Description, Flat Amount, or

Percent of Net

4. Click Update

6

Note: You CANNOT change the account from checking to savings, or vice versa, even

when the account number is the same. You must revoke the account and re-add it.

Select a New Default

When you have two or more accounts, you must designate a default account. Any pay that is

not distributed to other account(s) will be sent to your default account. To select a new default

account:

1. From the Direct Deposit Screen, click ‘Select a New Default’

2. Click the radio button next the account you wish to designate as the new default

3. Read the authorization disclosure; click I agree, or I do not agree with this statement. If

you agree, it gives the same weight as your written signature. If you don’t agree, the

Direct Deposit process is cancelled. If you have already agreed to this during your

session, you will not receive this message a second time.

4. You will then be prompted to update your default account to elect a Flat Amount or

Percent of Net amount

5. Click Update

7

Reorder Your Accounts

Net pay is deposited in the account order you designate. If there isn’t enough net pay to honor

a designated amount or percent, that account is skipped. Once all your account distributions

have been fulfilled the remaining amount of your check will be deposited into your default

account.

1. From the Direct Deposit screen, click ‘Reorder’

2. Enter the order in which you want your accounts to have funds distributed; click Apply

3. Read the authorization disclosure; click I agree, or I do not agree with this statement. If

you agree, it gives the same weight as your written signature. If you don’t agree, the

Direct Deposit process is cancelled. If you have already agreed to this during your

session, you will not receive this message a second time.

Close (Delete) an Account

In order to revoke an account, you must have more than one account active, so you always

have a default account.

1. Click the ‘Close Account’ hyperlink to the right of the account

2. Read the authorization disclosure; click I agree, or I do not agree with this statement. If

you agree, it gives the same weight as your written signature. If you don’t agree, the

Direct Deposit process is cancelled. If you have already agreed to this during your

session, you will not receive this message a second time.

3. Click ‘OK’ to confirm. The closure will be reflected in the next processed payroll.

8

Buy U.S. Savings Bonds

Employees can use a payroll direct deposit through their HR Self-Service Account to buy

savings bonds.

1. Go to www.treasurydirect.gov to set up a Treasury Direct account and receive a

TreasuryDirect account number and access card. For assistance, call (844) 284-2676

2. Set up a Direct Deposit Account for your TreasuryDirect Account; enter the following

information:

a. Bank – Search for 51736158 as the Routing Number or Treasury Direct as the

Bank; click the name to select

b. Description – US Bonds

c. Account Type – Savings

d. Flat Amount/Percent of Net – Amount to be deposited each pay period

e. Account Number – TreasuryDirect Account Number

3. Click Update